How To Build A Portfolio With Less Risk Than The S&P 500

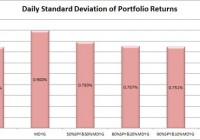

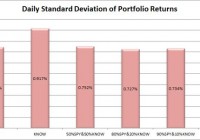

Summary When measuring risk adjusted returns over a long time period, SPY regularly beats individual investors. Due to high liquidity and small spreads, SPY is a better investment for investors that don’t want to worry constantly. For investors seeking more thorough diversification, I’ll lay out my portfolio plans. The long term bear case for SPY is a doomsday scenario, short term cases are arguments for market timing. Investors dealing with practical constraints such as trading costs have extremely low chances of beating SPY for risk adjusted returns. Every investor wants to be able to beat the market, but success is difficult to judge. Posting larger gains than the market by taking on additional risk is not the same thing as outperforming the market. I believe investors can occasionally struggle to see the forest because they are so caught up in the trees. Without stepping back, it may be difficult to judge how much risk is actually involved in any given portfolio. I think if we compare portfolios over a very long time period, many investors could agree that the deviation of returns is a viable metric for assessing risk. Under CAPM (Capital Asset Pricing Model), investors use Beta to establish the level of risk. I like that method, but it still has some substantial short comings. The theory assumes that every investor is holding the market portfolio and that diversification is in full effect. That causes some problems when we start assessing the required return. If the investor is not actually fully diversified, then the portfolio contains risks that could have been mitigated by better diversification. Making SPY the cornerstone Most textbooks will say that the S&P 500 is a viable proxy for “the market”. Since the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) is heavily focused on large cap U.S. equity, I don’t think that SPY should be seen as a proxy for every investment security. However, I do believe that SPY (or a similar ETF) should be the corner stone of most portfolios. Why SPY makes sense Even though SPY does not represent the entire market, it does represent the largest parts of the U.S. economy and many of the companies have global operations. If an investor wants to rapidly gain diversification to the market, SPY is the best place to start. The advantage of companies with global operations is that the ETF contains some of the diversification benefits of being exposed to foreign economies. Liquidity and spreads SPY offers investors extremely high levels of liquidity which lead to small spreads and a relatively easy time entering or exiting positions as necessary. On a risk adjusted basis When we adjusted for the level of risk, as measured by the deviation of returns, we find that SPY has a lower level of volatility than most ETFs. There are some ETFs with less deviation, but most of those ETFs have several of the same companies. If an ETF holds several of the same companies as SPY and posts high correlation, similar total returns, and similar levels of risk, then that ETF is a viable alternative to SPY. I’m perfectly fine with using alternatives to SPY, but I wouldn’t want to build a portfolio that did not use either SPY or one of the many similar ETFs. My strategy for building a portfolio I’m in the process of building a new retirement portfolio. The account will be tax advantaged. The difficulty for investors in opening a new account is that the balances will be relatively low. Because the balances are relatively low, trading fees are a significant detriment to the success of the account. Even if an investor has a substantial amount of money outside of the account, it won’t make a difference for the individual account. Since the new account has less capital and thus is more susceptible to trading fees, the appeal of using ETFs is even more substantial. My ideal ETF portfolio looks something like this: 30 to 50% to large cap companies (possibly split between 2 ETFs) 15% to 25% in bonds (part international, part domestic) 10% to 20% in international ETFs (probably using at least 2) 5% to 15% between precious metals and natural resource companies 10% to 20% to REITs Some ETFs that I think merit automatic consideration for those slots are listed below. In my opinion, these are some of the first ETFs investors should consider when seeking the exposures listed above. Large Cap: The Schwab U.S. Large-Cap ETF (NYSEARCA: SCHX ), the iShares Core S&P 500 ETF (NYSEARCA: IVV ) and the Vanguard S&P 500 ETF (NYSEARCA: VOO ) Bonds-International: The iShares J.P. Morgan USD Emerging Markets Bond ETF (NYSEARCA: EMB ) and the PowerShares Emerging Markets Sovereign Debt Portfolio ETF (NYSEARCA: PCY ) Bonds-Domestic: The Vanguard Total Bond Market ETF (NYSEARCA: BND ), the iShares Core Total U.S. Bond Market ETF (NYSEARCA: AGG ), the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA: HYG ), the SPDR Barclays Capital High Yield Bond ETF (NYSEARCA: JNK ), the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA: LQD ) and the iShares U.S. Preferred Stock ETF (NYSEARCA: PFF ) -Note: PFF uses preferred stock International ETFs: The Vanguard FTSE Developed Markets ETF (NYSEARCA: VEA ), the iShares MSCI Emerging Markets ETF (NYSEARCA: EEM ), the Schwab Emerging Markets ETF (NYSEARCA: SCHE ) and the iShares MSCI EAFE ETF (NYSEARCA: EFA ) Precious Metals: The SPDR Gold Trust ETF (NYSEARCA: GLD ), the iShares Gold Trust ETF (NYSEARCA: IAU ) and the iShares Silver Trust ETF (NYSEARCA: SLV ) Natural Resources: The Market Vectors Gold Miners ETF (NYSEARCA: GDX ), the FlexShares Morningstar Global Upstream Natural Resources Index ETF (NYSEARCA: GUNR ), the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) and the SPDR S&P Oil & Gas Exploration & Production ETF (NYSEARCA: XOP ) REITs: The Schwab U.S. REIT ETF (NYSEARCA: SCHH ), the iShares U.S. Real Estate ETF (NYSEARCA: IYR ) and the Vanguard REIT Index ETF (NYSEARCA: VNQ ) As you can see from my desired exposures, the largest position by far will be substantially represented by SPY or a similar ETF. The position in natural resource companies will also duplicate some of the same stocks that I will be holding through the U.S. large cap ETF. For investors seeking to reduce risk below the levels created by