What’s Hot, What’s Not: SPY And Select Sector SPDRs At The Dawn Of 2015

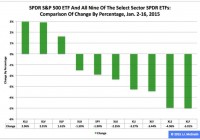

Summary The SPDR S&P 500 ETF has not had a happy new year thus far, shedding 1.90 percent in the first 11 trading days of 2015. During this period, the Utilities exchange-traded fund was first by return among the Select Sector SPDRs, rising 2.96 percent. Over the same time frame, the Financial ETF was last by return among the sector SPDRs, falling -5.01 percent. The U.S. equity market’s large-capitalization segment has been characterized by the relative overperformance of low-beta Select Sector SPDRs and the relative underperformance of high-beta sector Select Sector SPDRs in 2015 year to date, just as it was in 2014. Meanwhile, their parent proxy, the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) has struggled this year, as it dipped to $201.63 from $205.54, a drop of -$3.91, or -1.90 percent. This long-term sector rotation appears important for multiple reasons at this late stage of the economic/market cycle. With respect to economic matters, the International Monetary Fund cut its forecast Tuesday for global growth this year, to 3.5 percent from 3.8 percent, and the World Bank Group did likewise Jan. 13, to 3.0 percent from 3.4 percent. With respect to market matters, the S&P 500’s cyclically adjusted price-to-earnings ratio is at the historically lofty level of 26.77, according to 2013 Nobel Prize-winning economist Robert J. Shiller . Appearing below are comparisons of changes by percentages in SPY and all nine sector SPDRs in 2015 year to date, last month, last quarter and last year. Figure 1: XLU No. 1 Among Select Sector SPDRs This Year (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing daily share prices at Yahoo Finance . In 2015, the Utilities Select Sector SPDR ETF ( XLU ), Health Care Select Sector SPDR ETF (NYSEARCA: XLV ) and Consumer Staples Select Sector SPDR ETF (NYSEARCA: XLP ) have been not only the best behaved but also the only ones with positive returns among the sector SPDRs that break the S&P 500 into nine chunks. Elsewhere, I indicated it is an article of faith (and statistical interpretation) hereabouts that so-called PUV analysis is better than psychoanalysis in determining Mr. Market’s state of mind. What is PUV analysis? It is basically the study of the behaviors of XLP, XLU and XLV in comparison with their sibling sector SPDRs. If the PUV cluster of ETFs ranks in or near the top third of the sector SPDRs by return during a given period, then I believe market participants are in risk-off mode; if the PUV cluster of ETFs ranks in or near the bottom third of the sector SPDRs by return over a given period, then I think market participants are in risk-on mode. Given the relative performances of XLP, XLU and XLV that have them in the top three spots among the sector SPDRs this year, I believe market participants are in risk-off mode. And I think they will continue to be so, with changes in policy at the U.S. Federal Reserve the biggest reason why. In this context, I note the Fed announced the conclusion of purchases under its latest QE program Oct. 29 and that the ends of purchases under its previous two formal QE programs are associated with both a correction and a bear market in large-cap stocks, as evidenced by SPY’s dipping -17.19 percent in 2010 and dropping -21.69 percent in 2011. Figure 2: XLU No. 1 Among Select Sector SPDRs In December (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing daily share prices at Yahoo Finance. XLU also was the big winner among the Select Sector SPDRs last month, when the Technology Select Sector SPDR ETF (NYSEARCA: XLK ) was the big loser in the group. I suspect XLK may continue to struggle this year, with one large reason being the bias divergence in monetary policy at major central banks around the world. On the one hand, the U.S. Federal Reserve is oriented toward tightening; on the other hand, the Bank of Japan, European Central Bank and People’s Bank of China are oriented toward loosening. This divergence has led to significant movements in exchange rates, such as in the euro and U.S. dollar currency pair, or EUR/USD. The EUR/USD cross fell from as high as $1.3992 May 8 to as low as $1.1459 Jan. 16, a tumble of -$0.2533, or -18.10 percent, based on data at StockCharts.com. The change in EUR/USD and similar moves in other currency pairs indicate a strengthening greenback and a weakening everything else could pressure earnings of U.S. companies in sectors with substantial international businesses, which most likely will be a headwind for many of XLK’s components. Anyone doubting the effects of central-bank policy on financial markets should take a close look at the impacts associated with the Swiss National Bank’s surprise decision to discontinue its fixing of the minimum exchange rate between the Swiss franc and the euro last week, which I briefly covered in a piece at the International Business Times . Figure 3: XLU No. 1 Among Select Sector SPDRs In Q4 (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing daily share prices at Yahoo Finance. XLU also ranked No. 1 among the Select Sector SPDRs last quarter, while the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) ranked No. 9 in the group. Recently, I argued lockstep movements of the EUR/USD currency pair, the commodity price of crude oil and the share price of XLE appear likely to continue unless the Federal Open Market Committee makes clear it will delay the anticipated announcement of its interest-rate hikes April 29 and that it is preparing to carry out asset purchases under its fourth formal quantitative-easing program of the 21st century, aka QE4. I also argued the FOMC may be hard-pressed to present a convincing rationale for those actions, given the conditions described in “SPY Slips And U.S. Economic Index Slides In December” and that, without them, XLE might continue to be the equivalent of a canary in coal mine where things are looking darker by the day. These arguments still make sense to me. Meanwhile, I anticipate being underwhelmed by the ECB action or inaction on its own QE to come Thursday, and I expect Mr. Market will be so, too, except on a short-term trading basis, with plenty of sound and fury, signifying (nearly) nothing. Figure 4: XLU No. 1 Among Select Sector SPDRs In 2014 (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing daily share prices at Yahoo Finance. I am detecting a pattern here: XLU also led the way among the Select Sector SPDRs last year, when XLE lagged the rest of its siblings. Consistent with the above discussion of PUV analysis, I consider XLU key to the assessment of market sentiment based on the comparative behaviors of the sector SPDRs. If XLU ranks near No. 1 by return during a given period, then I believe market participants are in risk-off mode; if XLU ranks near No. 9 by return over a given period, then I think market participants are in risk-on mode. In the current environment, I therefore would be completely unsurprised should XLU continue to behave well this quarter and this year, not on an absolute basis but on a relative basis (i.e., in comparison with the other sector SPDRs and with SPY). The ETF may not produce gains, but it might produce losses smaller than those of its siblings, which is another way of saying SPY looks vulnerable, right here, right now. (Unless, of course, the Federal Reserve comes riding to the rescue, as it did in 2010, 2011 and 2012.) Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice.