What Is In Store For REIT ETFs Ahead?

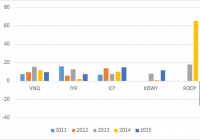

As the timeline of the first rate hike after a decade is approaching this month, interest-rate sensitive sectors like REITs are falling out of investors’ favor. REIT ETFs emerged a winner last year thanks to widespread volatility, but are mostly in the red this year as the Fed liftoff is looming large (read: Top ETF Stories of November ). Notably, REITs own and operate income-producing real estate. They are required to distribute at least 90% of their taxable income to shareholders annually in the form of dividends and can in turn deduct the payout from their corporate taxable income. The basic idea is that a rise in interest rates will undoubtedly lead to a high borrowing cost on which the REITs are highly dependent. Moreover, high-dividend yielding stocks like REITs usually become less attractive when treasury yields rise. At this point of time, we can say that a policy tightening is unavoidable in the mid-December Fed meeting; at least the Fed officials and economic progress are giving such cues. Minor lack in some economic readings wouldn’t come in the way of the Fed decision. Recent comments from the Fed have certainly influenced Treasury bond yields too. With the yields increasing, several investors may now be turning away from REITs. But do REITs deserve such negligence? Are investors overreacting? Let’s find out. Short-Term Yields Rising Faster Investors should note that the 10-year benchmark Treasury bond yields jumped 21 basis points to 2.33% (as of December 3, 2015) since the start of the year, a relatively slower ascent than what we saw in 2013 due to Fed taper talks. It was the short end of the yield curve that was hit hard (read: Short-Term Bond Yields Rising: Timely ETF Bets ). Yields on the six-month U.S. Treasury bonds surged 34 bps to 0.45% (as of the same date) since the start of the year as the Fed hikes the benchmark rate. In such a situation, investors can very well bet on the income-producing securities like REITs as long-term Treasury yields are not rising as fast as feared. Moreover, the Fed repeatedly asserted that it will take a slow stance in policy tightening giving yet another reason not to worry much over REIT securities. As investors continue to search for income, REITs can give them some market-beating yields which will in turn make up for capital losses also, if there is any. Economic Strength to Bode Well The negative correlation between rising rates and REITs, in all cases, is a common misconception. Notably, when rates rise on the back of a pickup in the economy, REITs actually outperform. As per reit.com , “in the 16 periods since 1995 when interest rates rose significantly, Equity REITs generated positive returns in 12.” The REITs business is associated with basic consumer requirements like apartments, shopping malls, warehouses, lodging and dining, office, hospital among others. In a growing economy, people consume and spend more in malls for discretionary purchases. An uptick in the U.S. housing sector is now a known fact; job growth will push office REITs and hospital REITs are always a stable area, irrespective of the market condition. Now, as the Fed is viewing the economy as strong enough to gobble up the first rate hike, there should not be much downside risks in REIT stocks and ETFs. After all, the job market is healing and inflation is inching up. REITs stand to gain with growth in occupancy and hike in rents. The consistent increase in rent will also help REITs to keep pace with inflation. Overvaluation Concerns However, there are hurdles in the path too as REIT ETFs are not all cheap investments. The popular Vanguard REIT Index ETF (NYSEARCA: VNQ ) trades at a P/E ((ttm)) of 34 times against the SPDR S&P 500 Trust ETF’s (NYSEARCA: SPY ) P/E of 19. So, just as the Fed pulls the trigger, a correction, probably a short-lived one, is expected in the REIT space. Below highlight three REIT ETFs that were relatively less hit by rate worries in the last one-month frame and proved sturdier in the pack. iShares Residential Real Estate Capped ETF (NYSEARCA: REZ ) The $319-million fund is heavy on Residential REITs and Health Care REITs. The 37-stocks fund charges 48 bps in fees. However, the fund has concentration risks as its first two holdings take about 23% of the basket. The fund yields 3.25% and was down just 0.02% in the last one-month frame (as of December 3, 2015). IQ U.S. Real Estate Small Cap ETF (NYSEARCA: ROOF ) The fund holds 60 small-cap stocks in the basket. It is an unpopular choice with about $86 million in assets. The ETF charges 69 bps in fees per year from investors. The product is less concentrated across its top 10 securities as no stock accounts for more than 3.50% of the basket. ROOF was down 2.5% in the last one month and yielded 5.68% as of December 3, 2015. The fund currently has a Zacks ETF Rank #3 (Hold) with a Medium risk outlook. iShares Cohen & Steers REIT ETF (NYSEARCA: ICF ) This $3.57-billion fund holds 30 securities. Industry-wide, retail, residential, specialized, office and health care REITs get double-digit weights. The fund charges 35 bps a year in fees. The fund lost about 2.9% in the last one month and yielded 3.22% as of December 3, 2015. Link to the original post on Zacks.com