Closed-End Funds Strategies For 2014 And 2015: CEFs For Buying And Selling

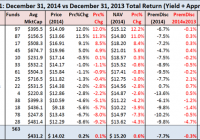

Summary GrowthIncome has ranked the Closed-End Funds for 2014 versus 2013 for 14 categories on a total return basis (yield + Appreciation). The losers, worst performing stocks in 2014, sometimes have become the best performing stocks in 2015. As this theory goes, some of the worst performing stock could be “Stars” in 2015. Also, the best performing stocks could be the worst. Losses to Stars: Over the years, the poorest performing closed-end funds (NYSEMKT: CEF ) at the end of the year often turned around and became the “stars” of the new-year. (In 2013, GenEqFnds was in 1st place; SingleStMuniFnds and NatlMuniBndFnds were in last place.) As a result, GrowthIncome has produced the following CEF investment strategies reflecting this past year’s performance. In addition, we have provided lists for the 10 best and worst CEF performers during this period with regards to Total Returns (Appreciation + Yield). As a result, you will find investment selections as a result of this analysis. Dow Vs CEFs: During 2014, the Dow Jones Industrial Average registered a 7.5% advance in stock prices with an average distribution yield of 2.0%, resulting in a total return of 9.5%. The CEF universe, representing over 560 Closed End Funds spanning 14 different categories, registered a 0.1% advance in stock prices with an average distribution yield of 7.2% for a total return of 7.3%. (click to enlarge) What’s Ahead? The rate on 10-Year Treasuries ended 2014 at 2.171% and further slipped to 1.95% on January 9, 2015. To the surprise of many economists and investors alike, this decline betrayed expectations as many believed that rates on 10-Year Treasuries would end up near 3.0% by the end of 2014. Federal Reserve: This betrayal of expectations was the result of the Federal Reserve keeping rates near “zero” so as not to disrupt a fragile recovery for the U.S. economy. However, as it became apparent that people were getting back to work and that consumers were spending money, the Fed ended America’s quantitative easing in an effort to slowly pull back its foot from the gas pedal. Yet Japan, China and the Eurozone are starting to pick up where America left off through various forms of monetary policy in an attempt to support their own struggling economies. Helped by the price of oil, which has fallen over 50%, the global economy could be set to enter a deflationary cycle and push the Federal Reserve to further delay rate hikes in America. 2014 Best Total Returns: The table below shows the top 10 performing Closed End Funds averaging a total return (appreciation and yield) of 35.5% for 2014. 3 WrldEqFnds (2 India and China) and 4 SpecEqFnds (2 real estate, utility and energy development) were among the winners. MS India Investment (NYSE: IIF ) was up 53.8%, and India Fund (NYSE: IFN ) was up 30%. (However, India Fund’s total dividends ($1.86/share) were made up of long-term capitals gains resulting in a total yield of 7.2% and a total return of 38.5%.) (click to enlarge) 2014 Worst Total Returns: Below is a table of the 10 worst performing Closed End Funds averaging a total return of -22.6% for 2014. 7 of the 10 were WrldEqFnds, a category which also had a strong showing in the top 10 CEF performers. WrldEqFnds with assets focused in countries dependent on oil were hit especially hard. Templeton Russia & East Europe (NYSE: TRF ) and Central Europe Russia & Turkey (NYSE: CEE ) were number “one” and “two” for the negative side, which is not surprising as economic sanctions have exacerbated the negative effect of oil’s decline. New Germany Fund (NYSE: GF ) was down -26.9% during 2014. However, it will pay out $3.17 per share on 1/28/2015 (ex- date of 12/29/14). The Thai Fund (NYSE: TTF ) will have a capital gains distribution of $3.52 per share on 1/16/15. Thai Fund will likely go down by a similar amount. Aberdeen Chile Fund (NYSEMKT: CH ) had 79% of its annual dividend come as a return of capital (ROC) while Cornerstone Progressive Return (NYSEMKT: CFP ) had 75% of its annual dividend come as a ROC. Though the yields look attractive, this asset base erosion keeps these funds far from GrowthIncome’s recommendation list. (click to enlarge) Things to Buy : If you want to play a “Dogs of the CEF Universe” method then we recommend buying Central Europe Russia & Turkey , Mexico Fund (NYSE: MXF ) and New Germany Fund . Central Europe Russian & Turkey Fund has 47% in Russia’s oil conglomerates and 53% in Poland, Turkey and Greece. If you want to establish a position, you may want to do it in thirds. The Mexico Funds and the New Germany Fund has little oil. (click to enlarge) Things to Sell: In a reverse “Dogs of the CEF Universe” play, we have chosen to recommend the sale of both Reaves Utility Income Fund (NYSEMKT: UTG ) and the real estate funds ( Cohen & Steers Qty Inc Realty (NYSE: RQI ) and ( LMP Real Estate Fund (NYSE: RIT )) and EV Municipal Income (NYSE: EVN ) as they will likely perform poorly in a rate hike environment. (click to enlarge) Caveats: We have chosen the losers in 2014 to be the winners in 2015. This is where we get interest rates to go up in 2015. As said by Lloyn Blackfein of Goldman Sachs: Though the Fed says that interest rates may go up, it is the “huddle mass” that says where interest rates may go up too.