GGN: Now Could Be A Good Time To Pick This High Yielder Up

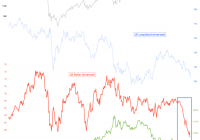

Summary GGN invests in gold and natural resources, with an option overlay and the ability to use leverage. GGN’s is trading at an over 5% discount to its NAV, despite a history of trading at or above NAV. That could make now a good time to consider this relatively risky high yielder. GAMCO Global Gold, Natural Resources & Income Trust (NYSEMKT: GGN ) isn’t for the feint of heart. But if you can handle a little risk and have been looking for a way to add hard assets to your portfolio, now could be a good time to consider this closed-end fund, or CEF. And with an over 12% yield, paid monthly, you’ll be getting a nice income stream, too. Not your average bear GGN isn’t your run of the mill gold fund. This CEF’s portfolio is roughly 50% metals and mining stocks and 33% energy and energy services stocks. So roughly 80% of the fund is in sectors that have been, you could say, out of favor. Oil and related stocks have been the most recent market pariahs taking a toll on this CEF’s market price. However that doesn’t mean that you should avoid these assets. Hard assets and related industries can provide a valuable hiding place when markets are in turmoil or when inflation is rising quickly. They are often seen as a safe haven. It’s this diversification opportunity that leads investors to include some hard assets in their portfolios. So, the current malaise in mining and energy stocks can be looked at as a reason to avoid the sectors, or as a Blue Light Special opportunity for adding hard assets to your otherwise diversified portfolio-Just in case. But there’s more to GGN than just a focus on hard assets. It can also make use of leverage ( around 7% or so recently ) and an option overlay strategy. The primary goal of the fund is to provide investors with a high level of income, capital appreciation is a secondary goal. Thus, the fund writes options on the stocks it owns. And since volatility is the norm in the precious metals arena, there’s plenty of opportunity to take advantage of the options strategy to create income. Right now GGN pays $0.07 a share every month. That was recently cut from $0.09, a fact that should prepare you for income volatility here. However, even with that dividend cut, the CEF still pays a handsome yield of around 12%. Thus giving you high yield exposure to a broad asset class that could provide a safe haven if the markets tank. The leverage piece of the puzzle is more difficult to reconcile with the fund’s income objective. However, with rates historically low, GGN is taking advantage of an opportunity to access cheap debt. That’s a double edge sword, since leverage can enhance performance on the upside and exacerbate losses on the down side. There’s been more down than up lately, so it’s a good thing that leverage is pretty light at around 7%. This is a piece worth watching if you decide to step in here. That said, sister closed-end fund GAMCO Natural Resources, Gold & Income Trust (NYSE: GNT ) is another option if you want to avoid leverage, but it’s yield is a couple of percentage points lower. I’ll write about this CEF shortly. The real opportunity While owning an income producing security in out of favor industries is a good reason to be looking at GGN, it doesn’t get at the real opportunity right now. And that’s the discrepancy between GGN’s share price and its net asset value, or NAV. Historically, GGN has traded at or slightly above its NAV, with the Closed-end Fund Association pegging the average premium over the past five years at a little over 2%. But right now GGN is trading at discount of around 5% or so. The reason for this is likely two fold. First, investors have been selling off anything related to oil over the last six months or so as oil prices have fallen precipitously. That includes GGN. Second, year-end selling to lock in losses to offset gains elsewhere for tax purposes. GGN is a prime target for tax less selling since last year was a less than stellar one for the fund; the fund’s share price was down nearly 25% in 2014. (Total return, which includes distributions, was a loss of roughly 15%.) That’s not a guarantee that you’ll see a 7% price jump as 2015 progresses in addition to a 12% yield. But it does mean that GGN’s shares look like they are being put on an even deeper sale than the two sectors on which it is focused. So, if you want to own some hard assets “just in case,” now is a good time to take a look at GAMCO Global Gold, Natural Resources & Income Trust. That’s especially true if you have an income bent and prefer to outsource at least some of your investment activities.