MSCI Pakistan: Add A Little Green To Your Portfolio

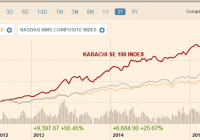

Summary Developed and current emerging markets are not offerings returns as high as frontier markets. Pakistan’s economic outlook is improving, thanks to China’s investment, low oil prices and rate cuts. MSCI Pakistan is a decent bet for a frontier market exposure; it’s cheap on relative valuation. Developed equity markets continue to trend higher. It is hard to predict the end of the current bull market, but the returns would be limited going forward. S&P trades at a PE of 21.24 while NASDAQ composite is trading around 23 times the trailing earnings. European markets are also rising but the upside seems limited given high multiples. Emerging markets are witnessing a slowdown in growth. High return investments are not easily found in the above mentioned markets under current circumstances. However, there are alternatives for investors with a high risk-appetite: the frontier markets. Frontier markets are small to be classified under emerging markets but they often entail a higher return at a higher risk. One such frontier market is Pakistan, which has started to look attractive. Equity market of Pakistan is trading at a substantial discount and can bring considerable gains to investors. Detailed thesis follows: Status of Pakistan might be upgraded to an emerging market. Pakistan is up for consideration to be included in emerging markets. MSCI will review for a potential upgrade in June 2016. According to WSJ, Pakistan is liquid and deep enough to be considered as an emerging market. KSE 100 index is one of the best performing equity markets since the financial crisis of 2008. Note that Pakistan meets most of MSCI’s emerging market requirements. It is highly likely that Pakistan will be upgraded to the emerging market status. If that happens, the PE multiple of Pakistan’s equities will expand resulting in substantial gains for investors. KSE 100 is one of the best performing equity markets trading at a discount. In 2013, KSE 100 rose 37%, in dollar terms, topping S&P 500 and every other benchmark in Europe. It was the third best performing market in 2014 with a 31% return. The index is up ~19% during the trailing twelve months. Despite the run, the index trades at 8.3 times forward earnings, an 18% discount to MSCI’s frontier markets. Source : FT.com Source: Yahoo Finance, MSCI, AHL Research The charts depict that after a decent run, KSE 100 is still trading at quite a discount. Further, the expected benchmark rate is 8%, which is equal to the rate back in 2006. KSE was trading at 11.3x at that time. This indicates that the index is undervalued by more than 20%. According to AHL research, ” When the policy rate stood at almost at the same level in 2006 as today i.e. 8.5%, and the earnings growth also being in close vicinity as today i.e. 10%, the market PE stood at 11.3x then, compared to 8.3x today, showing a substantial 27% discount, which the KSE100 is currently trading at (barring all other factors i.e. level and risk of macros and the market between two different times).” See the following graph to witness the correlation of interest benchmarks to the KSE 100 index. (click to enlarge) Focus Equity Estimates and AHL Research The graph clearly mentions that KSE 100 is negatively correlated to the interest rates. As Government is pursuing aggressive rate cuts, PE multiple is expected to expand. To review, Pakistan’s equity market is trading at a substantial discount based on historical PE levels; it’s also cheap relative to comparable indexes and markets. The economy is in a turnaround mode; related indicators are positive. Economy is getting a boost from several developments. Falling oil prices are a big positive that are keeping a check on inflation. This, in turn, is allowing for rate cuts, which will give a boost to economic activity and the stock market. Pakistan is a net importer of oil; prices of oil are not expected to go up any time soon, think recent U.S.-Iran deal. Oil prices will continue to have a positive impact on the economy of Pakistan. As mentioned above, low interest will also boost the economy. Interest rates are cut by 1% to drop to 7%. The Government is pursuing aggressive rate cuts; they are down from 10% in November 2014 to 7%currently. Other favorable factors include pro-business government and favorable demographics; 54% of the population of Pakistan is under 25 years. The current Government is heavily investing in infrastructure; a $500 million Metro transport project is recently completed in twin cities, Islamabad and Rawalpindi. Other construction projects are expected to boost materials and construction industry. Elimination of circular debt by the Government bodes well for power producers. Further, consumer spending is increasing; 26% p.a. increase in spending was recorded (pdf) during 2010-2012 as compared to Asia’s 7.7% growth. Analysts’ expect the GDP to grow at 4.6% p.a. through 2019. Pakistan’s security forces’ operation against terrorism is proving to be fruitful. Number of civilian casualties has declined by 81% since 2013. Number of drone attacks by the U.S. in Pakistan has decreased 62% since 2013 indicating that terrorist element is being eliminated efficiently. (click to enlarge) (click to enlarge) Source : South Asia Terrorism Portal Regarding the stock market, it was among the best performing markets in 2013 and 2014. In 2013, the market performed better than 2014 as mentioned somewhere else in the report. The point is that investors’ sentiment is not strongly correlated to the security related issues. Drone attacks and terrorism related causalities were higher in 2013 compared to 2014 yet the market performance in 2013 was better than 2014. Now, the security situation is getting better. This will boost investors’ confidence and will help the stocks rally in 2015 and beyond. China’s $46 billion investment in Pakistan makes the bull case a no brainer. China is investing in Pakistan for an economic corridor. $46 billion in investment is expected. Most of the investment will be used for power and infrastructure related development. Financial services, materials and power companies will be the primary beneficiaries of the investment. According to Barrons, Beijing’s investment is expected to boost Pakistan’s GDP by over 15%. The investment will, in time, put an end to Pakistan’s electricity woes, another positive from a business perspective. 