Comparing Healthcare Price Range Forecasts Of Market-Makers

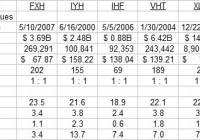

Summary Holdings of healthcare ETFs provide widely varied focuses on aspects of this broad ranging, important industry’s activities. ETFs and their separate holdings all can be directly compared as wealth-building investment candidates. Price-change prospects are seen in the hedging actions of market-makers at work. Qualitative criteria: Odds for investor profit, size of price change payoff, credibility of forecast, likely extreme price drawdown exposure, and anticipated holding period requirements. All have prior experience histories. Meaningful risk/reward comparisons and other personal-preference qualitative investing considerations provide the investor with an array of appropriate choices of securities positions. Contained here are specific price sell targets, holding period time limits, and prior price-risk exposure experiences. These guidelines encourage investor-set boundary disciplines for portfolio management. Healthcare is an important, wide-ranging industry ETFs with healthcare-provider holdings have very different emphases. Knowing what is involved, and the emphasis contained, is essential to addressing investment objectives of completeness and diversity. Just as the energy industry has a wide array of participants with differing principal activities, so too does the healthcare field have its important essential specialties and integrators in supportive-competitive relationships with one another. Parallels between the two distinctly different economic sectors are suggestive. Energy wildcatters of the Exploration & Production dimension have their functions in healthcare among the Biotechnology developers. Oilfield services providers have some healthcare similarities in the roles played by healthcare insurance companies. Medical equipment producers and developers have their counterparts in the energy scene. Transportation and delivery of energy products are paralleled by healthcare services organizations. Significant similarity of role exists between integrated international oil companies and major pharmaceutical organizations. We will not attempt precise categorization in an industry where we have limited experience or familiarity. The point is that the diversity of activities in each field comes together at the point of making investment choices. Those choices may, and in our opinion should, be more influenced by the investor’s objectives and perspective, than by a morass of minute distinctions between participants in their related fields. In every case what counts for the investor is whether or not the subject of an investment choice will be seen to be an effective competitor, for the period of the investment holding. Effective not only among the direct competing participants in the field of concern, but also among the full range of competitors for the use of the investor’s capital. Where investing “rubber meets the road”, capital meets commitment. Critically, with investments, perspective and opinion play a dominant role. Why this information is different from the usual It is intended to be a current update for active investors who have an awareness of what kinds of RATES of return they need to build wealth deliberately for specific purposes that tend to have inflexible need dates. For investors aware that normal price fluctuation in good-quality equity investments during the course of a year regularly provides capital appreciation opportunities which are multiples of the trend growths of those same securities. While not intended principally for long term, buy-and-hold investors salting away capital for an indeterminate general purpose sometime in the indefinite future, it may well be of help for those who have arrived at a decision time for portfolio strengthening in the healthcare area. All investors are, or should be, aware of the need to make comparisons between alternatives in their quest for objective satisfactions. Our intent is to urge a focus on the kind of universal investing dimensions that make comparisons valid across a wide range of subjects. The matter of price is a pervasive issue in any type of investment decision. Active investors need to know that the market professionals who assist portfolio managers of billion-dollar investment funds in adjusting their holdings have a special insight into the likely market actions that are making prices move. Moreover, because the pros must put firm capital at risk temporarily to do their job, they make price-hedging transactions in derivative markets to protect themselves. What they will pay for that insurance, and the way the deals are structured, tell just how far it appears likely that prices may move, both up and down. Analysis of their behavior is performed systematically, daily, on over 3,000 equity securities, stocks, ETFs, and market indexes. As it has been since Y2K. Careful record-keeping provides an actuarial history of how well the market-making community can anticipate price changes, issue by issue, in coming weeks and months. Here we apply that analysis and its perspective to six of the Exchange Traded Funds, ETFs, that hold securities of healthcare corporations. Subjects of the study The ETFs of interest here are Health Care Select Sector