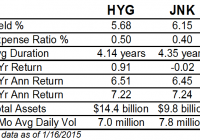

As 2014 has come to a close, investors have turned their attention to 2015 and looking for clues as to what the market and economy have in store for the new year. Below are divergences that unfolded in 2014 which raises the question of how they will be resolved this year. The resolution of these divergences will likely have implications on the performance of an investor portfolios this year. Oil Prices Knowing the stock market is not the economy and vice versa , determining factors contributing to the significant decline in oil prices is important. Certainly, increased supply is influencing the decline in crude prices. Equally though, as we have noted in several earlier articles, we believe lack of demand is also a contributing factor. The importance of the reduced demand leads strategists to raise the question of whether the global economy is entering a slowdown. To date, the U.S. seems to have shaken off the potentially negative impact of slowing economies outside its borders. Given the interconnectedness of the economic world today though, can the U.S. continue on its growth path while many other economies in the developed and emerging world struggle with growth? As the below chart indicates, historically, falling oil prices have been associated with slowing global GDP. Aubrey Basdeo, Managing Director at Blackrock, noted the potential negative impact of an extended run of low oil prices in an article late last year titled, Free Fallin’ . The article’s conclusion, Wherever the price ends up, it’s likely it’ll stay there for a while. We don’t see demand increasing, especially with China cooling off. In the short-term that could be good news for our economy – lower gas prices mean people have more money to spend – but it remains to be seen just how our country will be impacted by a sub-$60 oil price. The longer it stays low, though, the more difficult things could get. Highlighted in the Felder reference below was a comment by Howard Marks’ in a recent investor letter , “It’s historically unprecedented for the energy sector to witness this type of market downturn while the rest of the economy is operating normally. Like in 2002, we could see a scenario where the effects of this sector dislocation spread wider in a general ‘contagion.'” High Yield Bonds: Reduced Investor Risk Appetite The performance of high yield bonds has an above average positive correlation to the performance of equities. In short, as the economy grows, companies tend to experience better earnings growth. This improved earnings outlook generally leads to improved equity returns. Broadly, as companies generate better earnings growth, highly leveraged ones tend to experience an improved outlook as well. This in turn reduces the risk of default with highly leveraged companies. Consequently, high yield bond prices are bid up as investors are attracted to the higher yields provided by high yield debt in an environment where default risk seems lessened. A recent article by Jesse Felder of The Felder Report took an in depth look at the long term and short term price movements of high yield (NYSEARCA: HYG ) relative to a riskless 3-7 year Treasury ETF (NYSEARCA: IEI ) and the S&P 500 Index . As the first chart below shows, the high yield relative to treasury bond investment tracks closely with the S&P 500 Index. Felder notes in his article, Clearly, the chart above demonstrates that the strength in junk risk appetites led stocks off the lows back in 2009. Over the past summer, however, junk bonds started to lag stocks for the first time since the bull began (or lead lower, depending on your perspective). Since then the divergence has only gotten wider with each subsequent new high in the stock market [as seen in the below chart]: Large Caps Versus Small Caps And The Dollar The one asset allocation decision investors and advisers needed to get right in 2014 was to overweight U.S. equities, large caps more specifically, versus broad international. As can be seen in the two charts below, U.S. large cap stocks had a decisive performance edge versus developed international (NYSEARCA: EFA ), emerging markets (NYSEARCA: EEM ) and small cap equities (NYSEARCA: IWM ). With economies currently weaker outside the U.S. and interest rates lower in many European countries, foreign investors have allocated investment dollars to the U.S. This flow of funds into the U.S. has contributed to downward pressure on U.S. interest rates as well as continued upward pressure on the U.S. Dollar. The top chart above shows a longer view of the trade weighted US Dollar and its recent strength, although strong shorter term, the strength does not look exhausted when viewing the longer term chart. The implication of a stronger dollar has to do with the potential earnings headwind for large multinational companies. In a slow growing economy, the currency headwind can take a bite out of corporate profit growth. If this occurs, small and mid size companies are less exposed to exchange rates as business for these companies is mostly generated domestically. Lastly, the U.S. equity markets opened higher on the first trading day of the new year, but quickly turned lower near the time the ISM Manufacturing Index was reported. The manufacturing index was reported at 55.5 which was below consensus expectations of 57.5. This was the slowest rate of monthly growth in six months. Econoday noted, “growth in new orders slowed substantially, to 57.3 from November’s exceptionally strong 66.0, while backlog accumulation also slowed, to 52.5 from 55.0. Production slowed to 58.8 vs. 64.4….The abundant run of manufacturing reports point to year-end slowing in a sector which is oscillating going into the New Year.” The above highlights are just a few divergent factors that have developed recently. From a positive perspective, the equity markets have a tendency to climb the proverbial ” wall of worry .” We will cover more of our thoughts on these topics in our upcoming year end Investor Letter.