If Workday Beat Consensus, That’ll Be 13 For 14 Quarters Since IPO

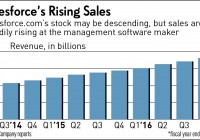

Well, it’s no Salesforce.com ( CRM ) in size, but investors are turning their attention to hot little rival Workday ( WDAY ), which reports earnings after the close Monday. The maker of cloud-based HR and financial software likely will show continued fast growth — while likely staying in the red as it spends to grow. For its fiscal Q4 2016 ended Jan. 31 , Workday guided to revenue of $317 million to $320 million, up 40% to 41% from the year-earlier quarter. Analysts polled by Thomson Reuters had modeled $320.3 million when Workday issued its Q3 results three months ago, but since then the consensus has slipped to $319.6 million. Workday didn’t forecast earnings, but analysts expect an adjusted loss per share of 4 cents vs. a 6-cent loss in the year-earlier quarter. Like many stocks, Workday has been scraping bottom lately, hitting a 39-month low on Feb. 9 at 47.32. Workday stock fell 16% on Feb. 5, but it wasn’t alone. That was the day Tableau Software ( DATA ) tanked 49.5% after releasing slower growth guidance for 2016, sending most software stocks down with it. Since then, Workday stock has enjoyed two good weeks, up 1% in early trading in the stock market today , near 60 but still down 25% for the year. Workday stock rose 3.2% Thursday, with enterprise software stocks helped by Salesforce.com’s late-Wednesday earnings beat and better-than-expected guidance. Salesforce.com stock rose 11% Thursday but was down a fraction early Friday. Noting that Workday “has beaten consensus revenue and EPS estimates in 12 of the 13 quarters it has been public,” D.A. Davidson analyst Jack Andrews is bullish. “We expect (Q4) revenue to grow 41.9% … to $321.2 million, above consensus … and above the high end of the (Workday-provided) guidance range. By segment, we are projecting 44.6% growth in subscription services to $263 million (81.9% of total revenue) and 31.0% growth in professional services to $58.2 million,” he said in a research report. He expects a 3-cent per-share loss minus items, a penny better than consensus. “One interesting note is that we believe Oracle ( ORCL ) has pulled back a bit on its promotional program on SaaS (Software as a Service) and aims to offer future promotions to customers tactically, rather than automatically,” Andrews wrote. Davidson maintains a buy rating on Oracle stock. It also has a buy rating on Workday stock, with a 99 price target. Oracle stock rose 1.8% Thursday, but was flat early Friday. Investment banker R.W. Baird on Thursday lowered its price target on Workday to 70 from 85, but it rates the stock outperform. “Workday’s share price has also been significantly reduced along with other high-valuation software stocks during the recent correction,” wrote Baird analyst Steven Ashley. In Workday’s Q3 earnings conference call with analysts, CFO Mark Peek said an adjusted operating profit likely wouldn’t happen until Q2 this year.