Finding Value In The Fed Rate Hike

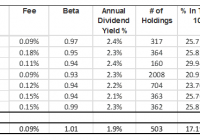

Summary Value funds have under performed post-2008 in part due to weakness in the financial sector. Rising interest rates are a sign of a strong economy and financial companies are more profitable with higher rates. Value is at its cheapest relative to growth in many years. Value has been in the doldrums for years due to underperformance in the financial sector. Financials led the market lower in 2007 and 2008. Following the rebound, banks were targeted by regulators and litigation costs weighed heavily on the sector. To top it all off, the Federal Reserve’s decision to keep interest rates at zero put a lid on the profitability from lending, at a time when borrowers were harder to find. The result was a long period of underperformance from the financial sector. Over the past 8 years, a good performance from the sector has generally been match the broader market’s gains, as the price ratio of the Financial Select Sector SPDR ETF (NYSEARCA: XLF ) versus the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) shows: (click to enlarge) With the Fed poised to hike rates, the financial sector is starting to come back to life. On July 20, St. Louis Federal President James Bullard said an interest rate hike in September was a 50-50 possibility. Even if a rate hike doesn’t come in September, a hike at the October or December meeting is coming (assuming economic data doesn’t take a sudden turn for the worse). The resulting increase in interest rate spreads, along with a stronger economy, should generate greater profits and improved overall balance sheets for banks and other financial services companies. Another reason to like the financial sector here, especially if you’re long-term bullish on the economy, is that banks currently have their dividend yields suppressed by regulators. Before the financial crisis, many banks paid out 50 percent or more of earnings as dividends. Today, banks are limited to 30 percent. Even if nothing changes to bank profitability, many banks could hike their dividends by as much as two-thirds based on today’s earnings if regulators ease up, which is likely as the memory of 2008 fades. Investing For the Shift Obviously, one way to play a rebound in the financial sector is directly with financial sector funds, but another set of funds that will be impacted by a rebound in financials is value funds because many value funds are overweight the financial sector. One fund that has hefty exposure is the Vanguard U.S. Value Fund (MUTF: VUVLX ), at 30.3 percent in the sector as of June 30. It has been a tough few years for VUVLX and other value funds due to its largest sector weighting delivering middling performance. Value funds also tend to be overweight energy and it’s been a terrible sector in the past year. Value has underperformed growth due to the recent spike in technology companies. Strong earnings from Internet firms such as Google (NASDAQ: GOOG ) and Netflix (NASDAQ: NFLX ) have pushed growth shares sharply higher. As this chart comparing the price of VUVLX to the Vanguard U.S. Growth Portfolio (MUTF: VWUSX ) show s, the recent drop in energy combined with the spike in growth shares has really weighed on relative returns. Once the financial sector starts outperforming, this performance will change for the better. (click to enlarge) VUVLX The four-star Morningstar rated Vanguard US Value Fund Investor Class seeks long-term capital appreciation and income by investing the majority of its assets in shares of U.S. common stock. The fund has a focus on large- and mid-cap value stocks that management perceives to be out of favor with the general market. These stocks may also have higher-than-average dividend yields and lower-than-average price/earnings ratios. As of the end of June 2015, VUVLX has a significant exposure to financial services stocks. Investment Strategy Portfolio managers James Troyer, James Stellar and Michael Roach are at the helm of VUVLX. The management team uses proprietary software and a quantitative-driven investment approach to identify stocks that they believe offer a good balance between strong growth and reasonable valuations when compared to industry peers. Managers construct the portfolio from stocks selected primarily from the Russell 3000 Value Index. While the fund typically concentrates on large- and mid-cap companies that the managers believe are selling below their true worth, it has no restrictions on the size of the companies in which it may invest. The fund may also invest up to 20 percent of assets in foreign securities and engage in currency hedging strategies associated with those investments. Fund managers are authorized to invest 15 percent of assets in restricted securities or other illiquid investments as well as hold small positions in stock futures, derivatives and exchange-traded funds. The fund may also take defensive positions, such as holding a large cash position, on a temporary basis in response to unusual market, economic or political conditions. The fund’s goal is to outperform the underlying benchmark Russell 3000 Value Index. This investment strategy has enabled VUVLX to beat the Large Value Category averages since its inception in June 2000. Portfolio Composition and Holdings VUVLX currently has $1.3 billion under management. The portfolio holds 99.28 percent of assets in U.S. stocks with the remainder in cash. The fund has a 37.24 percent exposure to Giant Cap stocks as well as 29.44 percent and 19.20 percent exposures to large- and medium-cap stocks. VUVLX also holds 12.08 percent and 2.05 percent of assets in small- and micro-cap stocks. The portfolio is heavily weighted toward the Financial Services, Healthcare and Industrial sectors. VUVLX is underweight Consumer Defensive and Energy shares. The fund has a P/E ratio of 15.67 and a price-to-book of 1.83. This broadly diversified fund normally invests in approximately 200 individual holdings across all market categories. The portfolio currently holds 238 individual securities with an average market cap of $32 billion, which compares to the category average of just over $84 billion. The top 10 holdings comprise 21.3 percent of holdings. They include Exxon Mobile (NYSE: XOM ), Wells Fargo (NYSE: WFC ), JPMorgan Chase (NYSE: JPM ), Johnson & Johnson (NYSE: JNJ ) and General Electric (NYSE: GE ). The next five largest holdings are Berkshire Hathaway (NYSE: BRK.A ), Proctor & Gamble (NYSE: PG ), AT&T (NYSE: T ), Pfizer (NYSE: PFE ) and Schlumberger (NYSE: SLB ). Historical Performance and Risk The fund has consistently beat its category. VUVLX generated 1-, 3- and 5-year total return averages of 6.82 percent, 19.64 percent and 17.86 percent respectively. These compare to the category averages over the same periods of 3.92 percent, 16.27 percent and 14.49 percent. VUVLX has an Above Average 3-year Morningstar Return rating and an Average 3-year Risk Rating. The fund has a 0.98 beta and a standard deviation of 8.93. These compare to the category averages of 0.98 and 8.55. VUVLX has a 30-Day SEC Yield of 1.99 percent. Expenses, Fees and Distribution This open-ended fund has an expense ratio of 0.29 percent, which is significantly less than the category average of 1.19 percent. VUVLX does not have any initial, deferred, redemption or 12b-1 fees. The fund has a $3,000 minimum initial investment for taxable and qualified non-taxable accounts. Conclusion Investors aren’t very interested in value today and as a result, value is the cheaper than it has been in years relative to growth. Growth stocks are enjoying a great run this year and thanks to solid earnings reports in July, another growth spurt is underway. Amazon (NASDAQ: AMZN ) reported strong earnings on Thursday and shares popped in after-hours trading, extending growth’s 2015 run. Investors too often chase what’s hot at the moment though, and with a major change in interest policy looming, a reassessment of long-term positioning is warranted. Putting aside the fundamental case for a turnaround in value, on a relative basis it appears value is due for a rebound. Add in the case for a stronger financial sector, which itself has spent most of the past 8 years underperforming or matching the performance of the broader market, and there’s a strong case to be made for value staging a comeback in the years ahead. Disclosure: I am/we are long VUVLX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.