Reaves Utility Income Fund: Monthly Payout Currently Offering A 6% Yield

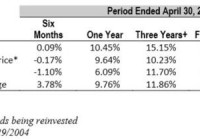

Summary Reaves Utility Income Fund is a CEF that invests in a broad range of utilities. Reaves is selling at a discount to NAV and offers a relatively safe 6% monthly yield. Reaves is not likely to outperform of underperform the utility indexes. About a year ago someone offered Reaves Utility Income Fund (NYSEMKT: UTG ) as a better alternative to my list of utilities in the comments section of an article I had written. I have been following the fund since that time and have placed this fund in some of the accounts I manage. UTG recently released its semi-annual report as of 4/30/2015. Total assets of the fund were $76,000 short of $1 billion and the net asset value (NAV) of the fund was $32.71 per share. UTG is currently selling for around $29.75 per share with a NAV of $30.37 as of 7/10/15. The recent underperformance of interest rate sensitive stocks has hurt both the NAV and selling price of the fund. UTG currently yields 6.1% with a monthly payout at just over $0.15 monthly. The price fluctuation of utilities does not affect the payouts of the companies so it may be an opportune time to consider this fund and/or utility stocks if one believes that interest rates will not rise shortly. UTG is a CEF or closed-end fund that aims to provide a high level of after-tax total returns consisting of tax-advantaged dividend income and capital appreciation. It targets 80% of its investment in dividend-paying common and preferred stocks as well as debt instruments of utility companies. The other 20% can be invested in other types of securities and/or debt instruments. It also uses options of utility companies in the search for returns. The historical returns of the fund when compared to the historical returns of the S&P Utilities Index and the Dow Jones Utility Average are shown in the table below: (click to enlarge) Source: UTG Semi-annual Report UTG also offered a graph showing the allocation of funds in its quarterly report as well. It is shown below: (click to enlarge) Source: UTG Semi-annual Report This graph shows that the fund’s definition of utility is rather broad. The fund holds railroads, roads, and oil and gas MLPs as well as REITs and media companies. UTG has loans for $290,000,000 with an interest rate of around 2%, which it uses for leverage. The top 10 holdings of the fund as of 3/30/15 were: NextEra Energy 5.27% ITC Holdings Corp 4.74% Union Pacific Corp. 4.67% Verizon Communications 4.26% American Water Works Co., Inc 3.96% Duke Energy Corp. 3.66% Scana Corp. 3.65% Dominion Resources, Inc. 3.59% BCE, Inc. 3.46% Sempra Energy 2.98% Expenses of this fund are about average for a closed-end fund. Investment advisory and administration fees last year ran $9.6 million or a little over 1% of the asset value of the fund. Other fees and interest on the loans add on another .5%, making a total of 1.5% to run the fund. Leverage probably covers the costs of administration with the additional dividend income it produces. Conclusion: This CEF is a good option for someone who wants to add utilities to their portfolio without the concern of researching individual companies. It appears to be a good bet for the retiree since it offers a monthly payout where much of the dividend qualifies for the 15% tax rate. The fund’s returns have kept up with the major utility indexes over its lifetime and will probably continue to do so in the foreseeable future. One should not expect to outperform the utility indexes with this CEF, but one will not likely underperform them either. Disclosure: I am/we are long UTG. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague