Investing In France: Yes, You Can

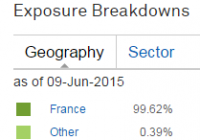

Summary Growth is back in France. Why you should consider the country as an investing opportunity. The iShares MSCI France ETF will rise and shine next year. Investing In France: yes, you can. It has always been a fun – yet interesting – exercise to reflect on the cultural differences and similarities that existed between the foreign countries that I visited and my own. Long story short, I eventually realized (after living in the U.S. for a year) that despite the legendary French cynicism , I had every reason to be proud of being French. Once back in France, I became more and more aware of how my country was perceived by foreign investors and analysts. Economically speaking, France is seen as the laughing stock of the Eurozone, rather than a role model. Of course, if our social model allows our country to be more resilient in times of crises, it is also true that it slows down the economic recovery in times of global growth. But ever since François Hollande got elected, the French Bashing in financial literature has reached a level never seen before. Agreed, there are plenty of reasons to worry about France’s future: unemployment rate, fiscal policy, lack of support for entrepreneurs, lack of reforms, you name it. To add insult to the injury, we even have a socialist government! And yet, in May 2015 ” the French economy smashed expectations , expanding by 0.6% in the first quarter following zero growth in the previous quarter ” and in June, according to the Banque de France’s macroeconomic projections : ” after three years of virtually flat growth, French GDP will expand by an annual average of 1.2% in 2015, 1.8% in 2016 and 1.9% in 2017. ” The institution lists three different types of factors behind the recovery of the French economy: external (cheaper oil and a cheaper Euro), specific to the Eurozone (expansionary monetary policy), and domestic factors (improvement in corporate profit margins). ” On a domestic level, the measures introduced to cut labor costs should also start to support activity via gains in cost competitiveness which will in turn boost exports, job creations and business investment.” Indeed, despite Mr. Hollande being a socialist scarecrow, reforms (that were voted within the first years of its mandate) are starting prove themselves efficient. And several factors allow us to be more optimistic about the country’s future: Finance Minister, Emmanuel Macron is currently pushing a rather liberal agenda – that should help French companies during their journey through the infamous French fiscal maze. For instance, stores are now allowed to open 12 Sundays a year . It might seem insignificant, but it actually indicates that the government has decided to go against its left wing, even if it means discussing topics that had been considered ‘taboo’ until this day. Regional elections will take place in late 2015, and the socialist party is expected to be crushed by former President Nicolas Sarkozy’s brand new “Republicans”. Due to the nature of the election, the impact on French policies won’t be significant but it will send a positive signal to foreign investors. In 2016, regional reforms will be put in place and France will be the theater of a ‘regional big-bang’ that will see the creation of ‘super-regions’. If the process will need a few months (if not years) to be effective, the new regional entities will be amongst the most important within the European Union. For instance, the future Auvergne-Rhône-Alpes will rank 7th in ” Europe’s economic ranking “, and its capital Lyon will finally reach the critical size it needed to compete with other European metropolis. The easiest way to bet on France’s recovery would be to invest in the iShares MSCI France ETF (NYSEARCA: EWQ ) , the only U.S.-listed fund to be exclusively composed of French stocks. Next chart presents its top 10 holdings (they amount to 45.8% of the total holdings), with their respective weights in the total assets: As we can see in the following charts , its sector exposures differ than the CAC 40 (France’s top 40 stocks by market cap, balance sheet, liquidity…), the usual benchmark for the French stock market. iShares MSCI France ETF’s Sector Exposure (click to enlarge) The three main sectors represent around 15% each of the global holdings and are the following: Industrials, Consumer Cyclical and Financial Services. Their combined weight drive the ETF’s performance away from the CAC 40 as a whole: CAC 40 vs EWQ: One Year Return (click to enlarge) As we can see, the ETF consistently underperformed the CAC 40 over the past year, even sinking in the negatives when the CAC delivered a return of 8.8% over the same period. This can be explained by the fact that one of the fund’s top holding, TOTAL SA (NYSE: TOT ), has been heavily impacted by the fall in oil prices this past year. Still, when compared to the Crude Oil performance, Total isn’t doing so bad: Fortunately, SANOFI SA (NYSE: SNY ) and BNP PARIBAS SA ( OTCQX:BNPQY ), the other main holdings (with respectively 9.02% and 4.98% of Total Assets) saw their stock value rise this past year: SANOFI SA BNP PARIBAS SA The fund’s focus on Consumer Cyclical and Financial Services stocks reduced its performance as well, as the French economy was slowed down by higher tax rates (both personal and professional) and investors were reluctant to make significant moves due to the lack of political vision regarding the upcoming economic reforms. Nevertheless, one should keep in mind the bigger picture: over the past five years, we can see EWQ clearly outperforming the CAC 40. CAC 40 vs EWQ: Five Year Return (click to enlarge) At this point, one could legitimately question the opportunity of boarding a sinking ship. But I see this past year as a blessing for someone willing to invest in EWQ (obviously, EWQ holders might feel differently), as it is now quite inexpensive compared to the potential returns. Indeed, Consumer Cyclical and Financial Services stocks should thrive on the cost-cutting reforms that the Banque de France underlined, as well as on the expected GDP growth rates. We can also be optimistic about future reforms as the government recently operated a more liberal turn. Last but not least, the regional reforms will lead to bigger regions, and could strengthen the industrial firms as it will ease their clients and suppliers networks. EWQ: Two Year Return (click to enlarge) Currently ( data obtained on June 06, 2015; via YAHOO Finance) at 26.70, the ETF is 4 dollars cheaper than last year’s high of 30.73, and as a result it becomes very affordable to invest in. As previously explained in this article, EWQ is bound to rise in the upcoming year. Last but not least: even if it is easy to make fun of France’s bureaucracy, or of its overall business environment, it would be a strategic mistake to disregard all investing opportunities. In case of a crisis in the Eurozone (think about Greece), France (along with Germany) will remain a safe heaven, as the 2nd strongest economy of the EU. It happened not too long ago, and an early taste of French markets could come handy in uncertain times. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.