Southern Company: Taking A Pass On This Quality Utility Name

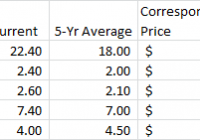

Buffett’s words should be heeded concerning Southern Company: “Price is what you pay. Value is what you get”. Compared to 5-yr average fundamentals, Southern Company looks expensive. While not a seller, I would not be a buyer either. However, investors should evaluate their dividend reinvestment position. Many readers know I have been bullish on Southern Company (NYSE: SO ) for some time. Over the previous two years, I have written eight articles focused on SO. With the recent spike in price to the $53 range, SO is now overvalued. At its current price, while I would not be a seller, I would not be a buyer either. “Price is what you pay. Value is what you get,” says Warren Buffett. While SO is a strong utility with a bright future, the value investors are buying is not as attractive as a few months ago. Below is a comparison of current valuations vs SO 5-yr average. The corresponding price is the valuation of SO at each of these 5-yr averages. As shown, these fundamentals indicate SO is overvalued compared to its averages since 2009. Source: Morningstar, MyInvestmentNavigator.com Earnings have been reduced recently due to write-offs of cost overruns at their Kemper project. There are questions being raised as to first $900 million cost overruns on the Vogtle power plants as the resolution has now been passed to the courts. The consensus belief is SO will win these lawsuits based on the terms of their contract. However, delays from the planned fourth-quarter 2017 and fourth-quarter 2018 start dates seem inevitable, and could lead to future charges against earnings. Southern Company still has several very positive trends that should continue to reward shareholders. The regulatory environment is quite favorable in its service territory. Return on invested capital ROIC is one of the best in the business at a 5-yr average of 6.75%, even after a dismal 2013 at barely over 5%. Unlike many of its peers, SO’s ROIC is above its weighted average cost of capital WACC of 4.2%. Southern Company has earned an A- rating by S&P Capital IQ for 10-year consistency in earnings and dividend growth. The rating puts SO in the top 3.3% of all companies reviewed by S&P and in the top five management teams for the entire utility sector. These are very admirable qualities for long-term investors. Concerning distributed generation, CEO Fanning is on record as embracing this potentially disruptive power trend. In an interview last year, he is quoted, Fanning touts efforts by Southern subsidiary Georgia Power to promote both utility-scale solar as well as distributed generation. “If somebody wants to buy distributed generation, I want to sell it to ’em. I’m completely happy to do that.” To support that effort, rate structures will have to be redesigned, something Fanning thinks state regulators will be “constructive” about supporting. “You need to do it fairly. There are three components of that. One is revenue , which should be done at avoided cost. Second — it is not net metering; that is a flawed concept. Second is a fair charge for connection to the network, and third is a fair charge for the backup generation and the energy when the wind is not blowing and the sun does not shine. As long as you do that right, we’re 100 percent in,” Fanning said. “This is something where we’ve got to play offense.” Morningstar rates SO with only 2 Stars, not a very compelling value. Their unique Bulls and Bears comments from the latest update in early Dec are: Bulls Say: Southern operates in the business-friendly Southeast, where its traditionally low power prices and sterling reputation help to foster a constructive and stable regulatory atmosphere. As of mid-November, Southern’s dividend yield was 4.5%, well above its peers’ [Author’s note: with the recent run-up in prices, yield is 4.0%]. With a stronger business model and premium returns, the yield premium is appealing in an otherwise overvalued sector. Business investment continues to head to the Southeast, which bodes well for the region’s economy and Southern’s customer base even though residential demand has remained tepid. Bears Say: Southern burns a lot of coal, so complying with carbon emissions and coal ash regulations could require significant investments that would raise customer bills, discourage usage. We include $500 million of potential cost overruns at Vogtle that we project Southern will not be able to recoup in rates and $200 million in extra owners’ costs. These figures could go much higher in a worst-case scenario. Utilities suffer in times of inflation and rising interest rates. Inflation erodes the value of the rate base on which a utility’s allowed returns are calculated. This is where an automatic dividend reinvestment program becomes a bit dicey. Although I wrote a book on DRIPs in 2001 for McGraw Hill, All About DRIPs and DSPs , reinvesting dividends in SO at the current price seems a bit risky. Accumulating the dividend in a cash account for reinvestment in other income stocks may be preferred until SO’s fundamentals improve. While Southern Company is replacing its coal generating capacity with low-cost nuclear, has one of the best management teams in generating Net ROIC, is in a growing service territory with friendly regulators, and is embracing distributed solar generation, the current share valuation leaves much to be desired. Waiting for a better valuation would be prudent. Author’s Note: Please review disclosure in Author’s profile.