Learning From Children About Investing

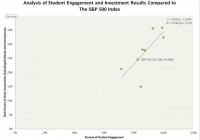

From the mouths of babes. Students show that one can beat the market, if s/he is interested. If you are passive, then invest in passive funds. If you are engaged, do it yourself or invest in managed funds. It was a simple enough project; teaching students to find a stock in which they might invest real money. That was the objective I had set when I was teaching at a high school in southwest Florida in 2013. I was assigned a class called, “Advanced Algebra with Financial Applications,” for seven periods. My goal? To teach high school seniors applied algebra for financial applications. I am on hiatus from the financial world, and wanted to return to teaching. With that, the school’s administration felt that having someone with a Series 7 and Series 66 talking to the kids on a daily basis about financial matters was an opportunity. Given that I am a stock jockey at heart, I was eager to show the students some basic stock analysis. I told them to invest in companies they knew. I showed them basic fundamental screening, so they could limit their choices to financially sound companies, actually had profits, and that those profits were likely to increase over time. Out of the approximately 190 students, 81 stocks were chosen. It was clear the students focused on products they bought or retailers where they shopped. The top five companies where the students wanted to invest were: Apple (NASDAQ: AAPL ), Disney (NYSE: DIS ), Coca-Cola (NYSE: KO ), Nike (NYSE: NKE ), and Procter & Gamble (NYSE: PG ). There were some surprising selections, and that was good, because I wanted the students to be creative, and try to find hidden gems. Companies such as Allegiant Travel (NASDAQ: ALGT ), Randgold (NASDAQ: GOLD ), L Brands (NYSE: LB ), Toyota Motors (NASDAQ: TM ), and V.F. Corp (NYSE: VFC ) made it to the ledger. We would monitor the progress of the stocks, and use current events to discuss any sharp moves in the stock prices throughout the year. Of course, this was a great opportunity to learn mathematics. Sadly, the Florida Department of Education daggered the program, and I had to transfer to another school. During the interim, I never gave the project much thought. Recently though, and ironically on the 500th day after we started, I went back to see how the portfolios were performing, and I found something very interesting. The classes that were fully engaged in the process, and who seemed to take the project seriously outperformed the S&P 500 market index. Most outperformed by a mile. It is worth describing what one means by “fully engaged.” High school students, being that they are still children, do not always do what they are supposed to do. Some of the classes had students simply not participate, and sadly, those students did not pass the class. I was not surprised by this, because this class of was being used for those students who historically struggled with mathematics, and had a history of failure. Keeping that in mind, I noticed that the classes where they fully invested their portfolios saw their stock positions outperform the market. I have a chart here to show what I mean. (click to enlarge) Essentially what happened was this: the classes with highest levels of participation saw their stock selections outperform the market. The correlation between participation and market performance was r = .7357 ( ρ = 0.0297). All of the classes where at least 85% of the students actively participated in the project outperformed the market index. The data showed that the bright line between outperformance and underperformance was an 82.75% level of participation. The data also showed when there was at least a 90% level of participation; the classes outperformed the market by at least 7.86%. Why did this happen? I did not count the students who refused to invest, so I only looked at those students who were participating. The non participating students had no effect on the outcomes directly. I guess I will say the usual disclaimer that more research will need to occur, but I am willing to make some educated guesses as to what happened. Given that this only studies seven classes, and 190 students, that is a fair conclusion to make. First, in the classes where there was full participation, there was a healthy competitive environment. One of the outperforming classes had a lot of football players in it, and they wanted to beat each other. Second, the outperforming classes had a higher level of collaboration, where the students would help each other in making decisions, and calculations for their stock selections. Of course, these observations are anecdotal, and will need to be measured in the future to determine whether anything significant exists. What this does tell me, is there might be some useful data for mutual fund companies to note. Mutual funds should have a team of analysts that have an environment of collaboration where the team members can support each other. Additionally, though, there should be a competitive environment where the stakeholders not just try to outperform the market, but try to outperform each other. For the individual investor, there are two clear conclusions. First, if one is willing to be fully engaged and active in their stock selections, then it is possible to outperform the market. There is a whole roster of superstar portfolio managers who can prove this point. If the individual investor does not have the time to dedicate to the process of finding fundamentally sound companies that will outperform over time, then hire a professional who will. Second, if one simply has a passive interest in investing, and merely does so to save for retirement or another goal, then passive indexing is just the thing to do. I hope this is useful for someone, and I will wish you happy investing. Additional disclosure: While I still have a Series 7 and Series 66, I am in no way publishing this as financial advice. If you need advice, I suggest you hire a professional. If you invest on your own, the decisions you make are yours, and so are the results.