The Market Map Portfolio: Holding Healthcare ETFs During Underperforming Months

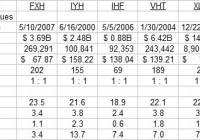

Summary Seeking Alpha contributor mentioned that my previous biotech seasonal portfolio could be improved with some tweaks. I backtested this strategy against mine, finding it to be a low-risk, low-reward strategy. I then tweaked Market Map’s strategy to find a high-risk, high-reward version of the same strategy. In my previous article, I introduced a biotech-heavy seasonal portfolio that resulted in a 4.57 cumulative return. To recap, the strategy not only outperforms a buy-and-hold strategy with the SPDR S&P Trust ETF (NYSEARCA: SPY ) 2 to 1 but also had nearly half the max drawdown. The strategy is summarized as follows. November to January: Hold the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) February to May: Hold the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) June to August: Stay out of the market September: Hold the SPDR Gold Trust ETF (NYSEARCA: GLD ) October: Stay out of the market Seeking Alpha contributor Market Map had this to say regarding the strategy: (click to enlarge) In other words, he proposed some changes that would lead to a better performance. Let’s review Market Map’s strategy and then run a backtest on it. Market Map’s Strategy As I understand it, Market Map’s strategy has three main differences from the one I presented. It has different allocations. It is in the market year-round. It cuts down on exposure during “high risk years.” Let’s deal with each in turn. First, the allocation issue. The major difference is that it forgoes gold in favor of healthcare. I will be using the iShares U.S. Healthcare ETF (NYSEARCA: IYH ) here. Second, Market Map’s strategy is in the market year-round, whereas mine avoided June to August and October. This gives the strategy more market exposure – likely increasing both risk and reward. I expect a higher cumulative return but at higher drawdowns. Finally is the “high risk” year issue. Market Map did not mention how to define high risk years. Thus we must define high risk years before running this strategy. Because we are backtesting, we cannot pretend to know that 2008 was to be a bad year, for example. Luckily, in my monthly “The Trader’s Book Summary” newsletter, I once reviewed a book called “The Stock Traders Almanac.” In this book, data from 1949 was analyzed, producing annual patterns, which I will briefly summarize below. Pre-presidential years outperformed. Presidential years outperformed. Mid-term years underperformed. Post-presidential years underperformed. Years ending with 5 outperformed. I will define “high risk years” as per the above. For a backtest over the past ten years, high-risk years are the following: In the backtest, during the above years, I will cut down portfolio allocation to 50%, putting the other 50% in bonds via the SPDR Barclays 1-3 Month T-Bill ETF (NYSEARCA: BIL ). And hence we have our strategy, all ready for backtesting. So here we go… The Results The results of the backtest follows. I am comparing this strategy to the following strategies: BIL_HOLD: Bonds – 100% invested in BIL SPY_HOLD: Stocks – 100% invested in SPY SPY_Cash: Sell in May – SPY in October and switch to Treasury bills in May Sector: Biotech seasonal strategy – The strategy I outlined in my last article Mm: Market Map’s strategy – The strategy as outlined above As you can see, the strategy did not perform as advertised. While both the max and average drawdowns were the lowest of all strategies (barring bonds), the cumulative return was also the worst (again, barring bonds). This strategy seems more like a low-risk version of SPY_Cash, as it did even better than SPY_Cash during the 2008 bear market, despite it being a strategy that was fully invested in the market during 2008. So my hypothesis was also wrong in expecting MM’s strategy to be a high-risk, high reward strategy. In fact, it is the opposite. Nevertheless, I wanted to give MM the benefit of the doubt in that his strategy could outperform mine, so I removed the constraints of trying to time market years. That is, I reran the backtest without the annual market timing aspect. The strategy then becomes being fully invested in the market year-round every year. In other words, we are making a much more simple modification to my previous strategy: Forget gold and avoiding the market during underperforming months; during these times, invest in healthcare instead. The strategy summarized: November to January: Hold the iShares Nasdaq Biotechnology ETF ( IBB ) February to May: Hold the Energy Select Sector SPDR ETF ( XLE ) June to October: Hold the iShares U.S. Healthcare ETF Let’s see how this strategy measures up: This is essentially a confirmation of my original hypothesis. MM’s strategy provides higher rewards in the long run but at a higher risk. Notice that MM’s strategy goes head-to-head with Sector until the 2008 market crash. Conclusion for Investors MM does not beat the sector strategy until 2014 due to having to recoup from its 2008 losses. However, in the long-term MM does prevail as the more profitable strategy. As to which is better, it’s a question of risk versus reward. Both strategies only require three trades per year. But MM stays in the market during underperforming months. But it is that extra exposure to the healthcare industry during those times – especially from 2014 to 2015 – that brings this strategy ahead of Sector in the long-run. Overall, it is up to you whether the extra cumulative performance is worth the extra risk exposure that comes as a result of being in the market year-round. Personally, I would be a bit worried about holding onto both biotech and healthcare year-round, as it seems a bit underdiversified compared to holding bonds and gold during underperforming months. If you’re interested in seeing some tweaks to this strategy, ask me in the comments section or via mail. I’ll be rolling out my premium Seeking Alpha backtesting newsletter soon, in which I backtest your strategies. For example, if you want to see the above Sector strategy tested with full market exposure or with different ETFs as the forerunners, just leave your ideas below.