Choosing Which Stocks To Sell For A Big Purchase

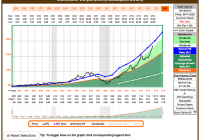

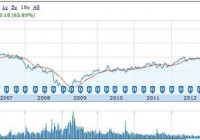

Summary This article outlines the thinking process of needing to sell some stocks for a big purchase. Know how much cash is needed to liquidate from stocks, so as not to sell more than needed. Must keep emotions in check, and sell stocks based on company valuation and future prospects of the business. Here’s a little background story to my situation. The Situation of Being Carless I recently sold my 2001 Toyota Echo. I bought it used about three years ago. The odometer indicates mileage of over 320,000km. While I owned it, other than the usual maintenance, I replaced the battery and the exhaust pipe. I managed to sell it for $500 less than my buying price. Not too shabby. I’m not one who drives a lot, but I only noticed how inconvenient it is after I sold the car. Now, I’m looking for another car. I’m still debating whether to buy a new car or a pre-owned one. Someone that knows a lot more about cars than me said that it’s probably better to buy a new one now that I got several years of driving experience down my belt. Further, it could be risky buying a pre-owned car because I don’t know its history. The previous owner could also have hid facts about crashes the car had experienced or changed the odometer. The ideal situation is that I anticipated I’ll need to “invest” in a car a couple years before and actually saved up for it. As we know, the general principle is to not put money into the stock market if you plan to use it within 5 years. The reality is I did not save up, and I don’t have a lot of cash on hand. So, other than to stop buying stocks in the meantime, I also needed to sell some of my shares. Emotionally, I don’t want to sell at a loss, and some of my holdings are in the red, especially energy companies. At the same time, I also want to take profit in my biggest winners. However, the better way is to try to suppress my emotions, and look at valuations and future earnings estimates instead. So, I should be looking at the valuations of all of my holdings and deciding which ones are possible sells. I especially don’t want to sell my core holdings, but if they’re excessively overvalued, or I feel less comfortable with them for some reason, it might make sense to take some shares off the table and take some profit. Unfortunately, I made some sales before I wrote this article. I notice I’m much more logical and less emotional when I rethink the process in writing. How did I Choose What to Sell? It is through this event that I realize more prominently that I’m less comfortable with some stocks than others. In other words, this exercise more critical helps me determine what I should be holding or not. Further, I also look at valuation, as well as compare a holding’s future prospects with others. Another consideration is gains. The market is uncertainty; it could drop 25-50% for whatever reason at any time period. Still, I would probably regret later by selling some shares in my winners, as some would be against clipping the wings of their winners. Royal Bank of Canada Royal Bank of Canada (NYSE: RY )’s shares are fairly-valued today. F.A.S.T. Graphs shows consensus analyst estimates of 4.7% earnings growth going forward. Adding that to its current yield of 3.9%, it indicates an estimated return of about 8.6% in Royal Bank shares today, which is an acceptable return for a blue chip investment. In Q2 2015, 63% of Royal Bank’s revenue came from Canada. The housing bubble has been the topic at the dinner table in recent years, especially in popular cities such as Vancouver and Toronto. The fear is that the average income cannot pay for the average housing prices. In January 2015, the Huffington Post’s article shows the income you need to buy an average house across Canada . In Toronto, an average household income of C$113,009 is needed for an average-priced house or condo of C$587,505 at the low mortgage rate of 2.99%. The monthly mortgage payment turns out to be C$2,560. If rates rose to 6%, the 2005 rate, the required household income would be raised to C$143,182. It’s worse in Vancouver. An average household income of C$147,023 is needed for an average-priced house or condo of C$819,336 at the low mortgage rate of 2.99%. The monthly mortgage payment ends up being C$3570. If rates rose to 6%, the 2005 rate, the required income would be raised to C$190,581. Of course these numbers are just that — an average. And it also makes a difference how much down payment a family has saved up. Still, it doesn’t change the fact that housing prices have been on the rise for over a decade in those cities. And with income levels misaligning with housing prices, there could be a ripple effect if the prices started to drop. I sold some shares in Royal Bank, and will continue monitoring, but I want to emphasize that if I had cash on hand to make my purchase, I wouldn’t have sold my shares. Baxter International I started a position in Baxter International (NYSE: BAX ) as a non-core. Then, I made it core. And now I sold out of it. It was a small position and I suppose I wasn’t strongly attached to it. I sold it essentially at breakeven. I might still receive a tiny position in Baxalta, as I sold it on June 16, but the settlement date is a few days later, while the company spins off the Baxalta shares to shareholders as of the record date of June 17. If I do receive shares of Baxalta, I’ll be monitoring it and decide if I want to add to the position later on. Starbucks Some of you might stare in disbelief that I sold some shares of Starbucks (NASDAQ: SBUX ). It has been one of my biggest winners with 50% gain. The high P/E is scaring me a little. I certainly wouldn’t add shares at a P/E of 36. Looking at the F.A.S.T. Graph below, it’s at the high end of its valuation. (click to enlarge) If it trades sideways again, so that earnings catch up some, I might add to my position again. Actually, I should have sold McDonald’s (NYSE: MCD ) before selling Starbucks because Starbucks has better future prospects. However, my McDonald’s shares are below my breakeven point, and psychologically, it’s hard for me to separate from those shares at present levels. That said, in hindsight, I shouldn’t have bought McDonald’s at the price that I did. And a thought just came to me…I should have sold McDonald’s at a small loss and kept my Starbucks shares because I believe Starbucks will outperform McDonald’s in the future. Whoops, I guess I should have written this article before I took action. I’m still a bit short on cash, so I might revisit my decision on McDonald’s next week. Microsoft Lastly, I sold some shares in Microsoft (NASDAQ: MSFT ). The other technology companies I hold are International Business Machines (NYSE: IBM ) and Qualcomm (NASDAQ: QCOM ). IBM is a core holding that I believe is much more undervalued than Microsoft. IBM’s P/E is under 11 and Qualcomm’s is under 14, while Microsoft’s is under 18. Consensus analyst estimates Microsoft’s earnings to grow at 6.7% in the near term, Qualcomm’s to grow at 1.3%, and IBM’s to grow at 5.1%. If I didn’t need the money, I wouldn’t sell the Microsoft shares because they’re not excessively overvalued. In Conclusion Looks like I couldn’t keep my emotions entirely at bay, but in writing this article, I believe my thought process became clearer and less sentimental. It would certainly have helped if I had a set of rules for selling stocks ahead of any sales based on allocation, diversification, quality, valuation, and future prospects. Ask Yourself Do you need to sell some of your stocks to make a purchase? Do you have a set of rules to determine what to sell when you need to? Do you ever sell for the sake of taking profit off the table to preserve gains and capital? If you like what you’ve just read, please consider clicking the “Follow” link at the top of the page, above the article title, to receive an email notification when I publish a new article. Disclosure: I am/we are long IBM, MCD, MSFT, QCOM, RY, SBUX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I’m not a certified financial advisor, and this article is not advising to buy or sell any security. Please use it as initial research.