QJPN Borders On Being Too Good To Be True

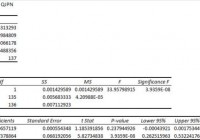

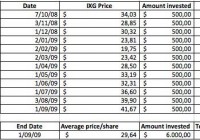

Summary I’m taking a look at QJPN as a candidate for inclusion in my ETF portfolio. The expense ratio is a bit high, but the diversification is moderate. The correlation with SPY appears low, and the overall risk level for a portfolio looks great. However, weak liquidity could be influence results. Despite the relatively short history on QJPN, I’ll keep it on my short list for international exposure. I’m not assessing any tax impacts. Investors should check their own situation for tax exposure. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the SPDR MSCI Japan Quality Mix ETF (NYSEARCA: QJPN ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does QJPN do? QJPN attempts to provide results which are comparable (before fees and expenses) to the total return of the MSCI Japan Quality Mix Index. QJPN falls under the category of “Japan Stock”. Does QJPN provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is about 44%, which is phenomenal for Modern Portfolio Theory. The extremely low correlation makes it much easier to mix the ETF into a portfolio and take advantage of the benefits of diversification. My goal is risk adjusted returns, and my method is minimizing risk. Standard deviation of daily returns (dividend adjusted, measured since June 2014) The standard deviation is very reasonable. For QJPN it is .8159%. For SPY, it is 0.7232% for the same period. SPY usually beats other ETFs in this regard, and the low correlation with SPY makes the higher standard deviation acceptable. Short time frame Investors should be aware that this is a substantially shorter time frame than I usually use. I would like to have about 3 years of data on the ETF for running statistics and half of one year is short enough to introduce sampling errors. In statistics, the minimum sample size is generally 30 so over 130 days of trading returns may seem sufficient, but I would caution investors to take this with a grain of salt. Liquidity concern The average volume comes in at just under 2000 shares. That’s a potential problem for investors that need liquidity and for running correlation values. I checked the dividend adjusted closing values for each day and there were very few times that the change was 0.00%, which means the low volume of trades was not the only factor in the low standard deviation. For statistical validity, I’m more concerned about the relatively short time frame that I have available than the number of shares trading each day. For an investor concerned about spreads and liquidity, the low number of shares trading could be the bigger concern. Mixing it with SPY I also run comparisons on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and QJPN, the standard deviation of daily returns across the entire portfolio is 0.6553%. If an investor wanted to use QJPN as a supplement to their portfolio, the standard deviation across the portfolio with 95% in SPY and 5% in QJPN would have been .7063%. While the low correlation makes very large positions look quite appealing, I wouldn’t want to risk my money on those statistics holding. However, the low correlation and reasonable standard deviation make this a strong contender for a position in my portfolio, even if I have to limit the exposure to something much smaller than the statistics would have suggested. Due to the potential for the low trading volumes and short time frame to distort the statistics, I will want more data before making a final decision on the ETF. So far, I am definitely considering it. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The SEC yield is 1.37%. That is too weak for a retiring investor to live off the yield, but the ETF still could merit a small position as part of a rebalancing plan to reduce the overall risk level in the portfolio is the investor was certain he or she would not have liquidity needs that would force them to sell. I’m not a CPA or CFP, so I’m not assessing any tax impacts. Expense Ratio The ETF is posting .30% for an expense ratio. I want diversification, I want stability, and I don’t want to pay for them. The expense ratio on this fund is slightly higher than I want to pay for an equity fund, but it isn’t enough to disqualify the ETF from consideration. Market to NAV The ETF is at a .29% premium to NAV currently. Premiums or discounts to NAV can change very quickly so investors should check prior to putting in an order. I wouldn’t want to pay a premium greater than .1% when investing in an ETF, unless I could find a solid accounting reason for the premium to exist. This premium looks small enough that I think I could enter into a position with a limit buy order that removed the premium. Largest Holdings The diversification within the ETF is moderate. Normally I want more diversification, but if the correlation and standard deviation hold up over a longer time period, I wouldn’t have any problem with the level of diversification in the ETF. (click to enlarge) Conclusion I’m currently screening a large volume of ETFs for my own portfolio. The portfolio I’m building is through Schwab, so I’m able to trade QJPN with no commissions. I have a strong preference for researching ETFs that are free to trade in my account, so most of my research will be on ETFs that fall under the “ETF OneSource” program. QJPN is going to be on my short list (for now) for potential inclusion in my portfolio as part of my international exposure. If QJPN continues to look better than other international ETFs under modern portfolio theory I will extend my analysis to look for other ETFs with similar holdings and a longer trading history so if the data on those ETFs support the statistics so far on QJPN.