Tech ETFs With Global Footprints At Risk

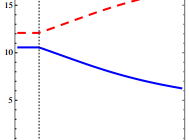

The U.S. dollar continues to appreciate against other overseas currencies. Large-cap companies with heavy overseas exposure could see revenue slow due to currency risks. Tech sector at risk of overseas exposure. As foreign central banks enact loose monetary policies, a strong U.S. dollar will negatively affect prominent technology stocks, along with related-sector exchange traded funds, that have significant overseas exposure. The Technology Select Sector SPDR ETF (NYSEARCA: XLK ) has been outperforming the broader markets, but a strong dollar could crimp the sector’s performance. XLK has declined 1.5% year-to-date and increased 16.0% over the past year. Meanwhile, the S&P 500 has dipped 1.7% year-to-date and risen 12.3% over the past year. A “strong dollar is negative for any company with significant overseas business,” James Kelleher, director of research at Argus, said in a CNBC article. “Companies like IBM and HP can’t totally avoid a currency headwind at the cost of being a global company.” According to Kensho quantitative analytic data, when the U.S. dollar appreciated 5% or more over 60 trading days on 10 separate occasions since January 1, 2005, tech companies were among the worst performers over the following three months. For instance, Hewlett-Packard (NYSE: HPQ ) traded in the red 70% of the time, with a negative median return of 4.51%. Intel (NASDAQ: INTC ) traded negative 70% of the time, with a median return of 2.97%. Adobe (NASDAQ: ADBE ) was negative 60% of the time, with a median negative return of 5.19%. IBM Corp. (NYSE: IBM ) also blamed the strong currency Tuesday for erasing any chance of a revenue increase this year, following its earnings report. XLK includes a 3.8% tilt toward INTC, 3.7% in IBM, 1.5% in HPQ and 0.9% in ADBE. Semiconductor ETFs, like the Market Vectors Semiconductor ETF (NYSEARCA: SMH ) and iShares PHLX SOX Semiconductor Sector Index ETF (NASDAQ: SOXX ) , also have significant exposure to INTC, which makes up 19.8% of SMH and 8.0% of SOXX. Additionally, the increasingly popular tech dividend ETF, First Trust NASDAQ Technology Dividend Index ETF (NASDAQ: TDIV ) , holds large positions in these large and stable tech names, including INTC 8.0%, IBM 8.0% and HPQ 3.0%. FX headwinds were “really the difference between growing pretax income and not growing pretax income in the fourth quarter for us,” CFO Martin J. Schroeter said. “Now, in this currency environment, and with the divestitures we’ve completed, our total revenue as reported will not grow in 2015.” An appreciating U.S. dollar makes U.S. products relatively more expensive in overseas markets. Sales in foreign currencies will translate to a lower U.S. dollar-denominated return in a strong U.S. dollar, or weak overseas currency, environment. Fueling the continued strength in the U.S. dollar, major central banks have been implementing loose monetary policies and enacting quantitative easing. For instance, all eyes were on the eurozone as the European Central Bank contemplated a Federal Reserve-styled bond purchasing program. “Policy diversion is driving this rally,” Win Thin, global head of emerging markets at Brown Brothers Harriman, said in the CNBC article. “The divergence is U.S. raising rates and the ECB, BOJ expected to do more easing, which typically weighs on a currency. Everyone’s very bullish on the dollar. The fundamental backdrop still favors the dollar.”