Exelon Corporation: A Promising Investment Opportunity

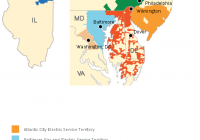

Summary The acquisition of Pepco will grant Exelon enhanced operational capacity as well as increase its ability to serve a greater number of customers in the different counties of the United. This acquisition will also result in expanded regulated business that will improve Exelon’s risk profile and ensure more stable revenue and earning steams compared to unregulated operations. Moreover, the hedging of commodity risk has not only ensured Exelon’s future earnings stability but has also given it a competitive edge in the industry. The company has a significant amount of debt to supports its project financing which will result in a focused business model. Based in Chicago, Illinois in the United States of America, Exelon Corporation (NYSE: EXC ), a well-known energy producer, has been pleasing its investors for a long time and has witnessed a sharp rise of more than 35% in its stock price over the past year. Source: Finviz The impressive performance was mainly due to some smart moves recently taken by the company. These initiatives have not only made the future profits more predictable but they have also given Exelon a competitive edge in the market. I believe Exelon is a promising investment opportunity for the long term. Let us analyze a few factors that support my opinion on the stock. Strategic Acquisitions and Divestitures Have Resulted in a More Focused Business Model Exelon Corporation has been making several acquisitions over the past few years that have not only enhanced its operational capacity but have also enabled it to enter and cater to new and growing markets. In April 2014, Exelon announced it would acquire Pepco Holding, Inc. which is one of the largest energy delivery companies in the Mid-Atlantic region that currently serves approximately 2 million customers in Delaware, the District of Columbia, Maryland and New Jersey. This merger will bring together Exelon’s gas and electric utilities – BGE, ComEd and PECO – and Pepco Holdings’s (PHI’s) electric and gas utilities – Atlantic City Electric, Delmarva Power and Pepco thus improving the combined operational capacity. This acquisition will enhance the company’s operational capacity as well as increase its ability to serve a greater number of customers in the different counties of the United States. As Exelon’s CEO said, “The combination of our companies will provide us an opportunity to take the customer service and reliability improvements we’ve already made in Maryland to an even greater level.” Moreover, the acquisition of Pepco will result in expanded and strong regulated business operations. This merger is expected to increase Exelon’s regulated business exposure to 60% to 65% during 2015-2016 which was previously approximately 55% to 60% on a standalone basis. The expanded regulated business will result in an improved risk profile with more stable revenue and earning steams compared to non-regulated operations. However, the Public Service Commission (PSC) has recently asked for some changes in the merger requirements that Exelon’s president has not agreed with. Since the PSC staff has demanded all the utilities to be managed at micro level with an independent board of directors for Pepco, this would impair Exelon’s ability to exercise control over its subsidiaries. Among the requests, the PSC staff has also demanded a $50 payment to each Delmarva residential customer, a $40 million 10-year set aside for Delaware workers’ job protection and some charitable commitments. These requests, if agreed upon, can result in heavy costs for Exelon thus hurting its future profitability. On the other side, the non-inclusion of these points would force the staff to push the commission to deny the company’s merger application. Presently, Exelon is facing a dilemma regarding the commission’s demands. This posed a possible risk to its future profitability. Perhaps, fair negotiations with the PSC staff could result in a win-win situation. Similarly, Exelon has been selling some of its non-core business assets in order to create a more optimized asset portfolio. To date, the company has divested five non-core assets which has resulted in nearly $1.4 billion of after-tax sales proceeds. This included the sale of its Fore River, Quail Run and West Valley plants for total after tax proceeds of $975 million during the third quarter of 2014. The company can use the sales proceeds to finance the acquisition of Pepco and build two combined-cycle gas turbine (CCGT) units in Texas that will enhance the company’s generation capacity as each unit is expected to add nearly 1,000 MW of capacity to their respective sites. Strategic acquisitions and dispositions have resulted in a more focused business model with improved generation capacity. This will support Exelon’s ability to successfully cater to the growing markets and give it an edge over those in its peer group. Effective Hedging Ensues Stable Earnings in Future Exelon’s energy generation business is exposed to commodity price volatility that can reasonably affect its future top and bottom lines. I believe the company can ensure stable revenue and earning streams in the future because it effectively reduces the commodity risk by hedging a portion of its portfolio on a three-year rolling basis. The hedge targets are approximately 90% – 98% in the first year, 70% – 90% in year two and 50% – 70% in year three. Source: Investor Presentation The hedging activity will help the company to meet its future cash requirements and other financial objectives that include dividends and investment-grade credit rating under a stress scenario. This again gives Exelon a competitive edge in the market and makes it an attractive investment option especially for dividend investors who seek a stable cash flows stream. Significant Debt Financing Supports the Core Business In the past, Exelon raised a significant amount of debt for project financing. Over the past three years it has successfully raised nearly $3 billion to finance several projects including Antelope Valley Solar Ranch, ExGen Renewables, Continental Wind and ExGen Texas Power. These projects have significantly increased the company’s generation capacity with no debt maturing earlier than 2021. Moreover, the company recently announced it would issue $750 million of senior notes maturing in 2020 with a coupon rate of 2.95%. The net proceeds will partially be used to pay-off Exelon’s exiting senior loan notes of $550 million with a coupon rate of 4.55% maturing in June 2015. This would result in interest costs savings of nearly $9 million annually and $4.5 million semi-annually that will boost the company’s future bottom line. Additionally, the remaining proceeds can be used to finance the Pepco acquisition that is expected to benefit Exelon in the long term. Significant debt financing will help Exelon to expand its core business and increase its generation capacity which will in turn support its ability to appropriately cater to the market. Rising Competition can limit its Future Growth Although Exelon is the largest nuclear energy producer in the United States, many alternative energy producing methods can give the company a tough time in the coming years. Presently, natural gas energy producers seem to maintain the lead. Due to the heavy capital outlay required for nuclear power plants and the way their reactors work, it is not easy to stop power generation whenever desired. On the other hand, natural gas fired plants are less capital intensive and the power generation can be easily tailored to meet the desired demand schedule. This gives natural gas energy producers a cost advantage over nuclear energy producers, thus enabling them to easily attract a greater number of customers by offering lower prices. Moreover, rapidly declining natural gas prices are further reducing the electricity production cost for these energy producers. During December 2014, the U.S. natural gas prices fell below $3 per million British thermal units for the first time since 2012. Source: Yahoo Finance Natural gas is the second largest source of power generation in the U.S. and produced nearly 27% of the country’s total electricity in 2013. The continuous decline in the natural gas prices and flexibility offered by less capital intensive natural gas fired plants supports the energy producers’ ability to price electricity at comparatively lower rates than nuclear energy producers thus capturing a major market share. In addition, the conventional energy producing methods including the coal fired and nuclear plants are severely affecting our climates, economies and most importantly, health. The electricity production in the United States accounts for more than one third of the total global warming emissions by the country. The coal fired power plants accounts for nearly 25% of these emissions whereas, natural gas fired plants represent only 6%. The rising concerns about global warming have forced many countries to invest in clean energy. The graph below shows the rising trend of clean energy consumption in the last 5 decades in different countries of the world. Source: Vox As the government is continuously encouraging the use of renewable source of energy, many renewable energy producers will witness a rising demand curve for their services in the near future. PPL Renewable Energy, one of Exelon’s competitors, is concentrating on natural gas and wind energy for power generation and has benefited from the falling natural gas prices in the past. Moreover, the company is continuously increasing its investment in renewable and clean energy production. Its hydroelectric expansion project in Montana has increased its clean energy generation capacity by 70% . The company’s hydro plants in Pennsylvania and Montana have a combined capacity of 757 megawatts of clean energy. Since Exelon is facing intense competition from both natural gas and renewable energy producers, it needs to focus on and invest in alternative energy producing methods for maintaining its market share. Conclusion The sum and substance of my analysis is that Exelon’s recently enacted initiatives have made it is well-positioned to serve the growing market. The strategic acquisitions and dispositions have resulted in a more focused business model along with improved generation capacity. A significant amount of debt financing also supports its future projects. Moreover, the hedging of commodity risk has not only ensured Exelon’s future earnings stability but has also given it a competitive edge in the industry. All of these factors make Exelon a safe and promising investment opportunity for long-term investors. However, Exelon also needs to focus on and invest in natural gas and clean energy producing methods for maintaining a decent market share in this highly competitive environment. Based on my analysis, I give the stock a buy recommendation.