The Oil Crash: 3 ETFs For Targeted Investment In The Energy Sector

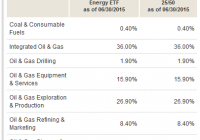

Summary My breakfast reading this morning was an article from a fellow Seeking Alpha author suggesting that bargains could be found in the energy sector. While disagreeing with nothing in his article, I wondered what I could offer an investor who might be interested in using ETFs for a diversified investment in the sector. I came up with three solid candidates. This article will provide a brief overview. As a Seeking Alpha author myself, as time allows I enjoy reading as many articles as I can from fellow authors. My breakfast reading this morning included this article from fellow Seeking Alpha author Regarded Solutions . I think it is a great article, and well worth taking the time to read it for yourself. Essentially, though, the premise was as follows: The energy sector has been killed recently, due to the low price of oil. However, unless one believes in the imminent demise of oil and all its uses, now may be a good time to at least look at scaling into bargains. In particular, the author recommends taking a hard look at Exxon Mobil (NYSE: XOM ). Before I go any further, let me be explicit that it is not the purpose of my article to either dispute any of the points in his article nor to diminish anyone’s interest in purchasing shares in Exxon Mobil. However, I am ETF Monkey, after all. “What,” I thought, “might I suggest to the person who liked the concept, but wished to employ the power of ETFs to diversify their risk, as well as possibly invest in small, incremental chunks?” My research led to three quality candidates: Vanguard Energy ETF (NYSEARCA: VDE ) Energy Select Sector SPDR Fund (NYSEARCA: XLE ) iShares U.S. Energy ETF (NYSEARCA: IYE ) Let’s take a quick look at each ETF, and then I will offer a couple of concluding comments at the end. Vanguard Energy ETF Let’s start with some relevant data from the current factsheet . VDE has an inception date of 9/23/04, so has been around for almost 11 years. It tracks the MCSI USA Energy IMI 25/50 Index . As of 6/30/15, the fund contains 151 stocks, compared to 149 in the index. It has $5.0 billion in Assets Under Management (AUM). In classic Vanguard fashion, it carries a very low .12% expense ratio and has an average spread of .03%, very good performance for a sector-specific ETF. Finally, it carries a 30-day SEC yield as of 7/27/15 of 2.76%. Here is a look at the sector breakdown: Next, let’s have a look at the Top 10 holdings, after which I will offer a couple of comments. (click to enlarge) I’d just like to draw your attention to a couple of things: You may have noted that Exxon Mobil is the fund’s top holding, at 21.3%. In other words, for every $1,000 you invest, you are essentially investing $213 in Exxon Mobil. Even though there are 151 stocks in the portfolio, the Top 10 comprises 62.1% of total net assets. This is a much higher concentration than a broader market index ETF, such as the Vanguard Total Stock Market ETF (NYSEARCA: VTI ), for which the Top 10 holdings only comprise 14.4% of total net assets. However, in this context, this is a good thing. You are still making a very targeted investment in a sector, while still retaining a measure of defense against single-entity risk . Within the sector, the major portion of your funds are in developed, established companies. Energy Select Sector SPDR Fund Again, let’s start with relevant data from the latest factsheet . XLE, from State Street Global Advisors (NYSE: STT ), one of the oldest providers of ETFs, has an inception date of 12/16/1998. It tracks the S&P Energy Select Sector Index . As of 6/30/15, the fund contains 42 stocks, compared to 40 in the index. It has $11.6 billion in AUM. The fund carries a very competitive .15% expense ratio and has an average spread of .01%, which is truly exemplary for a sector-specific ETF. Finally, it carries a 30-day SEC yield as of 7/27/15 of 2.89%. Here are the fund’s Top-10 holdings: A couple of notes: Despite the far smaller number of stocks in XLE vs. VDE (40 vs. 151), the Top 10 concentration is virtually the same; 61.64% for XLE vs. 62.10% for VDE. At the same time, Exxon Mobil’s weighting is “only” 16.38% here vs. 21.30% in VDE. Therefore, your decision between the two may at some level hinge on how much concentration you wish to have in Exxon. iShares U.S. Energy ETF As always, some relevant data from the latest factsheet . IYE, from BlackRock, Inc. (NYSE: BLK ), has an inception date of 6/12/00. It tracks the Dow Jones U.S. Oil & Gas Index . As of 6/30/15, the fund contains 92 stocks, compared to 93 in the index. It is the smallest of the three ETFs, with $1.27 billion in AUM. The fund has an average spread of .03%, and carries a 30-day SEC yield as of 6/30/15 of 2.50%. Unfortunately, IYE also carries an expense ratio of .45%, meaning that the fund would need to outperform our two competitors by some .3% per year to overcome the handicap from expenses. Here are the fund’s Top-10 holdings: My thoughts: IYE is in the middle of the pack in terms of diversification, with 92 holdings. It’s Top 10 concentration is the greatest of the three ETFs, at 63.69%. Its weighing in Exxon Mobil is also the highest of the three; at 22.57% vs. VDE’s 21.30% and XLE’s 16.38%. Again, this may factor into your decision if you desire a heavier weighting in Exxon. Comparative YTD Performance As featured in the article that inspired this offering, the energy sector has been hit hard recently. That being the case, how have our three ETFs performed? Have a look: VDE data by YCharts As you can see, VDE and XLE are in a virtual dead heat, with only .1% separating them. It becomes basically a tie when you factor in XLE’s slightly higher 2.89% vs. 2.76% SEC yield. Summary and Conclusion Based on my examination, I am going to call it a tie between VDE and XLE. Both have long track records. Both have impressive amounts of AUM. And both have very competitive expense ratios which, all other things being equal, ultimately puts money in your pocket. As always, though, I will include the caveat that the question of which ETF you can trade commission-free may factor into your ultimate decision, particularly if you wish to make multiple small, incremental investments. My thanks to Regarded Solutions for a wonderful inspiration, and to all of you for reading. Happy investing! Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.