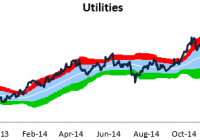

3 Utility ETFs Suffering From Rate Hike Worries

Banking on strong recovery in the U.S. economy, analysts are expecting a possible rate hike in September or October this year. Meanwhile, rate hike worries have been weighing on the major benchmarks. Recently released economic data including construction spending, auto sales and job number all came in on the strong side. These have elevated the rate hike possibility further. Strong Economic Recovery After having a dull first quarter, the economy rebounded strongly in the second as indicated by several economic data. The Fed also remained optimistic about a recovery in the second quarter based on strong labor and housing data. According to the U.S. Labor Department, the U.S. economy created a total of 280,000 jobs in May, witnessing the largest job addition since December 2014. Though the unemployment rate marginally rose to 5.5% in May, the rate is expected to decline gradually to Fed’s target this year. The average hourly wages also witnessed a strong year-on-year gain of 2.3%. Among other major economic data, the U.S. Department of Commerce reported that construction spending surged 2.2% in April, its fastest pace since May 2012. Also, most of the major housing data showed that the housing market recovered strongly in April. Meanwhile, U.S. light-vehicle sales gained 1.6% year over year to 1.63 million units last month, witnessing its best May ever in terms of light vehicle sales. Rate Hike Worries Strong economic data indicates that the economy is back on track in the second quarter, leaving behind the first-quarter contraction. This raises the possibility of a rise in interest rates, which have been near zero since the 2008 financial crisis. Before deciding on a rate hike, the Fed will closely watch the labor market situation and the inflation rate. However, the Fed remained “reasonably confident that inflation will move back to its 2% objective over the medium term”. The evolving macro environment points toward a possible rate hike in the not-too-distant future. Stock market investors are finding this prospect somewhat discouraging, which has been showing up in the market’s daily activity in recent sessions. Higher interest rates can make stocks less appealing and especially so in the dividend space. In this scenario, sectors including utilities that are expected to be affected by a rate hike have suffered heavily in recent times. 3 Utility ETFs Suffering The Utility sector is one of the most rate-sensitive sectors due to its high level of debt. Utilities are capital-intensive businesses and the funds generated from internal sources are not always sufficient for meeting their requirements. As a result, the companies have to approach the capital markets for raising funds. As a result, a rising rate environment may have a negative impact on this sector. Here, we highlight 3 utility ETFs that have suffered in recent times on rate hike worries. PowerShares DWA Utilities Momentum Portfolio (NYSEARCA: PUI ) This fund provides exposure across 40 securities by tracking the DWA Utilities Technical Leaders Index. Nearly 40% of total assets are allocated to the top 10 holdings. Sector-wise, multi-utilities take the top spot at 37.7%, while electric utilities and gas utilities take the next two positions. PUI has amassed $31.9 million in its asset base while it sees light volume of around 9,000 shares a day. The ETF has 0.60% in expense ratio and has declined 3.7% over the past one month. Guggenheim S&P 500 Equal Weight Utilities ETF (NYSEARCA: RYU ) This fund follows the S&P 500 Equal Weight Index Telecommunication Services & Utilities, holding 36 stocks in its portfolio. It is well diversified across its holdings with none of the companies accounting for more than 3.2% of the total assets. The ETF has been able to manage $128.3 million in its asset base and is moderately traded with more than 58,000 shares per day. It charges 40 bps in annual fees and expenses. The product has declined 3.2% in the trailing one-month period. iShares U.S. Utilities ETF (NYSEARCA: IDU ) This ETF provides exposure to 61 firms by tracking the Dow Jones U.S. Utilities Index. The fund has amassed $583.3 million in its asset base while it sees a moderate volume of around 417,000 shares a day. The product is largely concentrated in the top 10 firms that collectively make up for half of the basket. About 52% of its assets are allocated to electric utilities. The ETF charges a fee of 43 bps annually and has lost more than 2.9% in the past one month. Original Post