Under The Hood Of SPDR Barclays High Yield Bond ETF

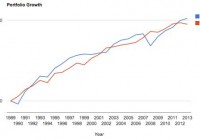

By John Gabriel For strategic, long-term exposure to U.S. high-yield bonds, investors may consider SPDR Barclays High Yield Bond ETF (NYSEARCA: JNK ) as a small core holding. The fund can also serve as a tactical investment for the satellite portion of a diversified portfolio. Investors should bear in mind that high-yield bonds are one of the most volatile sectors of the fixed-income market. Long-term-minded investors looking to JNK as a strategic position are likely to find the diversification benefits of high-yield bonds attractive. High-yield bonds tend to be negatively correlated (or uncorrelated) with government and aggregate bond portfolios, which often make up the bulk of most investors’ fixed-income exposure. Moreover, high-yield bonds are poised to hold up relatively well in the event of rising interest rates and inflation. While rising rates and inflation tend to be the enemy of typical fixed-income securities, the high-yield bond asset class tends to outperform its fixed-income peers during such periods thanks to its stocklike returns and heavier dependence on business fundamentals. Consider that over the past 10 years, U.S. high-yield bonds have shown positive correlation (74%) with the S&P 500, while the Barclays U.S. Aggregate Bond Index has been relatively uncorrelated (26%) over the same period. Remember, interest rates will typically rise when the economy is in good shape and businesses are performing well. High-yield bonds tend to perform well when issuers’ fundamentals are strong or improving (and vice versa). Tactical investors may look to a fund like JNK as a way to bolster income in a yield-starved environment. However, investors should not look at the fund’s yield in isolation. Rather, the current yield should be viewed in relation to the yield offered by U.S. Treasuries with the same maturity. The difference between the two is what is known as the credit spread, and it represents the premium that investors can collect for assuming additional credit risk. The credit spread should also be viewed relative to the expected default rate. According to Moody’s, since 1983 the historical average default rate for high-yield bonds is 4.8%. In the trailing 12-month period through October 2014, the U.S. high-yield default rate was 2.4%, relatively flat from a year ago. Rising default rates typically result in widening credit spreads. But default rates are expected to remain low (around 2%) thanks to favorable credit conditions. Fundamental View The U.S. high-yield bond market has evolved over the past few decades. Whereas in the 1970s the overwhelming majority of high-yield bonds were so-called “fallen angels” (bonds issued by companies that had their credit ratings downgraded from investment-grade to high-yield status), today there is a vibrant and healthy market for new-issue high-yield bonds. According to SIFMA, in 2014, new issuance of high-yield bonds in the United States was $278 billion through October, slightly below the $285 billion sold in 2013 in the same period. By comparison, high-yield issuance averaged $95 billion per year from 1999 to 2009. Many investors may find the significant income potential of U.S. high-yield bonds attractive, particularly in the current low-yield environment. Their income potential is a primary point of appeal that attracts investors to the high-yield corporate-bond market. Indeed, there are very few other investments that offer high- to mid-single-digit yield potential in the current market environment. But other factors to consider include the asset class’ diversification benefits as well as its ability to withstand the impact of rising interest rates, potential inflation, and an uptick in the instance of default. U.S. high-yield bonds offer a favorable risk/reward profile relative to other major asset classes thanks to their equitylike returns with significantly less volatility. Owing to its generous yield, the Bank of America Merrill Lynch High Yield Master II Index (the generally accepted benchmark for the asset class) generated an annualized total return of 7.6% over the past 15 years. This compares to a total return of about 4.6% for the S&P 500. But the BofAML HY Master II Index’s annual standard deviation over that period was 9.9%, compared with 15.3% for the S&P 500. Adding a stake in high-yield bonds to complement aggregate bond exposure can help improve a portfolio’s diversification benefits. In fact, over the past five years, high-yield bonds have been uncorrelated (12%) with the Barclays U.S. Aggregate Bond Index. The asset class’s lack of correlation with investment-grade bonds and its negative correlation with government bonds should be an advantage when we finally see the inevitable rise in