VDADX: A Great Mutual Fund That Is Remarkably Low On 2 Key Sectors

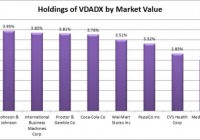

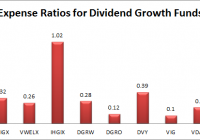

Summary VDADX offers investors a great start to building a dividend portfolio. The fund is missing almost all exposure to the utility sector and to oil and gas. The expense ratio is exceptionally low, and the historical volatility has been better than that of the market. Investors should be seeking to improve their risk-adjusted returns. I’m a big fan of using ETFs to achieve the risk-adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. Despite my frequent use of ETFs in my personal investing, many retirement accounts still use mutual funds as a major source of their investing. When it comes to assessing the mutual funds, one of my earlier favorites is the Vanguard Dividend Appreciation Index Fund (MUTF: VDADX ). Largest Holdings I’m starting the analysis by looking at the largest holdings in VDADX. As you can guess from the name, there is a heavy emphasis on receiving dividends from the portfolio. (click to enlarge) The holdings are a little on the heavily concentrated side with several holdings over 3%, and it is interesting that the fund opted to include heavyweights on both Coke (NYSE: KO ) and Pepsi (NYSE: PEP ). However, I don’t see any real disadvantage to holding both for better diversification since the investor won’t be stuck paying trading costs to buy each individually. The thing that really stands out to me is that there is no Exxon Mobil (NYSE: XOM ) or Chevron Corporation (NYSE: CVX ) in the top 10. XOM is yielding over 3.5% and CVX is up near 5%. That really concerns me. Though I did not chart the rest of the top 100 holdings, I did scan through them looking for Exxon or Chevron. Neither was included anywhere in the top 100 holdings. Granted oil prices are plummeting and oil stocks may seem “risky”, but a small inclusion would be entirely appropriate for a portfolio focused on dividends. The yields are high, and the companies would benefit from higher gas prices while many parts of the economy would be disadvantaged by high fuel prices. For diversification purposes, it is very strange not to have them included. On the other hand, Vanguard is including quite a few other holdings that I wouldn’t put at the top of the list for a fund focused on dividends. For instance, Costco (NASDAQ: COST ) is included in the portfolio despite having a yield of only 1.09%. There is nothing wrong with Costco as a company from my perspective, but the portfolio already has quite a bit of retail exposure and is lacking in the big gas companies. Diversification Benefits The correlation to SPY is just under 97%, so diversification benefits are not very substantial. However, the volatility on the fund is materially lower at only 87% of the level on SPY, which is nice for investors who would prefer more stability in their portfolio values. Yield & Taxes The SEC yield is 2.19%. Again, this feels fairly low for a dividend portfolio and brings me back to the question of why companies like Chevron were not given a prominent weighting in the portfolio. Expense Ratio The mutual fund is posting an expense ratio of .10%. I want diversification, I want stability, and I don’t want to pay for them. An expense ratio of .10% is absolutely beautiful and makes VDADX a solid choice for investors. Sector Allocations To go a little deeper into the absence of the major oil companies I like to see included in a dividend growth portfolio, I grabbed a chart of the sector allocations. (click to enlarge) As you can see, the oil and gas sector was only 1.3% for the fund. That matches the index that the fund is tracking; however, I find it interesting that the index was designed to limit the exposure to oil and gas. If I were establishing a dividend index for a fund that could be used as a major portion of an investor’s portfolio, I would want to increase the oil and gas weightings to around 10%. The other interesting factor is that utilities are also mostly absent. Unless the investors are buying utility companies themselves, the ideal allocation, in my opinion, would include a higher weighting for utilities in the 10% to 15% range. Conclusion For investors looking at the very long-term picture, the extremely low expense ratio is beautiful. Vanguard has been one of the best in the business at creating low-fee mutual funds. I don’t think a fund should be chosen purely for the expense ratio, but I do believe investors should be very aware of it. When I’m putting together hypothetical portfolio positions, one of the things I include is the expense ratio on the individual positions to track the overall expense ratio on the portfolio. The overall portfolio looks solid with the exception that oil and gas is largely absent and the utility sector is strangely underrepresented despite several utility companies having strong yields. If I were using VDADX as a core holding in my retirement accounts, I would want to complement it with specifically increasing allocations to large-cap oil and gas companies and a geographically diversified group of utility companies. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis.