The Weakness In The Natural Gas Market Persists

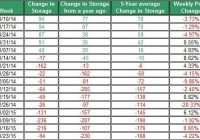

Summary The price of UNG kept coming down last week. The low extraction from storage is related to the warmer-than-normal weather. The recent rally in oil didn’t bring UNG back up. The recent recovery in the oil market didn’t provide any back-wind for The United States Natural Gas ETF, LP (NYSEARCA: UNG ) that kept coming down in the past week. The Energy Information Administration reported another lower-than-anticipated withdrawal from storage. (Data Source: EIA, Google Finance) The chart above presents the normalized prices of natural gas and UNG since the end of November 2014 till date – over this time frame, UNG fell by 38% and natural gas by almost 37%. This modest gap is due to roll decay attributed to the contango in futures markets. For now, the markets are still in contango, which means this gap between UNG and natural gas prices is likely to further widen in the coming months. But this also suggests that the market expects natural gas prices to start picking up again in the coming months. The EIA reported another lower-than-expected extraction from storage of 115 Bcf. In comparison, the extraction last year was 270 Bcf and the 5-year average was 165 Bcf (as a side note: these comparisons are only intended to provide crude base lines – after all, they also entail a lot of noise (as is the case in any weekly comparison), and as such, we should put an asterisk next to these base lines). The ongoing lower-than-expected extraction from storage may have rendered another blow to UNG this week. Most of the shifts in storage this time of the year are related to changes in weather. The relation between the changes in storage compared to the 5-year average and the shifts in temperatures from normal has remained strong this winter – the linear correlation is still at 0.74, which means the R-square is around 54% (this result in based on certain assumptions, including linearity and normality – two assumptions that might not hold up under scrutiny). This result only tends to show that the ongoing warmer-than-normal winter, on a national level, has kept the extraction from storage lower than normal for this extraction season. On top of this, the current storage level is around 24% higher than only 1.2% below the 5-year average. So the lower extraction, along with relatively normal storage levels has been enough to bring down the price of UNG to its current low levels. (Data Source: EIA , National Climate Data Center ) Last week’s deviation from normal temperatures was 6.38. So for next week’s storage report, the extraction from storage is likely to be, yet again, lower than the 5-year average, which was 165 Bcf. The ongoing low withdrawal is likely to bring storage to even slightly higher-than-normal levels in the coming weeks. Over the next couple of weeks, the weather is still projected to be colder than normal in the east and hotter than normal in the west. For February, the recent monthly report of the National Oceanic and Atmospheric Administration predicts above-normal temperatures in many parts of the U.S., except for certain regions such as the Northeast. But the weather forecast still entails uncertainty mainly related to a potential El Nino. But for now, it seems hard to see how UNG will start to pick up again to its high levels unless the weather starts to get much colder than it is now. After all, even the recent recovery in oil prices didn’t bring natural gas up. The recent news from Baker Hughes of the sharp drop in oil rigs has influenced oil inventors to adjust (or speculate on) their expectations about changes to the U.S. oil supply. This news brought oil prices back up in the past week. Oil rigs have declined by 83 rigs last week, and by a total of 276 rigs in the past year. But this rally didn’t seem to have much of an impact on natural gas prices, which only kept coming down. After all, gas rigs slipped by only 5 in the past week to reach 314. The uncertainty in the weather forecast for February could imply high volatility in the natural gas market. If the withdrawal from storage continues to be lower than normal, this could keep the price of UNG down. For more see: ” Has the Weakness in Oil Fueled the Decline of UNG? ” Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.