Why Active Managers Like Volatility

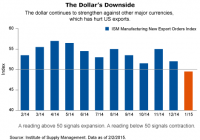

With quantitative easing finished and the Fed poised to raise rates, we are already starting to see stocks exhibit more volatility. We expect that to continue, and that stocks will rise or fall based on their fundamentals. In this environment, we believe active management is likely to become increasingly important to achieving sufficient returns. Capital markets offered some surprises for investors last week. Stocks rose globally with the Dow Jones Global Index rising 0.72%, while US stocks rallied with the S&P 500 hitting another record high. In addition, Treasury bonds sold off and oil continued its multi-week rebound. Clearly, asset classes are rotating and moving in different directions. A good example of this rotation can be found in the energy sector. Energy stocks have disappointed since last summer, falling in lockstep with the price of oil. However, in the past few weeks the price of oil has rapidly reversed course, helping energy stocks to rebound. The average energy-sector equity mutual fund returned almost 12% in the past month (as of February 13, 2015), well above every other sector fund average, according to Morningstar. Home and Away We’re also seeing divergent paths among fourth-quarter earnings reports. So far, earnings season has been positive, beating expectations. But there’s a substantial difference between companies that derive their earnings domestically from companies that derive their earnings largely from outside the United States. Why? Because the rising dollar has dragged down their fourth-quarter earnings results. A look at factory activity over the past few months drives home this point. The ISM manufacturing index has dropped to 53.5 in January from 57.6 in November. Weakness in foreign demand pushed new export orders down to their lowest level since November 2012. The caveat is that, like the price of oil, the dollar could reverse course relative to other currencies and the above scenario could change. Divergence can also be found in economic growth in the euro zone. For the fourth quarter, the euro zone skirted a recession and actually delivered modest growth. However, growth varied widely across member countries. Germany and Spain both saw their economies grow 0.7% in the quarter, beating expectations. Not surprisingly, some European countries didn’t fare as well, with both France and Italy falling short of expectations and Greece experiencing a -0.2% growth rate. Despite the disparity in growth, sovereign bond yields may not be dramatically different between these countries (except Greece) thanks to investors’ belief that the European Central Bank will stand behind this debt. Still, the performance of their stock markets could be where we see that growth gap reflected. The Perils of Indexing At Allianz Global Investors, we have long argued that once quantitative easing ended, we would see a change in the market environment. In other words, a move away from QE – which served as a rising tide lifting all boats – to an environment where stocks rise and fall on their individual fundamentals. We worry that the large number of investors who have enthusiastically embraced indexing in the past decade will be negatively impacted in this market environment, where we’re likely to see far more volatility, asset-class rotation and overall differentiation among individual securities. Unfortunately, indexing generally does not allow investors to avoid those companies that can be hurt by a rising dollar or the falling price of oil. And indexing does not allow investors to pivot when the dollar begins falling or the price of oil again changes course. In addition, as we look out on 2015, we expect relatively low stock returns. This again makes the case for active investing as investors will need to make active bets in an effort to surpass low market returns. In short, there are periods when markets are more conducive to index investing, as we saw over the past few years, but this environment isn’t one of them. We hope investors recognize the importance of active management in this unique and ever-changing market environment. We believe, a “buy the index and go home” strategy in times of uncertainty could come back to haunt investors.