Pick Your Poison: No Return On Safety Or More Risk On Your Return

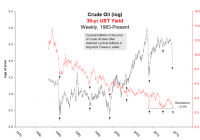

Summary Oil price moves and fluctuations in foreign exchange rates have increased the amount of risk associated with financial assets. The tail risk has increased as a result of the need for central banks to respond to oil prices and the performance of their trading partners. The size of the foreign exchange market and the amount of leverage involved make changes in exchange rates far more risky than changes in any other prices. Markets in Motion Lower oil prices are beneficial for oil consumers whether they be oil-consuming countries or consumers in the US filling up at the gas pump. That does not mean they are beneficial to financial markets. The price of a financial asset is determined by the return one expects to earn from holding the asset and the amount of risk or uncertainty associated with that return. A rapid change in any environmental factor increases the uncertainty associated with the return and therefore reduces the value of the financial asset. There have been numerous articles about the falling fortunes of the oil sector. On January 19, 2015 Barron’s presented a summary of one analyst’s estimates of how much the earnings of the S&P 500 would be reduced by the reduced earnings of the energy sector. The estimates do not seem worth quoting since they were developed without addressing the issue raised by the first sentence of this posting. While the energy sector’s earnings will be reduced, earnings in some other sectors will benefit. The net result is the introduction of considerable uncertainty into any forecasts of the profitability of a large number of companies. That uncertainty will repress stock prices. Thus, the uncertainty introduced by rapidly changing energy prices definitely has stock market implications. However, the December 17, 2014 posting entitled “Oil Prices” pointed out that the greatest macroeconomic risk associated with falling oil prices would be their impact on foreign exchange markets: “The foreign exchange markets are so big that a major dislocation there can have all sorts of unanticipated consequences.” Furthermore, it is quite conceivable that foreign exchange markets and oil markets could reinforce each other in terms of their financial market impact even when their macroeconomic impact diverges. By introducing instability, they both could be contributing to lower stock prices by increasing the risk associated with holding stocks. That can be true regardless of whether they have a positive or negative impact on the return. The December 17, 2014 posting went on to note: “One should keep in mind that financial institutions make markets in both currencies and foreign bonds. If a major financial institution gets caught with excess inventory of the wrong currencies or bonds, dislocation to the financial system could be significant.” One could argue that financial institutions also make markets in commodities such as oil, and therefore, that risk should be noted. However, as big as it seems, commodities markets are small compared to foreign exchange markets. On Jan.16, 2015 the Wall Street Journal was full of stories illustrating just how disruptive unanticipated foreign currency fluctuations can be. However, the foreign currency fluctuations were only very indirectly related to oil prices. The topic du jour was an action by central banks, current action taken by the Swiss central bank and anticipated actions by the European central bank and the Fed. Among the following articles: ” Swiss Move Roils Global Markets ,” ” Bankers, Traders Scramble to Regroup After Swiss Move ,” ” Fallout From Swiss Move Hits Banks, Brokers ,” ” Europe’s Smaller Central Banks Likely to Cut Rates After Swiss Move ,” ” Swiss Shock Tarnishes Central Banks ,” ” Swiss Bank Shares Plummet After SNB Move ,” ” Gold Shines as Traders Seek Safety From SNB’s Shock Move ,” ” Swiss National Bank’s Franc Move Buoys Dollar ,” ” U.S. Government Bond Yields Fall for Fifth Straight Session ,” and ” UBS and Credit Suisse Earnings Get a Swiss Finish ,” one gets an idea of just how important foreign currency fluctuations are. The scope includes non-oil commodity prices (e.g., gold), earnings of banks, pressures on central banks in countries like Denmark, impacts on the economies of many nations, government bond yields, stock market prices in some nations, and the reputation of central bankers. The disruption is not just restricted to turbulence in all those markets, it also involves financial institutions closing their doors (e.g., Global Brokers NZ Ltd.) or having to raise additional capital (e.g., FXCM Inc.). On January 17, 2015 the Wall Street Journal reported estimates of the losses of a number of financial institutions. The article entitled “Surge of Swiss Franc Triggers Hundreds of Millions in Losses” included estimates for Deutsche Bank (NYSE: DB ) and Citi (NYSE: C ). While the hundreds of millions of dollars involved might seem significant, for US banks they pale compared to the regulatory risk pointed out in the March 5, 2014 posting entitled “The Widows’ and Orphans’ Portfolio and US Banks.” Nevertheless, they are just one more reason to avoid US banks in a portfolio designed to have a low volatility and a stable return. Even when addressing issues that seem totally unrelated to foreign currency, it is impossible to ignore a market as large as the foreign currency market. A good illustration occurs in an article published on January 16, 2015 in the Wall Street Journal. It was entitled “What’s the Matter With Canada?” The major thrust of the article concerns Canada’s manufacturing sector, but it was impossible for the article to thoroughly address that issue without discussing the impact of oil prices on the Canadian dollar. It may well be that the decline in US stock prices so far in 2015 is an adjustment to the uncertainty introduced by the volatility in oil prices and currency markets. It certainly is consistent with the increase in uncertainty or risk associated with holding stocks. However, when foreign currency fluctuations are involved, there is a significant increase in what is known as “tail risk.” Countries can default, financial institutions can go broke, and governments can be forced to support their financial system and their economies. Such shocks are often viewed as exogenous and therefore impossible to predict. It is true; they are impossible to predict and this posting in no way constitutes a prediction that they will occur in the US. However, they are not totally exogenous and the ground is fertile for them to occur. Just that fact will impact the return on financial assets. The first half of 2015 will provide significant opportunities to investors as companies adjust to the recent volatility in oil prices and currency values. Because currency fluctuations can have large impacts on all variables from interest rates to revenue growth of individual companies, what is apparent is that regardless of what adjustments are made in a portfolio, the risk associated with any asset has increased.