Wisconsin Energy’s 3.93% Yield: A 5-Year High

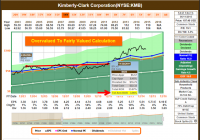

Summary Wisconsin Energy has demonstrated strong growth in earnings and dividends. The pending acquisition of Integrys moves WEC from a $15 billion utility to a $24 billion utility. The combined company will have 1.5 million electric customers and 2.8 million gas customers. The just-announced 8.3% dividend increase is in addition to the 8.3% increase earlier in 2015. The current yield (based on the newly indicated $1.83 annual dividend) is in its upper historic range. Wisconsin Energy Corporation (NYSE: WEC ) provides electric and natural gas service to customers in areas of Wisconsin and the Upper Peninsula of Michigan. Total assets are about $15 billion. WEC was formed in 1987 but its predecessor companies date to the founding of the Milwaukee Electric Railway and Light Company in 1896. The Enterprise The company currently operates three subsidiaries. We Energies is the utility enterprise that operates under the trade names of Wisconsin Electric Power Company and Wisconsin Gas LLC. W.E. Power LLC designs, builds, and owns power generating plants. It is involved in various projects, including generating stations, wind developments, and quality control systems. WISPARK is a full-service real estate development company. In the past, WISPARK developed master-planned business parks, including more than twelve million square feet of buildings Southeastern Wisconsin. Currently, WISPARK develops real estate projects that support and complement key programs of Wisconsin Energy Corporation and the development efforts of communities within WEC’s utility service territories. Acquisition of Integrys The current big story at Wisconsin Energy is the pending acquisition of Integrys Energy Group Inc (NYSE: TEG ). This will expand WEC’s service area to include parts of Minnesota, southern Michigan, and northeastern Illinois. The acquisition is introduced on the WEC website : Wisconsin Energy Corp. and Integrys Energy Group Inc. have entered into a definitive agreement under which Wisconsin Energy will acquire Integrys in a transaction valued at $9.1 billion. Upon completion of the transaction, the combined company will be named WEC Energy Group, Inc. The combination of Wisconsin Energy and Integrys brings together two strong and well-regarded utility operators with complementary geographic footprints to create a larger, more diverse Midwest electric and natural gas delivery company with the operational expertise, scale and financial resources to meet the region’s future energy needs. This acquisition will increase WEC assets from $15 billion to $24 billion. The WEC website has a concise fact sheet that describes the two companies. Here is a summary: Integrys shareholders to receive $71.47 in stock and cash Integrys shareholders will receive a total consideration of $71.47 per share, in the form of 1.128 Wisconsin Energy shares plus $18.58 in cash (74% stock and 26% cash). After the acquisition, former Wisconsin Energy shareholders will own 72% of the company and former Integrys shareholders will own 28%. WEC CEO Gale Klappa will serve as chairman of the combined companies. Corporate headquarters will be in metro Milwaukee, with operating headquarters in Chicago, Green Bay and Milwaukee. The new company will have more than 1.5 million metered electric customers and 2.8 million metered natural gas customers. The resulting company will operate seven regulated electric and natural gas utilities across Wisconsin, Illinois, Michigan and Minnesota. It will be the 8th largest natural gas distribution company in the U.S. The combined entity will be committed to accelerated investment in Integrys territories, including their 5-year plan to invest up to $3.5 billion in infrastructure and operational initiatives. Three Criteria for Evaluating Potential Acquisitions In the WEC Q1 2015 conference call , CEO Gale Klappa reminded participants that on June 23, 2014, WEC announced plans to acquire TEG. He said the deal meets or exceeds the three criteria that WEC uses to evaluate potential acquisition opportunities: First, we believe the acquisition will be accretive to earnings per share in the first full calendar year after closing. Of course, that would be 2016. Second, we believe it will be largely credit neutral. And finally, we believe the long-term growth rate will be at least equal to Wisconsin Energy’s standalone growth rate. Combined Companies Klappa elaborated about plans for the combined companies: We expect the combined company will grow earnings per share at 5% to 7% per year, faster than either of us is projecting on a standalone basis with more than 99% of those earnings coming from regulated businesses. Our customers will benefit from the operational efficiency that comes with increased scale and geographic proximity. And over time, we’ll enhance the operations of