The SPDR S&P Global Dividend ETF: Do High Yield Dividend ETFs Reach Too Far?

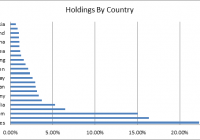

A globally diversified, passive, total return fund which seeks very high dividend payouts. Several of its heaviest weighted companies pay dividends in excess of net income. Several heavily weighted assets have dividends potentially at risk. We all know the famous biblical anecdote of David interpreting the Pharaoh’s dream. There were to be seven years of plenty followed by seven years of famine. Pharaoh heeded the analysis and prepared the kingdom for the lean years. It’s fair to say that this might have been history’s very first documented investment advice. It required discipline to make the right choices at the right time and then stick to a plan. Comparatively speaking one might say that these are lean year for dividends but it certainly won’t remain this way forever. So, how should a retirement portfolio be positioned for both the lean and fat years? One way is to invest in a dividend focused ETF, but the investor must tread carefully here. The idea is not just to get a dividend return, but to also minimize risk. The important at-a-glance metrics to examine carefully are: trailing dividend yields, payout to net income ratio and the strength of cash flow. These three will give an indication of consistency and sustainability of the current dividend. Here’s one example: State Street Global Advisors’ SPDR S&P Global Dividend ETF ( WDIV ) . According to State Street , the fund’s objective is ” to seek to provide investment results that, before fees and expenses, correspond generally to the total return of the S&P ® Global Dividend Aristocrats Index.” The prospectus states that the fund’s strategy is to invest in a subset of the index, being at least 80% invested at all times. Some key rules are: investing in securities having paid increasing or stable dividends for at least ten years, a market cap of at least $1 billion, an average daily trade value of at least $5 million, a non-negative ‘Dividend to Net Income ratio’ and a maximum indicated dividend yield of 10%. Under these rules, the top 100 qualified stocks are selected with no more than 20 companies from any one country. The weightings of individual holdings are capped at 3% and individual country weightings capped at 25%. (source: WDIV ) The top five country weightings accounting for 65.72% of the fund are: United States, 21.59%; Canada, 15.71%; United Kingdom, 14.52%; France, 6.66% and Australia at 6.64%. EU member nations account for 35.08% of the fund. One must also consider that the fund includes companies based in emerging market countries such as South Africa, Thailand, Brazil and Malaysia, comprising 6.26% of the fund. The fund’s prospectus makes no mention of currency hedging, hence there’s a currency risk although the fund’s broad global diversification should mitigate those risks. 29.62% of the fund is held in cyclically defensive sectors: Utilities, 15.33%, Consumer Staples, 11.22% and Health Care, 3.07%. Those sectors most affected by economic cycles comprise 36.7% of fund: Financials, 25.45%, Consumer Discretionary, 7.74% and Materials, 2.98%. Lastly, 34.21% are held in semi-cyclicals (or cyclically sensitive), 11.65% in Industrials, 10.13% in Energy, 8.36 in Telecom Services and 4.07 in IT. (source: WDIV ) The following gives a snapshot of the top ten holdings with yields and dividend statistics. HollyFrontier Corp (NYSE: HFC ), the fund’s top holding at 2.61%, is a U.S. based petroleum refiner, processing 443,000 barrels per day producing gasoline, diesel, jet fuel, asphalt and lubricants. HFC operates 5 refineries through subsidiaries and also owns a 39% interest in Holly Energy Partners. Its dividend yield is 3.20%, and above the 1.68% industry average in the volatile oil industry. Over the past 5 years its average yield is 3.22%. Its trailing 12 month target payout ratio is high at 155.14% of net income; however, it manages to pay consistently, with a 5 year dividend growth rate of 61.15%. The share price to cash flow multiple is 10.65, well within the average S&P price to cash flow multiple of 14 times. Neopost ( OTCPK:NPACY ), at 1.67% of holdings, is a global provider of mailing solutions, digital communications and shipping services, based in Bagneux, France. The company services 90 countries with subsidiaries in 31 of those. Neopost targets