Yellen’s Inflation Compensation And GLD

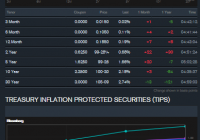

Summary The Fed is an important influencer of inflation, and for 2015, the Fed is ready to accept inflation as low as 1% and this will push down gold prices. The Fed is ready to fight possible long-term inflation as the economy grows by raising Fed Rates and gradually reducing its $4.55 trillion balance sheet if necessary. Yellen is signaling that the Fed is going to ignore market based weak inflation expectations as seen by the new term ‘inflation compensation’ on the Treasury market. Slim possibility that inflation will overshoot the 2% target, it is more likely to undershoot as energy prices are not transitory. A significant portion of gold holders still see high inflation as the economy strengthens. This is not applicable now and it is time to sell GLD before the crowd does. Fed, Inflation and Gold Frequent readers of my articles on gold will realize that I have been bearish on gold for quite some time now. Gold has many purposes and one of which is for its usage as storage of value. There will always be someone who is willing to buy and store gold if they do not believe in today’s monetary order or simply to form part of a diversified portfolio, and there are those who buy gold as an inflation hedge. This article is targeted for those who view gold as an inflation hedge. There will be a significant portion of investors who will buy gold as an inflation hedge, and it is the changes in inflation or inflation expectations which will have a big impact on the price of gold. There is no other institution that has more influence on inflation than the Federal Reserve, and this is why I believe that by following the Fed closely, we can better inform ourselves on inflation and that is why most of my gold article involves the Fed in one way or the other. The latest Fed document comes in the form of Chair Janet Yellen’s press conference on 17 December 2014. As always, the mainstream media is obsessed with when the Fed will raise interest rates, and there are a number of questions on it with the word ‘patient’ being the new buzz word. If you read the press articles elsewhere, you will probably be informed that the Fed will not raise rates for ‘a couple’ of meetings. Indeed, during the question and answer session, one reporter even wanted to confirm with the Chair if ‘a couple’ means 2 meetings which was subsequently confirmed. However, this is actually quite meaningless for the serious investors because Yellen has qualified her response as data dependent so who is to stop her from raising rates in the next meeting or 5 meetings down the road? She has certainly kept that possibility open, and remember that the US grew by 5% in the third quarter of 2014. My article may have come after all the buzz has subsided, but as you read about it in the new year of 2015, I hope to bring about new perspective based on some points that are largely ignored by the media. Let me bring your attention to the idea of inflation compensation, the existing size of the Fed’s balance sheet, and the Fed’s own inflation expectation for 2015, together with their view of a transitory low energy prices. Rate Hikes and Balance Sheet – Tools ready to Cap Growth Related Inflation Let us first begin with the concept that monetary policy works with a lag time. So the appropriate response to do is to predict as best as possible what will happen in the future and set policy that will ensure that the Fed’s dual mandate of stable prices and maximum employment is achieved as much as possible when the monetary policy takes effect. The Fed views that stable price means a 2% inflation target and predicts that this will be reached in 2017. Stable prices can only be achieved together with an appropriate Federal Funds Rate, which stands at 3.75% in the long run. However, the Fed set a target of 2.5% by 2017 to accommodate for the economic recovery and deal with the residual effect of the Great Recession. This will fit into the narrative where they would start to raise rates in 2015 and gradually guide rates towards their target as they expect the economy to grow in strength. For the shorter term, the Fed’s own forecast, which they would have factored in their own rate hikes, expects inflation to stay between 1% to 1.6% in 2015. This range is within the current Personal Consumption Expenditure inflation reading of 1.4% . So at least in the short term, the Fed is willing to accept lower inflation reading and this is going to be bearish on gold. However, gold might still catch a bid if there is a reasonable expectation for inflation to increase significantly in the future. This is where the size of the Fed balance sheet comes into the picture and where the uncertainty over the inflation compensation comes into play. The Fed is holding $4.55 trillion of assets as of 24 December 2014 and $4.47 trillion comes in the form of Federal Reserve credit. While this may have been accommodative in the past, it can also be used to keep a lid on inflation as seen in the quote by Yellen below. “Rather than actively planning to sell the assets that we’ve put onto our balance sheet, sometime after we begin raising our targets for short-term interest rates, depending on economic and financial conditions, we’re likely to reduce or cease reinvestment and gradually run down the stock of our assets. But our active tool for adjusting monetary – the stance of monetary policy so that it is appropriate for the economic needs for the country, that will be done through adjusting our short-term target range for the federal funds rate.” Yellen’s quote above shows that the Fed is ready to tighten monetary policy not only through the federal rate hike that is in the spotlight recently, but also through a gradual reduction of its balance sheet assets. Hence, we can conclude that the Fed is poised to reign in any runaway inflation that they expect when the economy recovers. This is an old economic theory that is about to be revisited by the investment community at large. Also, consider the argument that low energy prices may be here to stay in this excellent article by Kyle Spencer. The Fed has a bullish outlook for the US economy, and this is the majority view of the FOMC and they are prepared to reign in long-term inflation. The biggest cheerleader of them all has to be the Dallas Fed President, and you can read all about it in this article, Dallas Fed Fisher’s Prescience And GLD . In that article, I gave you the reason that the USD will rise, as the strong 5% GDP growth reinforces the possibility of an earlier rate hike and this will bring down the price of gold that is denominated in USD. In this article, I am now giving you another reason to sell which is to say that the Fed has capped all possibilities of inflation going higher than 2%. In all possibilities, inflation is more included to remain lower than what the Fed expects. My view is that the economy may grow, but inflation might not move towards the 2% target that is expected by the Fed. The tightening of monetary conditions by way of rate hikes will act as an inflation dampener in 2017. I have written about it in this article, Growflation And The 1% Fed Inflation Target In 2015 so I am not going to repeat myself. I am going to bring a new perspective of the declining yield of the 5-year treasury yields and how the Fed is responding to it. Instead of seeing it as a sign of a decline in inflation expectations, they see that it is possible that this could be due to an influx of funds due to the USD safe haven status. Inflation Compensation “Well, what I would say, we refer to this in the statement as “inflation compensation” rather than “inflation expectations.” The gap between the nominal yields on 10-year Treasuries, for example, and TIPS have declined-that’s inflation compensation. And five-year, five-year-forwards,as you’ve said, have also declined. That could reflect a change in inflation expectations, but it could also reflect changes in assessment of inflation risks. The risk premium that’s necessary to compensate for inflation, that might especially have fallen if the probabilities attached to very high inflation have come down. And it can also reflect liquidity effects in markets. And, for example, it’s sometimes the case that-when there is a flight to safety, that flight tends to be concentrated in nominal Treasuries and could also serve to compress that spread. So I think the jury is out about exactly how to interpret that downward move in inflation compensation. And we indicated that we are monitoring inflation developments carefully.” I have quoted Yellen on her answer above as this is a new concept. This would imply that the Fed would not take reference from market signals as credible inflation measurement for a while. This is evident in Yellen’s renaming of inflation expectation to inflation compensation instead. In other words, investors may expect 2% inflation in 5 years time, but increased demand for Treasury bills pushed down their actual yield to 1.538% (Current Yield of 1.66%-0.125% TIPS, see chart below). Hence, this 1.538% inflation market expectation is not a good gauge of actual inflation 5 years later. Source: Bloomberg This safe haven argument is not an unreasonable one, as Europe and Japan are still mired in economic troubles. Europe, Japan and Switzerland have all instituted negative interest rates, and it is only logical that international capital would flee these financial centers and enter into secure Treasury holdings, especially when the market has reasonable expectations that rates are going to rise soon. So to summarize it even further, Yellen is telling the world that the Treasury inflation pricing mechanism is malfunctioning now so don’t take it seriously. Since the Fed is going to raise rates soon, the danger is not that it would overshoot its inflation target, but rather that it will undershoot the inflation target. This is why I am bearish on gold as there is little upside to inflation to support gold prices. As long as the market continues its expectation that inflation is coming as the economy recovers, they will continue to overprice gold as there will be investors who will hold gold with a longer time horizon. Profiting with GLD In other words, there is a very slim possibility of high inflation in the days ahead, and the greater possibility is that inflation will undershoot the 2% target in the medium term. Hence, there is no reason to hold gold as an inflation hedge. As the new consensus builds around this, gold prices will continue its secular decline. The way for investors to profit from this is to sell the SPDR Gold Trust ETF (NYSEARCA: GLD ). There are other gold ETFs, but GLD is the most liquid at $27.45 billion market capitalization and 7.9 million of last known daily transaction. (click to enlarge) As you can see on the chart above, GLD has been on the bearish decline, but periodically there will be strength for which investors can sell on. This is indicative of a healthy market for which to sell GLD. The pullback indicates the profit taking of the bears. Of course, this bearishness of GLD will end one day as it approaches its true value. However, this will only happen after we see the significant portion of gold holders who hold in expectation of higher inflation as the economy grows give up their position. For most, this will only occur when they continue to see low inflation amid high growth. Then they will question themselves why they are willing to lose out on the economic growth by tying up their funds on their gold holding when there is very low inflation. So for readers who hold gold as an inflation hedge and are persuaded by my arguments, the time to sell gold is now before a flood of sell orders enter the market.