Do You Suffer From Investor ADHD?

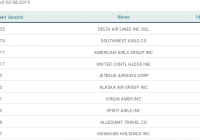

Many investors are constantly seeking to maximize total return but this is a tactic, not a goal. If your portfolio suffers from being idea constrained, capital constrained, or diversity constrained, you might just have Investor ADHD. Avoid Investor ADHD in order to achieve better results. Do you suffer from Investor ADHD? If you read the news finance pages every day looking for companies in the news as investment ideas, you might just have Investor ADHD. If you constantly seek out a new ticker to invest in, you might just have Investor ADHD. If you buy a stock and then worry simply because it goes down the next day, you might just have Investor ADHD. If you are interested in 4 tickers and can’t decide which one to buy, you might just have Investor ADHD. If you constantly seek to always outperform the S&P500 (or any arbitrary metric stick), you might just have Investor ADHD. If you have more than 50 tickers in your portfolio, you might just have Investor ADHD. There is a lot of information out there in the financial world; staying focused and on plan is not always easy. Those who are able to shut out all the noise, the hustle and bustle, the hype, and the hum of the marketplace chatter will find that they succeed better and with more consistent results than the person who spends 4 hours a day reading and watching the latest financial news and reviewing 100 tickers. Warren Buffett quietly focuses on a simple strategy of finding companies he understands that are selling at a deep discount from their value. Jim Cramer is perhaps the poster boy for Investor ADHD. He is not just a sufferer, he’s a carrier! Don’t get me wrong, I love Cramer. He’s a great entertainer and provides tons of real information on every ticker he comments upon. He just doesn’t stay focused, and his results are scattered (and under perform) as a result. (click to enlarge) (image source: wordpress.com) Managing Investor ADHD: I think most of us have at least some Investor ADHD. We are news and information junkies. If not, we wouldn’t be Seeking Alpha readers. The key to managing Investor ADHD is discipline and planning. It is important not to confuse activity with progress. A plan lays out a goal and the pathway to reach it, along with the criteria to build that pathway. Time Management of Risk Risk is the number one impediment to achieving financial goals. Taking on excessive risk reduces the probability that you will reach your goal and increases the frequency of failure. At the same time, it is also important to realize that a failure to accept adequate risk can also doom a plan to failure. For example, if you need to double your money in 3 years (for some unfathomable reason), then you simply will have to take on large risk. The market place balances risk with returns, accompanying the potential for high rewards with higher risk and greater chance for failure also. Nonetheless, you cannot reach a goal without taking some risk. You can’t collect your prize on the other side of town if you don’t leave the safety of home and venture out upon the roads to get there. The key is to minimize the risk you must take on in order to achieve your end goal. This is why blindly pursuing highest total return is foolish. Highest total return potential requires highest total risk with it. Total return is an impressive metric to look back upon to know what historically has performed well. But it is a one-way filter; it demonstrates those who have reached today in spite of risk or by managing risk the best. It has filtered out those who tried but failed. This is why total return as a goal is far different than total return as a success metric, a subtle but important difference. To illustrate the point better, consider the 10 companies with the best performance of the past 20 years . These are mostly boring companies not seen in the daily news except rarely. Many are Tortoises , a few are rabbits. 1. Kansas City Southern (NYSE: KSU ) 19,030% 2. Middleby (NASDAQ: MIDD ) 14,330% 3. II-VI (NASDAQ: IIVI ) 10,423% 4. EMC Corp. (NYSE: EMC ) 9,624% 5. Qualcomm (NASDAQ: QCOM ) 9,232% 6. Oracle (NYSE: ORCL ) 8,571% 7. Diodes (NASDAQ: DIOD ) 8,601% 8. Biogen Idec (NASDAQ: BIIB ) 6,334% 9. Celgene (NASDAQ: CELG ) 6,244% 10. Astronics (NASDAQ: ATRO ) 6,004% Parts 1 and 2 of my Tortoise series review the historical results of how time is used to manage risk in investing. Statistics show that the longer horizon you remain invested over, the more consistent and reliable your returns will be. For the S&P 500 (NYSEARCA: SPY ), you have a 100% statistical probability of obtaining a 10% average annual rate of return on your S&P 500 portfolio if you remain invested at least 25 years. That falls to 82% chance if you only use a time horizon of 20 years and only a 55% expectation of meeting your 12% annual rate goal if you are invested for 3 years or less. On the other hand, if 8% returns are your goal, then a shorter horizon will get you there with 100% statistical certainty of achieving that goal. You will just need a time horizon of 15 years to be 100% confident of that goal. If you can accept a confidence level of 92% for achieving the 8% goal, a 10-year time horizon will suffice. (source: J.D. Roth, tinyurl.com/5p9fqf ) I strongly urge everyone to read and study J.D. Roth’s wonderful work ” How Much Does The Stock Market Actually Return “. It is a revealing piece on realistic expectations and how time is your most important investing tool if you use a diverse portfolio. Diversity to Manage