small and midsized companies in Europe although 40% of its business is from North America. To put Neopost in perspective, its primary competitor in the industry is Pitney Bowes . The ADR carries a semiannual dividend of $0.1357, or 7.98% annually. Its dividend yield 9.62% is well above the industry average, 2.65%. Similarly, its 5 year average dividend yield of 7.20% is also well above the industry average at 2.66%. Neopost’s target payout ratio is just over 100% of net income, with a 5 year 1.10% dividend growth rate; the share price to cash flow multiple is 7.61. In other words, Neopost dividend target is 100% of income however manages to sustain and grow their dividend. U.S. based R.R. Donnelley & Sons Company (NASDAQ: RRD ), at 1.63% of holdings. What R. R. Donnelley does may best be described as ‘getting the message across’, through publishing, retail services, digital print, books, magazines, catalogs, inserts, statements and manuals for its clients. Donnelley’s dividend yield of 5.75% is well above the industry average 2.25% yield. Its 5 year 6.67% yield average also tops the industry’s 3.04% average. It needs to be noted that Donnelley’s expected payout ratio is 123.3, indicating that, technically, it’s distributing more than it earns. Over the past 5 years dividend growth is nil and it has a price to cash flow multiple of 4.71, possibly indicating declining revenues and a low share price Coca-Cola Amatil Limited ( OTCPK:CCLAF ), 1.45% of holdings, based in Sydney, Australia. Amatil is Coca-Cola’s bottler and distributor serving the South Pacific region. Amatil’s dividend yield is 3.28%, has a 5 year average yield of 2.28 but, importantly, has a sustainable payout ratio of 77.44% of net income, a 5 year dividend growth rate of 8.72% and priced at a somewhat high 22.42 times cash flow. This is a solid dividend paying holding. Centrica ( OTCPK:CPYYY ), 1.43% of holdings, whose business is in ‘ every stage in the energy chain ‘, from sourcing on the industrial side to servicing on the consumer side. Centrica employs 30,000 in the U.K., Ireland, Europe, North America and Trinidad. Centrica’s dividend yield is 4.91% and has a 5 year average yield 4.84%. Its 5 year dividend growth rate is 1.07%. Due to falling energy prices Centrica cut its dividend to nearly zero. Its expected payout ratio is 0.00%. Shares are priced at 5.99 times cash flow. (click to enlarge) (source: combined) Wm Morrison Supermarkets ( OTCPK:MRWSF ), 1.43% of holdings. As the name implies it’s a retail supermarket chain and offers home delivery. It’s the 4th largest supermarket chain in the U.K. Wm Morrison has fallen on tough times and this is one of the weaker holdings. Shares have fallen 15% in the past 52 weeks. However, Q1 sales did improve and market share remained steady at 10.9%. It will be removed from the FTSE 100 and placed in the FTSE 250. Although the historical statistics indicate that the company paid a 0.5004 semiannual dividend, has a 5 year average dividend yield of 4.48% and a 5 year dividend growth rate of 10.73%, it’s necessary to point out that the company has a negative P/E at -21.65. In March of 2015 the dividend was cut 63%. Hence, a second company in the top ten with an expected 0.00% payout ratio. Currently, it is selling at approximately 4.02 times cash flow Universal Corporation (NYSE: UVV ), 1.42% of holdings, is a global supplier of cured leaf tobacco for consumer tobacco product manufactures. Their services include packing, storing and financing. Universal conducts business in 30 countries and employs 24,000 permanent and seasonal workers. The Company pays a $0.52 share dividend or 3.67% annualized, a 5 year dividend average of 3.97%, a 5 year dividend growth rate of 2.06% and a sustainable expected payout ratio of 47.36%. Shares are priced at 8.95 times cash flow, well inside the S&P average. Not only is Universal a solid dividend paying company, but its target payout ratio has plenty of room to grow. UBM PLC ( OTCQX:UBMPY ), 1.40% of holdings, is a London based marketing, communications and media consultants, specializing in digital services as well as ‘person-to-person’ events, such as trade shows, exhibitions, conferences and live events. Its ADR carries a semiannual $0.16 per share dividend, 3.74% annually, well above the industry average of 1.48%. Its 5 year average yield is 3.97% with a 5 year dividend growth rate of 2.06%. The