NRG Energy: Kicking Its Residential Solar Segment Into High Gear

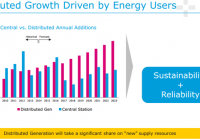

Summary Over the past few days, NRG Energy has further outlined its goals of residential solar domination. The company plans to be the second largest residential solar company by the end of 2015, which is a huge task considering its current 5th place position. NRG Energy’s management is surprisingly forward-thinking in its embrace of distributed residential solar, an industry inherently at odds with centralized fossil fuel generation. Residential solar has been growing at an astounding 40%-50% CAGR over the past few years, outpacing the growth of the broader solar industry. As the inherent advantages of distributed solar have become more clear, the switch from centralized energy to distributed generation has been a no brainer for many individuals. UBS AG (NYSE: OUBS ) has even stated , “By 2025, everybody will be able to produce and store power. And it will be green and cost competitive, i.e., not more expensive or even cheaper than buying power from utilities. It is also the most efficient way to produce power where it is consumed, because transmission losses will be minimized. Power will no longer be something that is consumed in a ‘dumb’ way. Homes and grids will be smart, aligning the demand profile with supply from (volatile) renewables.” While the vast majority of utilities have been bitterly opposing residential solar companies, NRG Energy (NYSE: NRG ) is looking to join them. NRG Energy, which is one of the largest fossil fuel utilities in the U.S., is surprisingly optimistic about home solar. While this viewpoint may seem contradictory given the opposing natures of centralized fossil fuel generation and distributed residential solar, NRG Energy certainly does not view it this way. NRG Energy has made its residential solar intentions much clearer in recent days. The company has announced that is planning to become the 2nd largest residential solar company, right after SolarCity (NASDAQ: SCTY ), by the end of 2015. This goal is indicative of NRG Energy’s incredibly ambitious distributed energy plans, as it has to increase its residential solar business by a number of magnitudes to accomplish this goal. While NRG Energy is currently ranked at a respectable 5th place in residential installs as of quarter 3, the gap between itself and 2nd place Vivint Solar (NYSE: VSLR ) is huge. NRG Energy still has a market share in the low single digit percentages as opposed to Vivint Solar’s approximately 15% market share. In fact, SolarCity and Vivint Solar make up for more than half of the residential solar industry’s market share. As a result, NRG Energy has started putting in enormous efforts to build and scale up its residential solar business in order to compete with the industry standouts. NRG Energy’s Unique Competitive Edge NRG Energy’s current position as one of the nations largest utilities gives it a financial clout and leverage never seen before in the emerging residential solar market. While all the top residential solar companies could have easily been classified as startups just a few years back, with SolarCity as no exception, NRG Energy is entering the industry as a proven and established business with countless billions on its balance sheet. The company’s huge finances and reputation as a proven business will give it an undeniable advantage over its competitors in the form of lower capital costs. Financiers could very well give NRG Energy cheaper access to capital due to the company’s already established brand. Of course, while most of NRG Energy’s cash will be tied its main business of centralized fossil fuel generation, having its huge fossil fuel business backing up its burgeoning residential venture will be invaluable for the company. NRG Energy could easily leverage its financial clout and well-established brand name to help achieve its grand solar ambitions. Forward-Thinking Management While it is extremely surprising to see a fossil fuels based utility focus so much attention on the distributed generation, this hints at NRG Energy’s extremely forward-thinking nature. Despite the fact that residential solar poses an existential threat to the company’s predominantly centralized generation model, NRG Energy’s management hold no bias against residential solar, and is in fact embracing this growing trend. The company’s enthusiasm about distributed residential solar starts at its CEO David Crane. He is so optimistic about residential solar that he has been qouted as saying, “We expect to convincingly persuade our investors that NRG has an embedded SolarCity within it,” and that “everyone is beginning to believe that residential solar is this trillion-dollar market that currently has about 1 percent market penetration.” David Crane is clearly all-aboard residential solar. Having a utility state that residential solar has the potential to be a trillion-dollar market is shocking to say the least, and would have been utterly unbelievable just a few years ago. His optimism is also a clear sign of residential solar’s promise. In fact, Crane sees so much potential in the company’s distributed residential solar segment that he is even considering creating a separate residential solar spin-off. Although a negligible percentage of NRG Energy’s revenue comes from residential solar, the company has been heavily emphasizing this aspect of their business in recent weeks. Just a few days ago, for instance, the company issued a press release and presentation touting residential solar’s immense potential, and the company’s plans for heavy future involvement in this industry. While residential solar currently makes up for less an 1% of the United States total energy generation, the company clearly believes in its exponential growth capabilities. NRG Energy’s recently released presentation constantly reminds investors of the emerging distributed generation. This specific graphical illustration from the presentation depicts the continually diminishing role of centralized generation as opposed to the growing role of distributed generation. (click to enlarge) Source: NRG Energy Risks Despite the immense promise of distributed residential solar, there is a considerable risk that the industry may not grow or mature as fast of NRG Energy has planned. In this case, the company’s would be in danger of losing sizable amounts of money on its massive residential solar infrastructure investments. The company is still, after all, making a huge bet on a relatively young industry with an abundant amount of uncertainty. Many factors pushing residential solar’s growth, such as subsidies or net metering policies, are largely out of the company’s control. Regardless of the risks, NRG Energy is likely making a wise decision by focusing on the residential sector, as most indicators point to distributed generation as the energy model of the future. The only obstacle truly holding distributed residential solar back from mass adoption is the lack of cost-effective storage devices. Even this though, will likely change in the future as battery innovations have sped up dramatically with the recent electric vehicle boon. Conclusion NRG Energy is changing with the times and embracing the shifting energy landscape. With solar power experiencing an exponential growth curve, the company is well-aware of residential solar’s future potential. NRG Energy’s valuation of $9B does not factor in the growth potential of distributed generation, and the company’s involvement in this highly promising arena. If distributed solar generation ends up replacing centralized generation as much of the evidence has suggested , NRG Energy will have a huge amount of upside given its early investment in the arena. While Vivint Solar is rapidly gaining on SolarCity in terms of marketshare, NRG Energy will likely be SolarCity’s true competition moving forward.