TAO: Real Estate In China Offers More Risk Than Returns

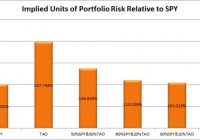

Summary TAO has been fairly volatile and feels even more dangerous to me because I’m bearish on China. Due to a low correlation with SPY, TAO would appear to fit reasonably in a diversified portfolio. The long term challenge for TAO is very high expense ratios that eat into any returns the ETF produces. Despite a high expense ratio, the holdings are fairly concentrated which may be one reason for the high volatility on the ETF. The Guggenheim China Real Estate ETF (NYSEARCA: TAO ) seeks to track the performance of the AlphaShares China Real Estate Index. I have to admit that I’m biased in looking at TAO as an investment because I’m a large bear on China. I believe equity values have been moving too high and domestic retail investors are holding meaningful positions in the Chinese equity market. If the market turns south it won’t just be a loss of equity valuations, it will mean less cash available for the domestic investors to spend on their other life expenses. In my opinion, that compounds the problem of holding exposure to China. Risk When measuring the historical volatility of investments in the SPDR S&P 500 Trust ETF ( SPY), the monthly standard deviation of returns has been almost twice as high as the deviation for SPY since the start of 2008. On the other hand, the correlation on monthly returns was only 65.5% which is fairly attractive. I put together a chart showing the changes in risk between holding a position that is simply invested in the S&P 500 versus mixing some TAO into the portfolio. (click to enlarge) Despite the very high level of risk for TAO, the low correlation does help it fit within the context of a portfolio. I’m not big on investing in China, but for investors that want to buy REIT exposure in China the added volatility at 5% of the portfolio isn’t too bad. Liquidity is challenging The average trading volume is only around 90,000 shares per day. If looking to invest in TAO, I would be applying a liquidity premium to the minimum acceptable level of expected returns. Yield The distribution yield is 2.33%. For being classified as real estate, the distribution is not as high as I would like to see it. When you see high volatility, low liquidity, and weak yields it is creating the perfect storm for investors to lose part of their portfolio since panic in selling could result in some fairly awful prices being realized. Expense Ratio The gross expense ratio is .95% and the net expense ratio is .71%. Simply put, that is way higher than what I am willing to pay on any ETF investment regardless of the exposure. These niche investment areas can result in fairly weak competition and fairly high expense ratios. Largest Holdings The diversification within the portfolio is fairly weak. Just over 50% of the value of the portfolio came from the top 10 holdings. (click to enlarge) Conclusion I’m bearish on China and I’ve found an international REIT ETF that offers investors high volatility, high expense ratios, and only moderate levels of diversification. It’s too bad investors can’t actually short stocks with no trading costs the way economic theory suggests. With such a high expense ratio it would be tempting to short the ETF and go long the underlying stocks to obtain the alpha from avoiding the expense ratio. Too bad it doesn’t work like that in the real world. That leaves me with no better option than just avoiding this investment. I wasn’t bearish on China a year ago. When the prices were more reasonable, I had no problem with exposure to the Chinese equity market. On fundamental valuations the market may not seem too bad, but any weakness could hurt the consumers which would hurt the fundamentals of the companies. If the prices fell far enough after adjusting for declining fundamentals, I wouldn’t mind buying exposure to China again. However, if I did that I would still be looking to get that exposure with a much lower expense ratio. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis.