5 Catalysts That Will Lift India ETFs In 2015 Even After 2014’s Big Gains

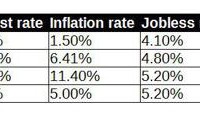

Summary India trades at low valuations compared to the U.S. and developed markets. India is home to a burgeoning consumer population entering their prime earning and spending years. India’s consumer market is under penetrated compared to the oversaturated developed markets. Prime Minister Narendra Modi’s business-friendly regime will attract foreign investors. The central bank lowered interest rates, which will stoke business growth. (click to enlarge) India’s ETFs and stock market were among the top destinations of 2014. The WisdomTree India Earnings ETF (NYSEARCA: EPI ) jumped 28% in 2014, while the iShares MSCI India Index ETF (BATS: INDA ) climbed 22%. They far outdid foreign developed markets, which fell 5%, and emerging markets, which shed 4%. 2014’s returns were driven by a perfect storm of government reforms and a dive in oil prices – a major import – that relieved a huge burden on government subsidies. The planet’s biggest democracy shows no signs of slowing down in 2015. Among numerous reasons I’m bullish on India, here are the top five. 1. Attractive Valuations EPI in changing hands at a price-to-earnings ratio of 14, price-to-book value of 2 and price-to-sales of 1.1. It’s trading at higher valuations than China and other emerging markets, but is lower than foreign developed markets and the U.S. The iShares MSCI EAFE ETF (NYSEARCA: EFA ) sports a P/E of nearly 15, P/B of 1.6 and P/S of 1. The SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) has a price-to-earnings ratio of 17, price-to-book value of 2.5 and price-to-sales of 1.8. Corporate earnings in India are expected to accelerate and perhaps double over the next few years, indicating companies deserve higher valuations. 2. Ideal Demographics More than half of India’s people are under age 25 and more than 65% are younger than 35. Demographers forecast by 2020 India’s median age will be 29 years, compared to 37 for China and 48 for Japan. A younger population goes hand in hand with more consumer spending as people form households and raise children. In addition, there are more workers supporting fewer retirees. Currently home to 17.5% of the world’s population, India is projected to be the world’s most inhabited country by 2025 with 1.396 billion people, outnumbering China with 1.394 billion. India has more young consumers in addition to an underserved market compared to the oversaturated Western markets. As of 2009, only 11 people per 1,000 owned cars in India versus 34 for every 1,000 in China and 440 for every 1,000 in the U.S. 3. Business-Friendly Reforms Prime Minister Narendra Modi’s win in the May election brought hope that the country would lighten gold import restrictions, ease environmental regulations to better compete with China and take on more infrastructure development. Modi lifted a ban in June on industrial growth in 43 areas that the Ministry of Environment and Forests had in place since 2010. Modi designated a new like-minded environmental minister and industrial projects that were once stalled are now being approved quicker. The government in November did away with the 80:20 gold importation law. The controversial rule required that 20% of gold imported be exported before new gold deliveries could be brought in. In November, gold imports vaulted to 150 tons – a fivefold jump year over year. Modi issued in late December five ordinances, akin to executive orders, to kickstart the economy. The most significant one eased land acquisition rules to reduce bureaucratic bottlenecks that had hindered development projects totaling almost $300 billion. One ordinance would allow private sector involvement in coal mining, while another aims to increase foreign investments in the insurance sector. India’s parliament has to pass the new ordinances at their next confab in February for the ordinances to be enacted. Some 311 million people in India live without electricity, but the government wants to provide access to the entire country by 2017. In an effort to achieve that, Modi is asking the government – which controls 90% of the coal reserves but is very inefficient – to auction its coal mines to private mining companies. India has the fifth largest coal reserves on the planet. The country is estimated to have lost $68 billion in economic output, or 4% of GDP, in 2013 because of power outages. Any electricity grid improvements would greatly benefit economic activity. India stands to draw more foreign investments thanks to a business-friendly regime at the helm. 4. The “Make in India” Program Modi unveiled in September the “Make in India” campaign to create jobs and boost manufacturing. The government has promised to remove entry barriers to business, and create a competitive tax environment to encourage manufacturing of low-cost products for both the foreign and domestic markets. 5. Central Bank Easing The Reserve Bank of India (RBI) surprised markets around the world this month by cutting its key interest rate by 0.25 percentage points to 7.75%. It marked the first rate reduction in almost two years, as the country experiences lower inflationary pressure thanks to lower food and oil prices. Lower interest rates will improve corporate balance sheets and encourage business expansion, especially in interest-rate sensitive industries such as banking and real estate. India’s economy will expand by 6.4% in 2015 after growing 5.6% last year, the International Monetary Fund forecasts.