Risk In addition to time as a risk management tool, diversity of holdings also helps manage risk . Generally speaking, a portfolio with a larger number of individual tickers (directly or via a mutual fund or EFT) will have less volatility and more reliable results than one with narrower holdings. The research, transaction costs, and available opportunities when trying to manage a portfolio of more than 50 individual tickers tends to become overwhelming. If you desire the diversity of more than 50 tickers, then it is probably best to focus on mutual funds and/or ETFs for all or a portion of your holdings. Avoid Being An ADHD Investor: These 8 habits will help you to avoid being an ADHD Investor: 1. First and foremost, set a clearly defined goal. Do you want to have $1 million, $5 million, $x million at the end of your “accumulation phase (generally start of retirement). 2. Consider your time horizon to reach that goal. Shorter time means smaller total returns and more risk. Time is your single greatest tool to manage risk. Start investing early! See part 1 and 2 of my Tortoise series for a discussion and statistics on this subject. seekingalpha.com/instablog/6618191-richa… 3. The second most important way to manage risk is through diversifying. If you do not have enough funds to own at least 20 equal weight tickers, then strongly consider using ETFs to provide diversity and minimize transaction costs. 4. Do not confuse activity for progress . Many investors like to compare their own results against the S&P500. That has some value as a total return metric, but *your* goal may not be total return. It may be capital preservation if you have accumulated or inherited $10 million. It may be safe and reliable dividend income, compound growth, or some other personal need such as “green investing” (oh pleeeeeeze tell me its not green investing!! hehe). 5. Always remember that almost all of us who write for Seeking Alpha are investors ourselves. Read between the lines. Watch out for agendas or pet companies, or a stated or unspoken objective that matches or departs from your own. Watch for what is not said in an reading an idea presentation. Spin can tell you a lot. Sometimes more than the actual information highlighted in a presentation. 6. Listen to and read the company conference calls. These are not just for analysts. They contain the most important information that you as an investor need to know. Keep in mind that “spin-factor” I mentioned in #5 above. Management is going to want to tell you what they want you to know, not what you need to know. For instance; “Results from consumer sales in the Midwest were held back by poor weather conditions which prevailed this past winter” is not just an excuse for low numbers, it is an admission that management is not managing weather risk by hedging for it using commodity or index hedges that are weather sensitive or by balancing with other business segments that benefit for weather that negatively impacts other segments. Thus, a simple phrase like “poor weather conditions” can tell you a lot about management and whether they are sharp enough to control the company’s destiny or at leave themselves (and you, the investor) at the whim of nature and other outside influences. 7. Following up on #6 above, seek out excellent management that has a firm grip on the reigns of destiny and guides the company though all conditions with a firm hand. These are the going to be the true champions for the long journey. 8. Read and embrace analysis that presents both good and bad sides of investments you are considering. No company is perfect. Understanding the strength and the weakness of a company will give you the edge in assessing what to watch for going forward to make it more successful or hold it back. This is true for both internal factors and the macro environment. If you know the 5 key things your company investment is sensitive to and will cause market moves in its shares, then you will know when to buy and when to sell. You will also be able to know in advance when these buy and sell points are nearing based on the gathering portents you will know to watch for. Closing Thoughts: When your brain starts screaming information overload, sit back and focus on a calming influence. Take the time to take a break. For me, I look out my window and see this view… (click to enlarge) (image source: photo by author) Developing and following these habits allowed me to create the opportunity to own my home with this view. Continuing to practice them allows me to enjoy it. I hope you all will create a dream, pursue it, and achieve it. I hope I am able to help you to do that with what I write based on my life experiences along the continuing journey. Richard Become an instant alert follower to be sure to get notice of all my latest analysis and income yield boost articles as they are released. You can follow this link to my other articles , most of which include covered option strategies. If you wish to receive notices of my future articles (or real time alerts as they publish), simply hover your cursor over the “FOLLOW” to the right of my picture at the top of this article or select the options in the author box shown below at the end of this article. I am not a licensed securities dealer or advisor. The views here are solely my own and should not be considered or used for investment advice. As always, individuals should determine the suitability for their own situation and perform their own due diligence before making any investment. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.