interest rates and potentially higher inflation. Of course, these advantages don’t come without risk. This economically sensitive asset class fell more than 32% in 2008 when the markets were roiled by the global credit crisis. Steady inflows from yield-starved investors have helped drive prices higher. The current option-adjusted credit spread between the BofAML HY Master II Index and U.S. Treasuries is about 4.4%. For some context, consider that the long-term average credit spread is about 6%. The all-time low of around 2.5% occurred in June 2007, while the all-time high occurred in December 2008 at the height of the credit crisis when the spread briefly spiked up to more than 20%. Fitch expects U.S. high-yield default rates will remain low through 2015 thanks to accommodative funding conditions and a recovering economy. Moreover, many of the highest risk issuers have taken advantage of favorable credit markets in recent years to extend their lifelines. Portfolio Construction This fund seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Barclays Capital High Yield Very Liquid Index. The index includes publicly issued U.S. dollar-denominated, non-investment-grade, fixed-rate, taxable corporate bonds that have a remaining maturity of at least one year. The fund uses a representative sampling strategy to track the index and currently has nearly 800 holdings. Its sector exposure is extremely concentrated, as industrials make up 89% of the portfolio. The financials sector makes up roughly 8%, while utilities round out the portfolio at about 4% of the benchmark. Issues rated BB and B make up 40% and 43% of the index, respectively. The remaining 17% is made up of issues rated CCC or lower. Currently, the fund’s modified adjusted duration is 4.38 years, and its weighted average yield to maturity is 6.39%. Fees This fund charges an expense ratio of 0.40% per annum. While this is quite a bit higher than those levied by funds tracking an aggregate bond index, it is cheap compared with actively managed funds in the same category. High-yield bonds tend to be more illiquid than investment-grade corporate bonds, which can make them comparatively expensive to trade. With an estimated holding cost of 0.72%, JNK reflects the challenges of employing a sampling strategy to track a relatively illiquid benchmark. Transaction costs explain the difference between the fund’s expense ratio and its estimated holding cost. Alternatives The closest alternative to JNK is iShares iBoxx $ High Yield Corporate Bond (NYSEARCA: HYG ) , which has a slightly higher expense ratio of 0.50% but a lower estimated holding cost of just 0.18%. HYG tracks the Markit iBoxx USD Liquid High Yield Index and also employs a representative sampling strategy. It currently has nearly 900 holdings and is much more diversified than JNK in terms of sector exposure. At 4.12 years, it has a slightly shorter duration than JNK. It also has a lower average yield to maturity of 5.59%. Another alternative for investors to consider is PowerShares Fundamental High Yield Corporate Bond ETF (NYSEARCA: PHB ) , which charges a 0.50% expense ratio. PHB seeks to outperform its cap-weighted peers by tracking a fundamental index developed by Research Affiliates, LLC. Investors concerned about the health of the economy and future default rates may favor PowerShares’ PHB, as its benchmark avoids the riskiest issuers (excludes issues rated below B). PHB has a comparable duration of 4.37 years, and its higher-quality portfolio offers a slightly lower yield to maturity of 5.05%. Investors concerned about the impact of rising interest rates may consider SPDR Barclays Short Term High Yield Bond ETF (NYSEARCA: SJNK ) or PIMCO 0-5 Year High Yield Corporate Bond ETF (NYSEARCA: HYS ) , which charge expense ratios of 0.40% and 0.55%, respectively. SJNK currently has a modified duration of 2.4 years, and its yield to maturity is 6.41%. HYS has a slightly lower duration of 1.96 years and currently offers an estimated yield to maturity of 5.47%. Disclosure: Morningstar, Inc. licenses its indexes to institutions for a variety of reasons, including the creation of investment products and the benchmarking of existing products. When licensing indexes for the creation or benchmarking of investment products, Morningstar receives fees that are mainly based on fund assets under management. As of Sept. 30, 2012, AlphaPro Management, BlackRock Asset Management, First Asset, First Trust, Invesco, Merrill Lynch, Northern Trust, Nuveen, and Van Eck license one or more Morningstar indexes for this purpose. These investment products are not sponsored, issued, marketed, or sold by Morningstar. Morningstar does not make any representation regarding the advisability of investing in any investment product based on or benchmarked against a Morningstar index.