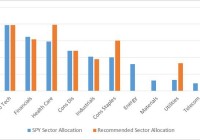

Summary 2015 will be a volatile year, and only the great stock pickers will come out significantly ahead. Don’t look for the needle in the haystack. Just buy the haystack! Taking the Jack Bogle approach might be the best way to mitigate risk and avoid unnecessary volatility. The first (and only) email request sent to SAFoundationalResearch@gmail.com was a request to create a model portfolio against the S&P 500. The weightings below are what we recommend for 2015: S&P 500 Recommendation Equity Sectors Weight Weight Difference Consumer Discretionary 12.0% 12.0% 0.0% Consumer Staples 9.9% 10.9% 1.0% Energy 8.3% 10.3% 2.0% Financials 16.5% 18.0% 1.5% Heathcare 14.5% 16.0% 1.5% Industrials 10.4% 8.9% -1.5% Information Technology 19.7% 19.7% 0.0% Materials 3.2% 3.2% 0.0% Telecom 2.3% 0.0% -2.3% Utilities 3.2% 1.0% -2.2% We fundamentally believe that 2015 will be a volatile year, and only the great stock pickers will come out significantly ahead. That being said, this portfolio will take the Jack Bogle approach and will strictly purchase SPDR ETFs. “Don’t look for the needle in the haystack. Just buy the haystack!” – Jack Bogle Some other rules for this $100,000 model portfolio: Opportunity to rebalance quarterly (but not required) Must be within +/-3% of the sector benchmark Must be at least 80% invested at all times Recommended $100,000 Model Portfolio Ticker Price as of Jan 2, 2015 Number of Shares Consumer Discretionary Select Sector SPDR ETF (NYSEARCA: XLY ) 72.15 166 Consumer Staples Select Sector SPDR ETF (NYSEARCA: XLP ) 48.49 224 Energy Select Sector SPDR ETF (NYSEARCA: XLE ) 79.16 130 Financial Select Sector SPDR ETF (NYSEARCA: XLF ) 24.73 727 Health Care Select Sector SPDR ETF (NYSEARCA: XLV ) 68.38 233 Industrial Select Sector SPDR ETF (NYSEARCA: XLI ) 56.58 157 Technology Select Sector SPDR ETF (NYSEARCA: XLK ) 41.35 476 Materials Select Sector SPDR ETF (NYSEARCA: XLB ) 48.58 65 Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) 47.22 21 Cash 244.31 244.31 After this article, Foundational Research will post a series of articles for each sector and the respective industries. Below are some highlights on half of the sectors: Technology Sector Highlights We remain cautious on the technology sector, and recommend an equal weight. Although the sector, as measured by the XLK, has outperformed the broader market in 2015, much of that is due to AAPL, which accounts for more than 16% of the XLK index. We also believe the shift to cloud computing will have a negative impact on earnings for most large-cap technology companies, especially over the next few years, when the highest switching over/expenditure costs are expected. Valuations are also higher than they used to be, with overall tech trading at a 22% premium to the 5-year median P/E and a 70% premium to trough valuation, but the Technology sector still trades at a -9% discount to the S&P 500. Telecommunications Sector Highlights News flow continues to be almost exclusively negative in the telecommunications sector. Pricing is likely to continue to be a problem in wireless, and the wireline business is in secular decline. The negative pricing/promotion backdrop in wireless accelerated this past year. While the competitive condition may take a seasonal respite early this year following the holidays, the intermediate-term prospects in this regard is for more of the same, in our opinion. That is, more brutal competition. Energy Sector Highlights The downturn in crude oil prices and the prices for oil & natural gas-related stocks accelerated to the downside over the two quarters. Demand continued to suffer from weak economic conditions and/or slowing economic growth, particularly in the eurozone and China. At the same time, investors were spooked by ongoing strong oil production growth from US unconventional basins and the recovery of disrupted output from Libya. There was also the risk that the sanctions on Iran might be reduced or eliminated, potentially opening the way for increased production (approx. +500,000-700,000 barrels/d). Finally, OPEC was not able to come to an agreement to cut production to balance the market, leading to a sizeable drop in oil prices the day after Thanksgiving. We believe that the share prices have over-reacted to the crude oil price drop. Historically speaking, whenever energy stocks have lead decline for six months, they then lead for the following six months. “This time is different” often leads investors astray. Industrial Sector Highlights We are concerned that reductions to oil & gas capital spending budgets will have an outsized impact on the machinery and electrical equipment industries. There appears to be an expectation that better consumer spending trends following cheaper gasoline prices will spur further capital spending from the consumer discretionary sector. This may be the case, but we’d expect any pickup in capex from the discretionary sector to take time, while the cuts from the oil & gas complex will be more immediate. Additionally, sales into the oil & gas complex are among the most profitable for our companies, and will be difficult to replace (even if there is a pickup in consumer discretionary capex). Consumer Discretionary Highlights The market weight recommendation on the consumer discretionary sector reflects a more balanced view of the tailwinds and headwinds facing the group over this year. Fairly significant 2014 underperformance in the group has led to more reasonable relative valuations of late, and that, coupled with falling gas prices (a potential benefit to the consumer) and easing top line/margin comparisons in F15 have resulted in a more balanced risk/reward. That being said, many near-term macro data points remain mixed (i.e. jobs, housing, food commodity costs) and could keep a lid on overall earnings growth, which prevents a more constructive view on the group, for now. Material Sector Highlights Downstream is the new upstream. While we retain our neutral recommendation on the complex, we favor downstream/processed/refined-related commodity companies that benefit from the decline in upstream pricing. The perfect storm of increased production, stemming from higher prices, followed by slowing demand growth has resulted in a backdrop where many upstream commodities are in “oversupply.” The stronger United States dollar is only adding fuel to the fire. We would remain positioned in those commodities that benefit from falling inputs and oligopolic behavior. Our two preferred commodities are steel and aluminum, with the former capitalizing on falling iron ore prices, and the latter on falling power prices. We would avoid copper and iron ore where we have yet to see price support, as the cost curve continues to decline. Consumer Staples Highlights The third-quarter earnings results certainly did not encourage us to change our view. The operating environment remains challenging for packaged goods companies, especially so for food companies, yet the consumer staples sector continues to make new highs. Investors seem to continue to seek out yield, and probably even more so, stability, as we move toward year-end. Category growth remains sluggish in developing markets, and has slowed in emerging markets. The currency headwinds have intensified for many companies. Domestic attempts to drive volume with more promotions have not been as successful as in the past. The debate continues as to whether there has not been enough innovation or the consumer is still in a constrained in spending mode – we believe it has. Healthcare Highlights We continue to believe the Patient Protection and Affordable Care Act (ACA) will be a positive force in healthcare for the next 3-5 years, with some potential ramifications that need to be watched. As we approach year 2 of the expansion part of the law, Republicans have taken control of the Senate, and the Supreme Court has decided to review another case relating to the legislation. Scientific breakthroughs are creating a cornucopia of new biopharmaceuticals for unmet or poorly served medical needs. The demographics of the major industrialized nations, including North America, Europe, and Japan, are changing to larger populations of elderly patients, who are major consumers of drugs. Utilities Highlights We see nothing operationally wrong with the Utilities sector. The reach for yield has caused share prices to increase. Without a capex increase, and with prices as high as they are, we believe they will not appreciate any further. The last time the Utilities sector lead the market over the course of a year, as it did in 2014, it only returned 1% total return the next year. Over the next few weeks, we will go in-depth on each sector, so please remember to “Follow” us to not miss anything!