SPDR ETF (NYSEARCA: XLV ), Vanguard Health Care ETF (NYSEARCA: VHT ), First Trust Health Care AlphaDEX ETF (NYSEARCA: FXH ), iShares U.S. Healthcare ETF (NYSEARCA: IYH ), iShares U.S. Healthcare Providers ETF (NYSEARCA: IHF ), and Direxion Daily Healthcare Bull 3x ETF (NYSEARCA: CURE ). Considerable differences exist between these 6 ETFs. One has been around since 1998 while another barely has a 4-year history. Another is structured in its makeup and holdings to cause its prices to have changes 3 times as large as the industry index. One is very concentrated in its holdings with ten names making up nearly two-thirds of its value. Another’s top ten holdings make up less than a quarter of its worth. The biggest ETF has investor commitments of over $14 billion; the smallest, less than a half-billion. One trades 9 million shares a day, another only does 90,000. Figure 1 provides the fundamentals: Figure 1 Most sell at P/Es just above 20, and at near 4x book value, save for IHF and less so, FXH. XLV and CURE are actively traded, with their entire capitalizations able to be turned over in 4-5 weeks. VHT and FXH both have considerably less liquid situations. What do they each hold? In Figure 2, the ten largest holdings of each are identified, with considerable duplication in a few names. XLV, VHT, and IYH have the most similar portfolios. FXH and IHF have a far more diverse set of stocks. Figure 2 UnitedHealth (NYSE: UNH ) and Actavis (NYSE: ACT ) are each in 4 of the ETFs. The largest average size holding is Johnson & Johnson (NYSE: JNJ ) with 3 ETFs each committing over 9% of their assets. But 14 stocks are held by only one ETF, out of the 25 issues so identified. The 3x leveraged ETF holds an undesignated mix of derivative securities to accomplish its special price characteristic in relation to the Health Care Select Sector Index. Some of the ETFs focus on big, established healthcare names like big-pharma producers, others like FXH and IYF look to more recent industry innovators. Comparing holdings’ prospects The investment prospects for each ETF should reflect the prospects for its major holdings, but that is not always so. Figure 3 shows how market-makers currently appraise the upside prospects for each of the larger ETF holdings in relation to the actual worst-case price drawdowns following prior forecasts like today’s. Figure 3 (used with permission) This picture plots ETF locations by coordinates of upside price change return forecasts on the lower horizontal scale, and by worst-case downside price change experiences following earlier forecasts like those of the present. The attractive green area contains issues with 5 times or more upside than downside prospects. The diagonal dotted line is the point at which price risk is expected to be equal to return. Issues higher than the diagonal have more risk than return, lower have better price change returns than risk exposure. Several issues share common locations. Comparing ETF risks and rewards Figure 4 provides the same comparisons for the Healthcare ETFs themselves, along with a market index norm in the form of SPDR S&P 500 Trust ETF (NYSEARCA: SPY ): Figure 4 The extreme compression of risk/reward tradeoffs pictured in Figure 4 indicates a market belief that despite high prices (limiting further upward price moves) in the foreseeable near future, these ETFs are market-correction resistant. But they are also viewed as under-performers relative to the market average SPY ETF at location [7]. Even CURE, with a 3x price leverage is seen to have an upside prospect of less than +5%, along with a downside history of some -5%. These valuations for the ETFs are significantly less optimistic than those held for their most important holdings in Figure 3, where upside prospects are all above +5%. None of their downsides have been, at worst, greater than their upsides, and many nowhere near as bad. To see what is driving the ETF situation, look at Figure 5. Figure 5 (click to enlarge) Here are the current MM forecasts for the healthcare ETFs, and the market outcome histories subsequent to similar forecasts. The mystery of compressed return forecasts from persistent high prices is at least partly explained in Figure 5’s columns 8 through 11. Four of the six have NEVER had a loss in their past 5-year histories following Range Indexes like today’s, and the other two are either 8 or 9 wins out of ten. Column 10 provides the real answer for the winning four, with holding periods ranging from only 9 to 17 market days. Even with their miniscule, below +5% gains, the annual rates of profit have been for the big winners multiples of 2x to 11x that of the market average. The other two candidates exceeded SPY’s annual rate of return by 500 to 700 basis points. Conclusion In a market environment highly expectant of a price correction, but one where that concern has been present for months, something that can produce very attractive rates of return one short holding period after another has real appeal for active investors. Here, there is an array of near-term investment candidates with high promise of reward at appealing rates, and prior experiences of fairly trivial price drawdowns during the brief holding periods needed to reach sell targets. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.