SPY, the most likely way to do it still involves a fairly substantial position in either SPY or another similar fund. The strategy relies on using relatively low levels of correlation in the other investments. If the positions are relatively small, their correlation is more important than their individual volatility. Rather than building from the ground up, investors should be looking for incremental ways to reduce risk. Small positions in other ETFs have the opportunity to provide that incremental benefit. Rebalancing I will probably rebalance on a quarterly basis, but I might consider doing it as frequently as monthly. The portfolio I’ve laid out above suggests that I would probably be using at least 9 ETFs in my portfolio. The top four positions in the list would each be represented by two ETFs. The REIT position might be through a single ETF, depending on what I can find. First looks When I run my first inspection on an ETF as a candidate, I usually compare the standard deviation on daily returns to SPY. That gives me a quick estimation of the correlation between the two ETFs. If an ETF is not liquid and no shares trade hands on days when SPY jumps up or down as investors are scared to leave their positions, that is an unappealing aspect. Therefore, I also want to know about the volume of the shares being traded. Don’t be fooled into thinking that an average trading volume of 10,000 shares implies that there is enough liquidity for statistics to be valid. I’ve seen ETFs with reasonable average trading volumes post days with 0 shares changing hands. If no shares trade hands, it results in invalid statistics. If investors resume trading the following day at a significantly higher or lower price, it may understate the correlation by assessing the price movement to the wrong day. Yield One of the things I love about SPY is the distribution yield, currently 1.87%. One of my goals in planning for retirement is to get to the point where I can live off the dividends. Yes, I could use investments with substantially higher yields, but that often means additional risks. In my portfolio, I may be able to structure it to have a higher yield, but it won’t be a major factor since the money is all staying in the retirement account. Rich Dad, Poor Dad I believe every investor should read through Rich Dad, Poor Dad. It’s a fairly simple book and contains a great deal of common sense, but I still meet people every day that don’t understand the difference between assets and liabilities in their personal life. The most basic definition is that an asset should put money into your pocket. A liability would remove money from your pocket. The problem with buying into companies (or ETFs) with no dividend yield is that they are not directly putting money into your pocket. Selling shares to create your own dividends Every finance book dealing with economics will mention that investors have the option to sell their stocks and create their own dividend when they need the money. While that is true at a technical level, it ignores behavior finance. Investors are tempted to buy when the market is high and sell when it is low. If the investor can live off the dividends, they can avoid trading mistakes. Security SPY offers investors so much diversification through international exposure, that betting on SPY going down over a very long period is betting on the world falling apart. While individual companies can and do fall from grace (remember Enron), the system behind SPY is strong enough that investors have a very reasonable case to ignore the market and just keep dollar cost averaging into their positions. Market timing is absurdly difficult Attempting to time the market is a losing game. Yes, there are periods where the market crashes. That’s why I believe in adding a few other positions to the core position in the S&P 500. I love diversification, but I don’t see a viable argument against holding SPY over the long term. If the companies comprising the S&P 500 get crushed, what investment is truly safe? I don’t believe gold or the USD will hold substantial value in a hypothetical scenario where the S&P 500 gets destroyed. If Exxon Mobile (NYSE: XOM ) and Chevron (NYSE: CVX ) are both getting destroyed, how would you get to the store for groceries? If Wal-Mart (NYSE: WMT ) is getting crushed, what retail stores are surviving? In a doomsday scenario, I don’t see many investments holding their value. How I plan to handle it When I’m able to transfer money into the account, I won’t try to time my entry into positions. Money goes in, assets get purchased. That doesn’t mean I’m willing to cross a huge spread, but that isn’t a concern with SPY. Even though I have a desired outline for my portfolio, the only position that’s really secure is that I’ll use either SPY or another ETF with very similar exposures. The point of adding other ETFs is that they provide benefits to the core position. If I can’t find enough ETFs that provide complimentary positions to SPY, I’ll just reallocate that position to even more S&P 500. Using SPY to avoid commissions If I didn’t have access to trading many ETFs without commissions, I wouldn’t expect the benefits of further diversification to outweigh the trading costs. If I hold 9 ETFs and rebalance quarterly, I’m looking at 36 trades per year. Assuming $10 per trade, we are talking about $360 per year. In a new retirement account with a starting balance of around $10,000, that’s a huge chunk. The difference between $40 and $360 over the course of the year is comparing .4% to 3.6% in expenses. Beating SPY in risk adjusted returns through active selection is very difficult. If an investor has to beat another 3.2% to cover the trading fees, it becomes nearly impossible. Remember, returns must recognize risk, so buying a single security that does very well is still taking on an enormous amount of risk. If I was paying commissions If I learned tomorrow that I would not be able to trade without commissions, I would make one trade upon getting the money into my retirement account. I would run a portfolio that was at least 80% SPY. Until I had over $50,000 in the account, I wouldn’t even consider reducing the SPY position. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. The analyst holds a diversified portfolio including mutual funds or index funds which may include a small long exposure to the stock.