UIL’s Updated Connecticut Merger Filing

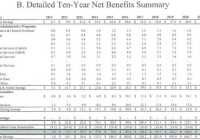

In late June the Public Utility Regulatory Authority of Connecticut issued a draft decision denying UIL’s merger with Iberdrola USA. UIL withdrew their application and filed a new application on July 31. The new application substantially addresses PURA’s concerns and increases the likelihood that this value creating merger will be approved. UIL Holdings (NYSE: UIL ) and Iberdrola USA ( IUSA ) (a subsidiary of Spanish utility Iberdrola (OTCPK: IBDSF )) are making their second attempt to get their merger through the notoriously difficult Connecticut Public Utility Regulatory Authority ( OTCPK:PURA ). As discussed in my earlier post , this is a merger that will create substantial value for the participants, so there was no way they would give up easily after PURA’s initial rejection. The new filing really lays out the benefits for the state of Connecticut, and should be enough to get the deal approved in that jurisdiction. PURA’s issues with the original application are summarized in this excerpt from the draft decision : The Applicants have not provided any measurable or quantifiable commitments that unequivocally assure the Authority that the public interest of the ratepayers will not be harmed. In response, the applicants have increased a number of the benefits Connecticut customers will receive, and presented them in a quantifiable way that easily allows PURA to see the advantages for customers. The draft decision also listed a number of items that had been included in recent Connecticut merger agreements. Many of the updates to the application are related to this list. A discussion of these items follows. Rate credit allocated to retail customer classes UIL and IUSA have increased the rate credits for customers from about $5M in the original application, to approximately $20M in the new one. The applicants have actually proposed three different methods to distribute the credit to customers. The first option would apply a $20M credit customers in the first year after the closing. Another proposal is for UIL to provide $26M of credits spread over ten years. The last option is essentially giving a $1.5M annual credit over thirty years. The present value of all three options is essentially the same, and the applicants are giving PURA a choice based on feedback they received from their earlier application. Commitment to accelerate the pole inspection cycle. This is basically a reliability commitment. For those unfamiliar with the issue, utility poles, like any other piece of the electric system, can wear out as they age. The end of a pole’s life can lead to a power outage or damage to property. Increasing the frequency of these inspections can reduce the number of surprise failures, resulting in fewer outages. Subsidiary United Illuminating (UI) is the custodian of 87,000 poles. In 2005 they pledged to improve their pole inspection process, and they have $700,000 budgeted for pole inspections in 2015. With an already strong commitment to inspecting utility poles, no further enhancements were made in this application. However, while UI will not address poles, they are making some quantifiable reliability commitments. In the first application UIL had only said there would be benefits from sharing best practices and better storm response, and that there would be no deterioration in service after the transaction. Now the applicants have pledged to increase investment in electric distribution system resiliency with a reduced recovery of the first $50M of this spending over a two year period. They are also making some reliability commitments at their Southern Connecticut Gas (SCG) subsidiary. UIL is promising to double the annual spending on the replacement of cast iron/bare steel pipe (from $11M to $22M per year) over the next three years without seeking recovery until the next SCG rate case. There are substantial reliability issues with these older pipes, and increasing the rate of replacement should have an impact on safety and dependability. UIL estimates the gas commitment will create a $1.6M benefit, and the commitment at UI will create a $5M benefit. Commitment to improve non-storm and storm related service quality performance at a minimum of the 10-year historical average UIL stated that they would improve a number of different service metrics by 5% by the end of the third year after the closing of the deal. These metrics were: average answering times, % abandoned calls, % appointments met. UIL also promised to maintain the high level of reliability at UI as measured by SAIDI and SAIFI. (SAIDI is the System Average Interruption Duration Index, essentially the average number of minutes a customer is out during a year; and SAIFI is the System Average Interruption Frequency Index, essentially the average number of times a customer has an outage in a year.) You can see how well they have been doing on these metrics by looking at this information from UIL’s 2015 Reliability Report . SAIFI SAIDI 2010 0.65 85 2011 0.81 102 2012 0.60 58 2013 0.58 51 Four-Year Average (’10 – ’13) 0.66 74 2014 0.56 53 2014’s SAIFI number was actually the company’s best in the past eighteen years. The 2014 SAIDI number was better than all but two of the previous eighteen years. Also, UI’s SAIDI and SAIFI numbers are better than neighboring utility CL&P. In 2014 CL&P’s SAIDI was 88.9 minutes, and their SAIFI was 0.77. It seems that UI maintaining current reliability numbers should be acceptable to PURA. Commitment to open space land UIL has not specifically addressed open space land, but they appear to be working on an issue that is related in spirit. This is regarding English Station, a retired power plant on a nine acre site that UIL sold over fifteen years ago. This property has substantial environmental issues, and there is a big dispute over who should pay the cleanup costs. The applicants have stated that if the merger is approved they will end the legal wrangling, and agree to pay for the cleanup of the site. This cost is currently estimated at $30M. (More information on the English Station dispute can be found here .) Seven year commitment to not move headquarters out of Connecticut The applicants have proposed to create a new management position entitled the President of Connecticut Operations. The President of Connecticut Operations will be headquartered in Connecticut, and the applicants state that the headquarters will remain in Connecticut for at least seven years. (I’m pretty sure we know where they came up with that length of time.) One issue that was not in PURA’s bullet list, because this is the first time it has come up in a Connecticut utility merger case, is ring-fencing. UIL has dramatically increased the robustness of their proposed ring-fencing provisions. The applicants have proposed creating a special purpose entity (SPE) adding another layer of separation between UIL and IUSA. 100% of UIL will be owned by the SPE, and IUSA will own the SPE. The SPE will have at least one independent director, and a “Golden Share” provision. This Golden Share has a non-economic interest in the SPE and will be owned by an administration company in the business of protecting special purpose entities. The Golden Share has the right to vote on certain matters, primarily with respect to the filing of bankruptcy. (More information can be found in Attachment 2 of the merger application.) UIL and IUSA have made a dramatic improvement in their merger application. The benefits Connecticut customers will receive have been increased and quantified, so it is easier to see the advantages of the deal for the state’s citizens. The applicants have specifically addressed many of the items PURA brought up in their earlier draft decision. In particular they have substantially beefed up the ring-fencing provisions, so a problem elsewhere in Iberdrola’s operations does not hurt any of UIL’s subsidiaries. Based on these changes it seems like the merger should have a very good chance of getting PURA approval. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.