Absolute Momentum Revisited

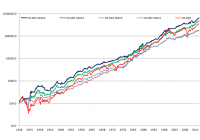

Trend following based absolute momentum, also known as time-series momentum, is the Rodney Dangerfield of investing. It “don’t get no respect.” Absolute momentum is little known and hardly used by investors. Yet it can be a very powerful tool, leading to both enhanced return during bull markets and reduced risk during bear markets. The more common type of momentum, based on relative strength, has little or no ability to reduce bear market drawdown. It may even increase volatility and downside risk. As I show in my book, Dual Momentum Investing , using both absolute and relative momentum simultaneously is the best approach in that it lets you benefit from the return enhancing characteristics of both types of momentum while incorporating the risk reducing benefits of absolute momentum. But absolute momentum has possible uses on its own for those who simply want to limit the downside risk and enhance the expected return of single assets or fixed portfolios. That is why I wrote the paper, “Absolute Momentum: A Simple Rule-Based Strategy and Universal Trend-Following Overlay,” which is now included as Appendix B in my book. I show how absolute momentum can be applied to a number of different indexes and assets, as well as to some common portfolio configurations, such as balanced stock/bond or simple risk parity portfolios. Absolute momentum is easy to calculate and apply. It is positive if an asset’s excess return (return less the Treasury bill rate) over a specified look back period is positive. One then holds that asset until absolute momentum turns negative. In my paper, I use data going back to January 1973, since bond index began at that time and international stock index data began close to it in January 1970. Elsewhere in my book, I also use January 1973 as the start date for my analysis, since my book’s featured Global Equities Momentum (GEM) model relies on the same fixed income and international stock indexes. Those wanting to see additional momentum result history can consult the references I give in the book showing attractive profits from relative strength and absolute momentum back to 1801 and 1903, respectively. However, I now think it would be a good idea now to extend my back testing of absolute momentum, since I learned that some investors are especially attracted to absolute momentum for several reasons. First, absolute momentum trades less frequently then dual momentum, which may be important for taxable accounts. Absolute momentum applied to just the U.S. stock market gives mostly long-term capital gains from stocks. The second reason absolute momentum may be worth looking at in more depth is that some investors have only a single investment approach that they are comfortable using. They may want to hold a portfolio that focuses solely on value plus profitability (see my earlier post, ” Value Investing Redux “), quality, hedge fund cloning, stock buy backs, dividend appreciation, micro caps, or other factors. So I think it would be helpful to see how absolute momentum looks when applied to aggregate U.S. stocks using the long-term Kenneth French data library that is available online. I compare 10 and 12 month absolute momentum filters to commonly-used 10 and 12 month simple moving average filters from April 1927 through December 2014, a period of 87 years. When we are out of stocks, assets are invested in one month Treasury bills. Here are the results with monthly readjusting of positions without transaction costs: Abs12 MA12 Abs10 MA10 US Mkt ANN RETURN 11.06 9.76 11.45 9.77 11.74 ANN STD DEV 12.53 12.83 12.88 12.50 18.70 ANN SHARPE 0.57 0.46 0.58 0.48 0.41 MAX DD -43.98 -48.22 -41.44 -56.62 -83.70 These are hypothetical results and are not an indicator of future results and do not represent returns that any investor actually attained. Please see our Disclaimer page for additional disclosures. (click to enlarge) We see that absolute momentum gives very attractive results compared to both buy and hold and the use of moving averages. Absolute momentum shows higher returns and Sharpe ratios, as well as lower maximum drawdowns, than comparable moving averages. In addition, moving averages have approximately 50% more trades and more false whipsaw signals than absolute momentum. So if we were to account for transaction costs, absolute momentum signals would look even more attractive compared to their moving average counterparts. Because of the additional transactions, moving averages are also not as tax efficient as absolute momentum. Dual momentum is still the premier momentum strategy for most investors, but absolute momentum may be a valuable tool for many others.