the seven utilities that will be part of our company by incorporating best practices system-wide. We believe that customers could actually see as much as $1 billion of savings over the next 10 years through a combination of lower capital and operating costs in Wisconsin. In addition, Integrys today, as you may recall, owns a 34.1% interest in American Transmission Company. Wisconsin Energy owns 26.2%. That means the combined entity will have a 60% stake in one of the largest independent transmission companies in the United States. WEC has a strong history of making successful “bolt on” acquisitions. The purchase of Integrys appears to be a logical fit. The projected $.4575 quarterly dividend is an 8.3% increase The companies appear to be on target to complete the transaction in the next few weeks. In a June 12, 2015 news release , WEC declared a pro rata dividend of $0.00459239 per share per day that will accrue from May 15, 2015, through the day before the effective date of the acquisition. This is the daily equivalent of WEC’s $.4225 per quarter dividend. It would be payable to WEC shareholders of record at the close of business on the day preceding the effective date of the acquisition. The WEC board also declared a pro rata dividend of $.00497283 per share per day (the daily equivalent of the new $.4575 quarterly dividend) from the date of the acquisition through August 14, 2015, which is WEC’s normal record date. The pro rata dividend would be paid on September 1, 2015 to shareholders of record on August 14, 2015. According to the press release: This new dividend level represents an increase of 8.3 percent over the current quarterly rate for Wisconsin Energy shareholders and – per the merger agreement – will bring Integrys and Wisconsin Energy shareholders to dividend parity. These pro rata dividend declarations are contingent on completion of the acquisition prior to Aug. 15, 2015. In the event that the acquisition does not close by that date, Wisconsin Energy shareholders of record on Aug. 14, 2015, will receive the regular quarterly dividend of $0.4225 a share, payable Sep. 1, 2015. Wisconsin Energy expects that in future years the projected payout target for the combined company will be 65-70% of earnings. Leadership Gale E. Klappa is the Chairman and Chief Executive Officer of Wisconsin Energy Corporation and Chairman, President and Chief Executive Officer of We Energies. He has held these roles since May 2004. He joined WEC as president in April, 2003. Prior to joining Wisconsin Energy, Klappa was executive vice president, chief financial officer and treasurer of Southern Company (NYSE: SO ). Previous positions at Southern included chief strategic officer, the North American group president of Southern Energy Inc. (now Mirant), president and CEO of South Western Electricity, SO’s electric distribution utility in the United Kingdom, and senior vice president of marketing for Georgia Power Company, a Southern subsidiary. Klappa is a 1972 graduate cum laude of the University of Wisconsin-Milwaukee, with a bachelor’s degree in Mass Communications. His excellent communication skill and his “radio voice” make for enjoyable and informative listening to corporate presentations such as quarterly earnings calls. Electric Light & Power magazine named Klappa CEO of the Year in January 2012, recognizing his role in executing the company’s Power the Future plan. This plan added 50 percent more generating capacity to the company’s operating fleet while cutting emissions of sulfur dioxide, nitrogen oxide and mercury by 80 percent. In September 2012, Corporate Responsibility magazine named Klappa Responsible CEO of the Year for his commitment to transparency, accountability and customer satisfaction. Allen L. Leverett has been president of WEC since August, 2013. He has served as president and CEO of We Generation, the company’s power generation group, since March 2011. Leverett has overall responsibility for Wisconsin Energy’s electric generation portfolio, fuel procurement, environmental compliance and renewable energy development strategy. Leverett joined WEC in 2003 as chief financial officer. J. Patrick Keyes has been executive vice president and chief financial officer of WEC and We Energies since September, 2012. He joined WEC initially as vice president and treasurer in April, 2011. Strong Dividend Growth David Fish lists Wisconsin Energy is a Dividend Contender with twelve consecutive years of dividend increases. David cites the following dividend growth rates (which do not include the just-announced 8.3% dividend increase): 1-year 8.0% 3-year 14.5% 5-year 18.2% 10-year 14.2%. Earlier in 2015, the quarterly dividend was raised 8.3% from $.39 to $.4225 per share (pay date 3/1/15), for an annual dividend of $1.69. The just-announced 8.3% dividend increase will raise it to $.4575 per share, for an annual dividend of $1.83. At the June 