10GW capacity is expected to be added by 2018. The economic corridor will link China to the markets in Central Asia and South Asia. ‘If ‘One Belt, One Road’ is like a symphony involving and benefiting every country, then construction of the China-Pakistan Economic Corridor is the sweet melody of the symphony’s first movement.’ – Wang Yi , China’s foreign minister All in all, China’s investment bodes well for the economic growth of Pakistan and its capital markets. For further insight into China-Pakistan economic corridor, see this (pdf) report. There is a turnaround in analysts’ sentiment about Pakistan. David M. Darst, Chief investment strategist at Morgan Stanley, thinks that the rise of Pakistan is just a matter of time. He further points out that Pakistan is among the nine countries in Asia that will add another China in the next 35 years. Commenting on Pakistani stocks he said, “What is important is that the stocks in Pakistan are still very cheap compared to the markets in the industrialised world and they are performing better than many markets in terms of returns,” IMF thinks that Pakistan has succeeded in stabilizing its economy; growth of 4.3% is expected during 2015. World Bank expects expansion of 4.4% during the current year. Goldman Sachs has included Pakistan in “Next 11” list of economies, which will be a key source for economic growth in years to come. Pakistan is an overlooked reform story without reform valuations, says Renaissance Capital. According to CIA Factbook 2015, “Pakistan is one of the larger, more liquid frontier markets and has advantageous demographics. These factors make it an attractive investment destination for investors looking beyond traditional emerging markets, which have been demonstrating slowing growth.” To review, Pakistan’s outlook is getting positive. A rise of status from a frontier a market to an emerging market will be catalytic for the growth of the stock market. Economic growth supported by low oil prices, low interest rate environment and diminishing security problem will add to the capital market’s growth. More importantly, China’s investment in the country will steer Pakistan’s economy in an upward direction going forward. How to Invest? Investors can get exposure to this frontier market through MSCI Pakistan ETF (NYSEARCA: PAK ). This ETF is designed to represent the performance of broad Pakistan equity universe. The ETF offers access to the highly liquid equities in Pakistan. The ETF was launched in 2014. However, the equities in the ETF posted a CAGR of 18% during 2011-2015. The ETF trades at a forward PE of 8.79 making it a cheap proposition. The ETF also compares favorably to other alternatives. (click to enlarge) Source : MSCI Another important factor is the weightage of sectors. PAK ETF is concentrated among financials, materials and energy. See the chart below: (click to enlarge) Source : Global X Funds As mentioned above, financials, energy and materials will be the largest beneficiary of China’s investment in Pakistan. Consequently, this ETF will outperform the market due to dominant weightage of these sectors. Further, the current Government is also focused on infrastructure development, which is another bullish indicator for the ETF. For fiscal year 2015/2016, the government has increased infrastructure expenditure by 27% . Low oil prices will continue to support the energy sectors and the ETF’s growth Another, relatively low-risk/low-return alternative is to invest in MSCI Frontier 100 ETF (NYSEARCA: FM ). Pakistan makes up 10.6% of this ETF. Kuwait, Nigeria and Argentina are the three largest countries in this ETF. Bottom Line Developed and current emerging markets are not offerings returns as high as frontier markets. However, the returns from frontier markets come with added risks. These investments are only suitable for investors with high appetite for risk. Anyhow, Pakistan’s economy is in a recovery mode, thanks to China’s investment, pro-business government, falling oil prices and interest rate cuts. Equity market of Pakistan is an attractive investment option given that the market outperformed developed markets even with worse security and economic conditions. Now, as the economic and security situation is stabilizing, high gains will certainly follow. MSCI Pakistan ETF is looking good amid high concentration in financials, materials and energy. Further, the valuation is cheap as compared to emerging markets. All in all, we rate MSCI Pakistan ETF a buy with more than 30% upside; the valuation is based on historic correlation of interest rate benchmarks to the PE multiples of the market. Risks Low trading volumes and liquidity concerns attached to frontier markets Highly volatile political conditions Re-ignition of the terrorist elements Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.