A High-Yield Option For Income Investors

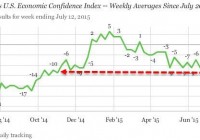

Investing in financial markets has become considerably more difficult since the summer. High yielding assets, as well as stocks have taken a beating. Market Vectors High-Yield Muni ETF, however, has seen a steady increase in principal, while providing an attractive dividend yield. As the Treasury yield curve has contracted, alongside falling equity markets, investors have been left with few avenues to invest. Higher yielding dividend stocks, generally yielding below 3%, have seen declines in principle due to the most recent equity market rout. Additionally, junk bonds have seen broad selling pressure as investors shunned riskier assets for fear of slowing economic activity. A lone star, however, has emerged in the form of the Market Vec tors High-Yield Municipal Index ETF (NYSEARCA: HYD ) . This asset has risen close to 4% since early July, while yielding a dividend of 4.81%. This combination of appreciation of principle, as well as stable dividend yield, could be a smart play for investors seeking income in coming months. With the Federal Reserve stuck to its zero-bound lending rate, income investors have had trouble finding sustainable income sources. The global economy continues to weaken, alongside the persistence of foreign central banks loosening monetary policy, causing the Fed to potentially have trouble hiking rates in the near future. The chart below is of the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) over the iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT ) . This indicator represents the Treasury yield curve. When the indicator declines, it signals a contraction of the yield curve, and thus lowered expectations of a rate hike for monetary policy. Since peaking in the summer of 2015, slowing economic growth, and global financial market volatility has spooked Fed members, forcing them to push out their projected time frame for hiking rates. Furthermore, with investors continuing to buy bonds, yields have fallen to levels providing very little income for investors. (click to enlarge) Moreover, financial market volatility has pushed both junk bonds, and broader equity markets lower. Investors feel that equity markets have topped globally, and the combination of falling currencies, and commodities signal that global growth concerns are finally resulting in increased caution. While dividend stocks may be outperforming the market on a relative basis, these companies are still losing value in 2015. As U.S. earnings season disappoints, investors are pushing all sectors lower. Additionally, weak equity market performance is weighing on junk bonds as risk sentiment diminishes. After my degradation of basically every asset class, there seems to be one lone performer that has provided true safe-haven status. High yielding municipal bonds have outperformed as investors favor the comfort of government backed securities, alongside an attractive yield. As municipalities have lowered their leverage in recent years, their perceived stability has risen. This index also does a nice job of spreading risk, allowing investors to get exposure to a basket of riskier municipal bonds, with lower overall default risk. The Market Vectors High-Yield Muni ETF has proven a strong investment amid the recent volatility in bonds, equities, and currencies. As long as the Fed prolongs raising rates, and financial markets remain volatile, this high yielding municipal ETF should provide steady gains. (click to enlarge)