Shorting China Based On GDP Growth Rate Projections Is Highly Risky

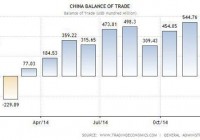

Summary China is looking at record trade surpluses in 2015, which should boost GDP growth. Many China shorts assume GDP growth moves in one direction instead of up and down. Shorting based on projections is risky, especially when there are many factors that can throw off these projections. China’s trade surplus is currently trending up. After a relatively quiet first quarter in 2014, the balance of trade improved drastically throughout the remainder of the year. In fact, the country recorded a record monthly trade surplus of $54.5 billion last November . For the whole of 2014, the trade surplus soared by 47 percent over the previous year and wound up at a record $382.46 billion. (click to enlarge) What’s driving the trade surplus and why they may continue The drastic change in the balance of trade is not all that surprising when the fall in commodity prices is taken into account. Since China is the biggest importer of many commodities, it makes a big difference when it is able to pay less. To illustrate the drop in commodities, the Continuous Commodities Index is down by almost 14 percent over the last 12 months and continues to go down. Crude oil, the most important commodity, is down by more than half. The drop occurred in the second half of the year and accelerated by late November. This will have an impact since China imported 6.17 million barrels per day in 2014, an increase of 9.5 percent over the prior year. With commodities going the way they are, China can expect continued bumper trade surpluses. Trade surpluses should be especially high for at least the next two quarters due to the high base of the preceding year. Barring a drastic rebound in commodity prices, the trade surplus in 2015 is very likely to be substantially higher than the one in 2014, which was already a record setting number. Why China’s trade surplus matters Trade surplus matters because it influences GDP growth. In fact, one of the main components of GDP calculated using the expenditure approach is net exports. The difference between exports and imports, can be a trade surplus or trade deficit. Therefore, a large or increasing trade surplus will boost GDP growth assuming all else remains the same and can help offset weaknesses elsewhere to a certain extent. GDP growth in China is in turn one of the most closely watched metrics by many people. The reason why is simple. As the second largest economy, China is one of the most important markets for many companies around the world. Certain sectors such as commodities are especially sensitive to whatever goes on in China. (click to enlarge) For the fourth quarter of 2014, GDP growth rate came in at 7.3 percent. GDP growth rate for the whole of 2014 was 7.4 percent. The expectation was for 7.2 percent and 7.3 percent respectively. The target set by the Chinese government at the beginning of the year was for “about 7.5 percent” annual GDP growth. China shorts assume that China’s growth rate will go down However, despite GDP growth beating expectations, there are many who remain bearish when it comes to China. For instance, the International Monetary Fund (IMF) projects GDP growth to come in at 6.8 percent for 2015 and 6.3 percent the following year. There are others who are even more bearish. With so much negative sentiment around, it’s no wonder that some may be tempted to short China. The thinking is that a slowing economy will have a negative impact on company earnings, which in turn should affect their valuation. Shorting makes sense in such a situation. However, since there is no one who can accurately predict the future, it’s not possible to say for certain what will happen in the future. It may or may not be true. In other words, expectations that China’s growth rate will continue to go down may be misplaced. (click to enlarge) China shorts will point out that the current growth rate is much less than the double digit growth in previous years. However, contrary to what is often reported, double digit growth in China is actually the exception and not the norm. GDP growth rate does not move in a straight line, but goes up and down along the way. There are many factors that can throw projections off course Record trade surpluses are just one factor that can result in China’s growth rate coming in above expectations. For instance, the IMF originally expected China’s GDP growth for 2014 to come in at 7.2 percent early in the year. They later raised this to match the official government target. In other words, the projections for 2015 could be adjusted upwards in the coming months just like the IMF did the previous year. Furthermore, the Chinese government is a wild card as it has several options available to influence GDP growth. For instance, the one year benchmark lending rate is at 5.6 percent, which is quite high in an era where low interest rates are common. Besides interest rates, reserve requirements for banks is at 20 percent. China also has fiscal reserves that could be used. Depending on what target the Chinese government sets for 2015, it may deploy some or all of the available options. All of which can throw projections way off course, which would have negative implications for shorts that are banking on projections coming true. Shorting China based on GDP growth expectations is therefore highly risky and not recommended.