payout ratio is a very sustainable 47.36%. It recently announced a dividend of $0.24. The company has also been recently upgraded by leading analyst, for example Societe Generale ( OTCPK:SCGLY ) and BNP Paribas ( OTCQX:BNPQY ), to ‘buy’. UBM’s expected payout ratio is 58.26% of earnings and is priced at 12.40 time cash flow. The sustainable payout ratio, analyst upgrades and cash flow multiple within the S&P’s average makes it a solid holding. Williams Companies (NYSE: WMB ), Inc., 1.38% of holdings, is a U.S. based and recognized by Forbes as the most admired energy company for 2015. It is a supplier of liquid natural gas, olefins used in plastics production, owns interstate natural gas pipelines and processes oil-sands. Williams Companies provides services through subsidiaries such as Transco , Gulfstream and Northwest Pipeline . The company pays a quarterly dividend of $0.59 per share, annualized to about 4.86%, a 5 year average yield of 3.24%, a very notable dividend growth rate of 26%, a sustainable payout ratio of 76.96% of net income and trades at 10.36 times cash flow. Williams is a well-founded dividend paying asset. New York Community Bancorp Inc. (NYSE: NYCB ) at 1.36% of holdings, is a New York State Charted Bank Holding Company of New York Community Bank and New York Commercial Bank . These subsidiaries service both consumers and business banking needs in New York City, New Jersey, Florida, Ohio and Arizona. The holding company pays a quarterly dividend of $0.25, about a 5.85% annual yield, a strong 5 year average yield of 6.48%, but having no dividend growth over those 5 years compared to the industry average of 18.04% dividend growth. Its expected payout ratio is high but sustainable at 90.92% and trades at 15.84 times cash flow, slightly above the S&P average. With an improving U.S. economy, particularly in the Florida housing market, it may well be worth the risk. (click to enlarge) The fund is diversified with 102 holdings and a dividend yield of 3.95%; 3.84% less fees and expenses. The recent fixed income selloff may have contributed to the -2.40% one month return. Year to date the fund returned 3.30% and since inception, 9.21%. The average top ten cash flow multiple is 10.3. This may be compared with the benchmark MSCI S&P ® Global Dividend Aristocrats Index yield of 4.61% and a price to cash flow multiple of 8.17. The fund’s FY1 P/E ratio is 15.30, identical with the index as well as the 5 years earnings growth of 5.44%. The market capitalization of the fund is $63.51 million with 950,000 shares outstanding. Currently the market premium is 0.73% over NAV and total management fees are 0.40% annually. (source: WDIV ) There are similar funds for instance the Guggenheim S&P Global Dividend Opportunities Index ETF (NYSEARCA: LVL ), weighted towards Energy, Financials and Utilities. However, just looking at a few of the most heavily weighted companies revealed payout ratios in the hundreds and several others currently having 0.00% payout targets. Another high yield dividend focused ETF, the First Trust Dow Jones Global Select Dividend Index ETF (NYSEARCA: FGD ), also had similar metrics. Since WDIV is a rule based passively managed fund, one should expect variations as companies are dropped or added to the fund as the rules guided metrics change. Generally speaking, though, there are several heavily weighed components which do pay a high dividend, but those dividends are potentially at risk. Granted, the fund will adjust for that, but the question becomes whether or not the passively managed fund will make those changes in a timely manner. The investor must keep the goal in mind and what the alternatives are. The most secure assets like U.S. Treasuries, AAA rated foreign sovereign or even the largest most solidly founded corporations are very highly priced, hence have lower yields. Paying up for such small returns is not a good strategy, especially when a correction is almost certain to happen when the major central banks unwind their QE programs. Similarly, just reaching for the highest yields without regard to risk will lead to similar ‘negative’ results. High yielding ETFs might be okay if an investor has available ‘risk capital’, but generally, these funds seem to be reaching a little too far out on the limb to stake a major portion of one’s capital in the interim. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.