19, 2015 closing price of $46.58, this equates to a yield of 3.93%. WEC’s Total Dividend Return number (aka “The Chowder Rule”) is the 5-year dividend growth rate of 18.2% plus the current yield (in this case the new, or indicated yield) of 3.9%, or 22.1%. This is extraordinarily high for a utility and it reflects WEC’s stated policy of increasing the payout percentage to be more in line with peers. Therefore, since the payout ratio is now approaching the company’s target of 65-70% of earnings (as stated above), one would expect the dividend growth rate to moderate in the years ahead. In fact, one can see this already in the declining rate figures for 1-year and 3-year, compared with the 5-year rate. How did I find Wisconsin Energy? I was introduced to Wisconsin Energy through Seeking Alpha. WEC kept appearing in the comment threads of many Seeking Alpha articles about utilities and I read a few articles about WEC. In 2012, Larry Smith wrote one article about WEC, David White wrote two articles, and Saibus Research wrote seven articles. It’s quite likely that I glanced at some of these articles, but I did not immediately give WEC a serious look because the yield always seemed too low to merit further consideration. At some point, I began to notice WEC’s exceptionally strong growth in earnings per share and in their dividend. Through a quarterly earnings transcript or webcast, I became aware of the company’s commitment to grow the dividend. That was when I realized that the reason the yield always seems low is because the market gives WEC a premium valuation. The market is rewarding WEC for its strong growth. A lesson learned: Don’t stop looking at a company just because the yield seems too low. Look first at the growth of earnings per share and the dividend. My first conscious memory of giving serious consideration to WEC was after reading Ong Kang Wei’s March 21, 2013 article, Wisconsin Energy: A High Growth, Fundamentally Strong, Low Beta Pick For My Dividend Portfolio . I became convinced that I wanted to add WEC to the portfolio. The key factors were: 1) Impressive leadership, beginning with CEO Gale Klappa; 2) Strong growth in earnings; 3) Strong growth in the dividend; 4) Consistently high marks for WEC everywhere I turned. Still, I didn’t make the first purchase until nine months after reading Kang’s article. I made these purchases of WEC shares: December 31, 2013, at $41.24; December 30, 2014, at $53.70; March 4, 2015, at $49.80; June 1, 2015, at $48.35; June 10, 2015, at $45.16, and June 19, 2015, at $46.68. The average price was $48.31. In retrospect, I made a mistake by making a large purchase on December 30, 2014, which elevated the average price. (When the utility sector kept roaring higher, I trimmed 9% of the stake on January 27, 2015, at $57.28.) Currently, WEC is 5.8% of my retirement income portfolio. Financial Data Here are some key metrics from Morningstar via BetterInvesting.org : Common shares outstanding: 225.5 million Long Term Debt: $4,169.2 million Total Debt: $5,159.0 million Total Capital: $9,669.6 million Long Term Debt as a Percentage of Capital: 43.1% 52-week High: $58.01 52-week Low: $41.90 Annual Financial History Fiscal Year 12/31 2010 2011 2012 2013 2014 Sales (millions) 4202.5 4486.4 4246.4 4519.0 4997.1 Pre-tax Profit 505.9 776.7 852.6 915.3 950.0 Net Income 454.7 513.2 547.1 576.5 588.3 Earnings Per Share 1.92 2.18 2.35 2.51 2.59 The 5-year growth rate: Sales 3.6%; Earnings Per Share 7.6%. Price/Earnings History and Valuation Trends FY Hi Price Lo Price EPS Hi P/E Lo P/E Div Payout Hi Yld 2010 30.3 23.4 1.92 15.8 12.2 .80 41.7% 3.4% 2011 35.4 27.0 2.18 16.2 12.4 1.04 47.7% 3.9% 2012 41.3 33.6 2.35 17.6 14.3 1.20 51.1% 3.6% 2013 45.0 37.0 2.51 17.9 14.8 1.45 57.6% 3.9% 2014 554 40.2 2.59 21.4 15.5 1.56 60.3% 3.9% Average P/E Ratio: 15.8 Current P/E Ratio: 18.4 Interpreting the data The trends for earnings per share and annual dividend are up. The company has intentionally raised the payout ratio to be more in line with other utility companies. The market has consistently given a premium to WEC shares. Three times in the last five years the yield has approached 4.0%, only to see the stock price be bid up by investors. The 5-year market price trend reflects the bull market we have seen, as does the steadily rising P/E ratios. The high price thus far in 2015 was $58.01. The data confirm that WEC is what Chuck Carnevale would call a “premium value” stock. WEC’s consistent growth in earnings and dividends has resulted in a consistently escalating stock price. The challenge in purchasing shares of Wisconsin Energy (soon to be known as WEC Energy Group, Inc) is not to overpay. I overpaid with the 12/30/14 purchase. The current price of $46.58 reflects several dynamics of the market place. The utility sector has cooled off in recent weeks, most likely in anticipation of less accommodation by the Federal Reserve