You Hungry? Have A Look At This Food And Beverages ETF

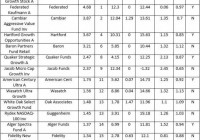

Summary This Food and Beverage ETF is poised to grow in the coming years. It offers a solid diversification of highly valued growth stocks in the food and beverage industry. The majority of the holdings in this ETF expect to have higher earnings in the future which offsets the current valuation. “So long you have food in your mouth, you have solved all questions for the time being” Quote by Franz Kafka Food and beverages, from sausages to drinks, there is always demand for something delicious. As the population of the world is growing, I am expecting that demand for food and beverages will continue to surge. The PowerShares Dynamic Food & Beverage Portfolio ETF (NYSEARCA: PBJ ) offers a perfect opportunity to take advantage of the ever growing food industry. This article will cover a fundamental analysis of PBJ. Dynamic Food & Beverage ETF This ETF is based on the Dynamic Food & Beverage Intellidex Index. This Intellidex index includes a variety of American food and beverage firms active in the production, manufacturing, sale and distribution of food and beverage products. Some of its holdings are well-known firms such as Starbucks (NASDAQ: SBUX ), Heinz-Kraft (NASDAQ: KHC ), Monster Beverages (NASDAQ: MNST ) and many more. In my view, these are typical expensive growth stocks and they certainly do not come cheap. As these are stocks with high P/E ratio’s I can understand that for some investors it carries too much unique investment risk . This food and beverage ETF offers the opportunity to diminish this unique risk as it’s well diversified. Therefore, it makes this ETF an interesting candidate for a retired investor who would like to invest in the fast growing food and beverage industry but not carry a large individual investment risk. Food and Beverage ETF: Profile Source: ETFDB The issuer of this ETF is Invesco , a large independent investment management company incorporated in Bermuda. The expense ratio of 0.61% is a reasonable number and should not be considered expensive. With 188 million assets under management it’s not a large ETF. The fund is rebalanced quarterly, every February, May, August and November. This ETF is currently trading 2% under its year high. Food and Beverage ETF: Return This ETF has pleased investors over the last few years as can be seen in the line chart underneath: (click to enlarge) Source: Ycharts Food and Beverage ETF: Sector Breakdown (click to enlarge) Source: ETFDB The Food and Beverage ETF has an excellent mixture between small and large cap stocks. Sector wise, holdings are mostly consumer defensive with a small part in the consumer cyclical sector and the rest in industrials . Food and Beverage ETF: Top Holdings Source: Invesco The main holdings of this ETF are Monster Beverages, Kraft-Heinz, Mondelez (NASDAQ: MDLZ ), Starbucks and General Mills (NYSE: GIS ). Together they consist of more than 26% of the entire ETF. Source: Ycharts As can be seen in the line chart above, the main holdings have yielded normal to abnormal returns in the last 2 years. Monster Beverages has done As can be seen in the line chart above, the main holdings have yielded normal to abnormal returns in the last 2 years. Monster Beverages has done especially well. Unfortunately, these large growth players do not come at a discount, as their current P/E is relatively high as shown underneath: Source: Ycharts Nevertheless, when looking at the forward P/E (the ratio of current price divided by predicted earnings), the 4 firms all have a lower P/E. This indicates that earnings are predicted to increase . That’s exactly the kind of growth you are looking for. This is an ETF with substantial expected growth in the future . That sheds a more positive light on the current valuation of this ETF. The Food and Beverage ETF: The main 3 holdings Monster Beverages is a firm that manufactures energy drinks, natural soft drinks and fruit drinks including their most known brand Monster Energy. The firm currently has a market cap of over 30 billion. It’s a firm with a high P/E, yet its expecting to grow significantly in the future as shown underneath: Monster Beverages estimates Source: 4traders The expected EPS of Monster in 2017 is $4.68, a substantial increase in comparison to today’s earnings per share. Kraft-Heinz is a firm which resulted out of the merger of Kraft Foods and Heinz, backed by 3G Capital and Berkshire Hathaway (NYSE: BRK.A ). They currently own 13 brands. It currently holds a P/E of around 50 which labels it not cheap. Mondelez is a large confectionery, food and beverage conglomerate with revenue over $30 billion. Recently, Bill Ackman bought a 5.5 billion stake in Mondelez. In his views the firm should accelerate revenue’s and cut costs or sell itself to a competitor such as Kraft-Heinz for example. This is positive news as it gives the ETF some short term boost. ETF Fund Characteristics Source: Invesco The overall P/E ratio of this ETF is around 22. This is not considerably high or low for an exchange traded fund. An earlier ETF I covered from Invesco was the PowerShares Water Resources Portfolio ETF (NYSEARCA: PHO ), which is currently valued at a P/E of over 30. Even as I laid out in that article, there were plenty of reasons for that ETF to surge in the future. I don’t consider the current P/E of 22 a red flag for this ETF and also see plenty of reasons for this ETF to continue to rise as I discussed earlier in this article. Conclusion The food and beverage industry is a sector with significant growth and relatively high valuations. Buying such stocks is an incredibly difficult endeavor as many of these firms have a high P/E and for many investors that does not sound like good value for money. However, this ETF is an excellent opportunity for a retiree which aims to take part in the growing food and beverage industry. The market cap breakdown shows a perfect mix between micro, small and large cap stocks. This diversity makes it an interesting stock for retirees as an investment in a single stock would yield too much unique risk . I consider PBJ a safe investment for a retired investor. It might not be poised to explode the coming months, but I consider it strong enough to weather any conflict that might happen due to one of its (overvalued) holdings falling over. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PBJ over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.