Should I Have High Yield (Junk) Bonds In My Portfolio?

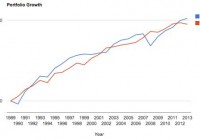

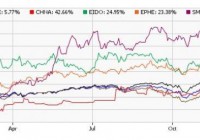

Summary By buying junk bonds I would take on more risk. The trade off is I would expect better returns. Do high yield junk bonds belong in my portfolio? Junk Bond Risks Companies that have low credit ratings pay higher interest rates, but of course those rates come with higher risk of default. Below we show data from Fitch that shows historical default rates. Non-investment grade (junk) rating consists of data rated BB and below. As can be seen default rates rise quickly as rating grades get worse. Fitch Global Corporate Finance Average Cumulative Default Rates: 1990-2013 1 year 2 year 3 year 4 year 5 year 10 year AAA 0 0 0 0 0 0 AA 0.03 0.03 0.07 0.13 0.19 0.24 A 0.08 0.22 0.38 0.52 0.71 1.82 BBB 0.19 0.66 1.19 1.76 2.36 4.64 BB 1.09 2.68 4.27 5.71 6.95 10.94 B 1.94 4.54 6.87 9.01 10.88 11.44 CCC to C 23.51 31.48 34.96 37.01 39.58 39.54 Investment Grade 0.11 0.35 0.61 0.88 1.17 2.27 Speculative Grade 2.88 5.33 7.38 9.16 10.70 13.38 All Corporate Finance .73 1.43 2.04 2.59 3.07 4.07 It is wise to keep in mind that during severe market corrections ratings tend to get downgraded and default rates increase. Fitch-Rated Global Corporate Finance Issuer Default Rates Default Rates 1990-2013 Year Default Rate (%) 1990 1.36 1991 2.25 1992 0.65 1993 0.00 1994 0.00 1995 0.11 1996 0.29 1997 0.08 1998 0.42 1999 0.85 2000 0.38 2001 0.90 2002 2.17 2003 1.16 2004 0.12 2005 0.32 2006 0.07 2007 0.10 2008 1.28 2009 2.58 2010 0.49 2011 0.30 2012 0.65 2013 0.51 As we can see above during both the Tech Wreck and the Great Recession defaults increased substantially. Junk Bond Returns compared to 5 Year Treasuries Portfolio Visualizer provides some excellent tools for backtesting. I used their tools to generate a backtest for comparing High Yield Bonds to 5 Year Treasuries. Portfolio 1 – High Yield Bonds – As represented by Vanguard High Yield Corporate (MUTF: VWEHX ) Portfolio 2 – Five Year Treasuries (click to enlarge) (click to enlarge) As shown about High Yield bonds did return slightly more, but had a much larger maximum drawdown and worse risk adjusted returns based on the Sharpe Ratio and the Sortino Ratio. (click to enlarge) The year -by- year comparison shows that treasuries performed well when the equity market was correcting while High Yield bonds performed poorly. Conclusions Junk Bonds had a slightly higher CAGR over the 1990-2013 time frame, but the advantage was small 7.11% to 6.59% and Junk Bonds actually trailed the treasuries from 1990-2011. Was the small advantage in CAGR worth the risk? The maximum drawdown for the junk bonds was -21.29% the max drawdown for the Treasuries was -4.33%. Junk bonds had a Sharp Ratios of 0.41 and Sortino Ratio of 0.75 compared to a Sharpe Ratio of 0.59 and a Sortino Ratio of 1.40 for the treasuries. I’m semi-retired and bonds are the low-risk part of my portfolio. The possibility of a 20% plus drawdown in the ‘safe’ part of my portfolio makes be lean toward selecting the treasuries. When you add in the fact that the high-yield bonds barely beat the treasuries in total returns it’s a no-brainer. Not only did junk bonds have larger drawdowns they had them at the worst possible time. When equities were taking a beating in 2008 High Yield bonds were going right down with them: -21.29%. Treasuries were up 13.32% in 2008; this is exactly the kind of negative correlation I want my bond holding to display during an equity market correction. Junk bonds have taken a hit lately and the spread between high yield and investment grade bonds has widened. Some investors may view this as an opportunity. I still do not view the risk/reward favorably. If I need higher returns I would be inclined to add more equities and keep my bond investments in Treasuries or investment grade corporate bonds. Bonds are in my portfolio to provide safety, smoothing out my returns and keeping me from having to sell losing investments during a correction. Junk Bonds don’t fit the bill. I won’t be adding junk to my portfolio. I am not a professional advisor or researcher. I am an individual investor who studies investing and shares my thoughts. I encourage all investors to do their own due diligence and please share your findings. I strongly feel the best thing about Seeking Alpha is the sharing of ideas. Please comment; I value your input. Divergent opinions are welcome.