Will The Fed Bring Down SLV?

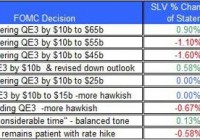

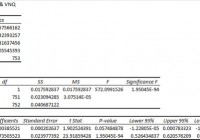

The FOMC’s statement was released on January 28. The price of SLV could come down once the FOMC starts to raise rates. The concerns over the global economy aren’t likely to change the FOMC’s view about raising rates this year. The recent decision of the FOMC didn’t stir up the silver market as shares of iShares Silver Trust ETF (NYSEARCA: SLV ) slightly declined on the day the statement was released. But, the sentiment of the recent statement may suggest the FOMC is still on its road to raise its cash rate in the coming months, which could curb down the recent rally of SLV. Let’s review the latest from the Fed and the potential ramifications of its policy on SLV. The recent FOMC meeting concluded with little changes to the wording of the statement. The FOMC reiterated its stance about being patient over its next rate hike: The Committee judges that it can be patient in beginning to normalize the stance of monetary policy. The FOMC still remains bullish about the U.S. economy mainly when it comes to the labor market – this is partly due to the fall in oil prices. Nonetheless, the FOMC estimates inflation could fall further in the near-term albeit rise back up to its target in the medium-term: Inflation is anticipated to decline further in the near-term, but the Committee expects inflation to rise gradually toward 2 percent over the medium-term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. (click to enlarge) Source of data: FOMC’s site and Bloomberg The reaction to the recent decision wasn’t too harsh at first and the price of SLV only slightly declined. The following day, however, SLV tumbled down. In most of the meetings in 2014, the reaction of silver prices to the FOMC statement was mostly negative, because the FOMC’s policy kept turning more hawkish. Lower inflation doesn’t seem to persuade investors that the FOMC is reconsidering not to raise rates later this year. For now, the inflation is likely to keep coming down. Even the 5-year inflation expectations have slowly come down in recent months. (click to enlarge) Chart taken from FRED As you can see, the inflation expectations for the next five years are still not far off the Fed’s 2% target. This figure could decline further in the coming months as low oil prices are likely to pressure it down. But, the Fed still estimates that over the mid-term the inflation will remain around the 2% range – inline with its target. But, the main issue remains whether the drop in U.S. inflation in the near-term and the concerns over the global economy could be enough to persuade FOMC members to push forward the first rate hike and subsequent raises. The progress of the global economy – while it does influence FOMC members’ decisions – isn’t a major factor when it comes to the two mandates the FOMC has – inflation and jobs. When it comes to both cases, the FOMC’s objectives are on the right path. (click to enlarge) Chart taken from FRED This, however, doesn’t include the progress in U.S. wages – they remain relatively low and haven’t picked up in recent months. The little progress in wage could be a factor to tilt the scale towards keeping the Fed’s cash rate low for a longer time than currently estimated. Many still estimate that the FOMC will move forward and raise its cash rate this year. Moreover, most of the FOMC’s voting members also estimate the cash rate will be raised this year – according the December FOMC statement. Finally, it’s worth noticing that unlike the December meeting, in the recent meeting there weren’t any dissenters to the decision. This could be another indication that no major changes were made to rock the boat. If the FOMC remains bullish on the U.S. economy and won’t let the recent drop in U.S. inflation to change its view, then this could mean a rate hike in the coming months. This decision could start to pressure up U.S. treasury yields and thus bring back down the price of SLV. Moreover, the ongoing recovery of the U.S. dollar, which is likely to be boosted by a rate hike, could also adversely impact the price of SLV. In the meantime, even though the price of SLV rose by over 14% during the month, the demand for the silver ETF didn’t rise – the silver holdings of SLV are still around 319 million ounces of silver, which represent a 3.1% drop, year to date. The FOMC’s minutes will be released next month and could provide more insight behind the recent policy meeting. But, until the FOMC starts to raise rates, the concerns over the global economy and the drop in U.S. treasury yields could keep the price of SLV from plummeting again and erasing its gains from earlier this year. For more see: Will Higher Physical Demand for Silver Drive Up SLV?