to keep interest rates low. The proposed purchase of Integrys has moved through the regulatory approval process with good speed. The companies are preparing to complete the transaction this summer. There may be some “wait and see” hesitancy within the investment community (either that the deal may be delayed or blocked at the last minute, or that the deal may be not be as good for WEC as company management has maintained). The long anticipated but just-announced dividend increase may not be fully reflected in the stock price. For whatever reason(s), WEC is 19.7% off its 52-week high. Investment thesis As an exercise in personal discipline, beginning with this article, I intend to write approximately one article per week about each of the companies in my retirement income portfolio. Part of this is a journal-like, one-paragraph investment thesis statement describing why I own shares of each company. Here’s that paragraph: Wisconsin Energy is the most impressive utility company I have studied. The key elements of this are strong management, an excellent service record, a history of successful bolt-on acquisitions, clear goals and operational transparency, good growth in earnings per share, exceptional dividend growth, and a clearly stated dividend policy. The high yield for the past five years has ranged from 3.4% to 3.9%. Thus, as funds are available, I will consider buying WEC when the yield approaches 4.0%. WEC is my first choice in the utility sector. My goal for this investment is to watch the pending acquisition of Integrys to see if WEC can continue its good history of successfully integrating acquired companies; to monitor management for signs of leadership transition plans (Klappa appears young and energetic, but he is older than I am); and for WEC to be in my “second group of four,” with a target portfolio allocation for WEC of 5.75%. (You can read more about that below in the portfolio review.) What could go wrong, or prompt a sale? The risks include adverse change in management, deteriorating earnings, change in dividend philosophy and policy, a shift to a more difficult regulatory environment, unexpected problems with integrating TEG into the combined operations. If I were initiating a position now, my target would be $46.33 (a 3.95% yield at the new indicated dividend of $1.83). Since WEC is already well represented in the portfolio, my target buy price for adding more shares is $44.68 (4.1% at the new indicated dividend). My target price for trimming some shares is $62.03, (a 2.95% yield at the new rate). Portfolio review I have tried to design my retirement income portfolio around “four groups of four,” that represent my top sixteen priority holdings: 1) JNJ, MMM, PEP, and WPC, with a target allocation of 6.0% each; 2) GPC, EMR, O, and WEC, with a target allocation of 5.75% each; 3) PG, T, IBM, and STWD, with a target allocation of 5.5% each; 4) NNN, HCP, NWN, and VTR, with a target allocation of 5.0% each. A fifth group is composed of DLR, HTGC, HASI, EVA, PEGI and (yet to be purchased) MAIN. Below is my Retirement Income Portfolio as of June 19, 2015. Companies are ranked by their percentage of the portfolio. “TDR” is the Total Dividend Return (aka the Chowder Rule number). “Target” is the target portfolio allocation for each stock and “Actual” is the actual percentage of each stock in the portfolio. Company Ticker Price Div Yield TDR Credit Target Actual WP Carey WPC 62.32 3.82 6.1 18.8 BBB 6.0 6.1 Pepsico PEP 94.86 2.81 3.0 10.7 A 6.0 6.0 AT&T T 34.99 1.88 5.4 7.7 A- 5.0 5.9 3M MMM 158.95 4.10 2.6 13.5 AA- 6.0 5.9 Jnsn&Jnsn JNJ 99.86 3.00 3.0 10.4 AAA 6.0 5.9 Proc&Gam PG 80.54 2.65 3.3 11.3 AA- 5.5 5.9 Realty In O 46.07 2.28 4.9 9.9 BBB+ 5.75 5.9 Wisc Energy WEC 46.58 1.83 3.9 22.1 A- 5.75 5.8 Emerson El EMR 58.11 1.88 3.2 9.0 A 5.75 5.8 Genuine Pts GPC 92.21 2.48 2.7 10.4 A+ VL 5.75 5.8 Int Bus Mach IBM 166.99 5.20 3.1 17.7 AA- 5.5 5.7 Starwood Pr STWD 22.79 1.92 8.4 nmf BB 5.5 5.4 HCP Inc HCP 37.73 2.28 6.0 9.4 BBB+ 5.0 5.2 NW Nat Gas NWN 43.42 1.86 4.3 7.2 A+ 5.0 5.0 Nat Ret Prop NNN 36.70 2.28 4.6 6.5 BBB+ 5.0 5.0 Hercules Tech HTGC 11.78 1.24 10.5 n/a BBB- 2.5 4.8 Ventas VTR 65.19 3.16 4.8 12.5 BBB+ 5.0 2.2 Hammon Arm HASI 21.31 1.04 4.9 n/a NR 2.0 2.2 Enviva EVA 19.56 1.65 8.4 n/a NR 2.0 2.0 Digital Realty DLR 67.93 3.40 5.0 24.7 BBB 2.0 1.2 Pattern Enrgy PEGI 29.95 1.37 4.6 n/a NR 1.0 1.0 Cash 1.5 1.3 This article is the journal of my retirement income portfolio. It is not intended as a recommendation to buy or sell any security. This is presented to offer ideas for stocks to study and to offer a work in progress of one person’s attempt to design a portfolio of dividend-paying common stocks. Please do your own due diligence. Disclosure: I am/we are long WEC, NWN, GPC, PG, EMR, MMM, JNJ, PEP, T, HCP, NNN, O, IBM, WPC, DLR, STWD, VTR, HTGC, HASI, PEGI, EVA. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.