Spain Is The Next Greece – Avoid EWP

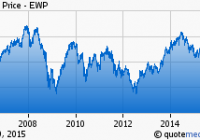

Summary A political push is underway in Spain that appears to me to have a lot in common with Syriza’s rise to power in Greece. Leftist politicians have won a majority of Spain’s municipal elections and taken control of key cities including Madrid and Barcelona, and they have their eyes on national control. If Spain is going to be the next Greece, then its future actions and direction are not likely to sit well with its Eurogroup partners. The investment community is likely to see this as “contagion,” and that does not bode well for the euro, European equities, and judging by the developments in Greece, Spanish equities. Thus, no matter what happens between Greece and its creditors, it would seem wise to avoid Spanish stocks and the iShares MSCI Spain Capped ETF. Some pundits believe that any sort of closure for the Greece issue is a plus for Europe, whether Greece stays in the eurozone or leaves it. But there is one European market sector that I do not see a positive outlook for either way. Spain looks to be the next Greece because of a political circumstance similar to what occurred in Greece before the current crisis heated up. Thus, I suggest investors sell the iShares MSCI Spain Capped ETF (NYSE: EWP ) and Spanish stocks generally. A succession of leftist political victories in Spain too closely resembles what happened in Greece before it raised issue with its creditors. I believe it will lead to division between Spain (perhaps emboldened now by Greece’s display of strength) and more progressive economies to the North. While Spain is not in the same situation as Greece, its political policies and direction moving forward are likely to trouble investors. Before Syriza, a decidedly left wing party, was elected into power in Greece, everything seemed to be improving, at least from our perspective over here. The economy was growing and the budget was operating at a surplus. Yes, there was still extremely high unemployment and unbearable taxation for a people suffering in strife, but from the perspective of those on the outside Greece was doing better. It was, in the end, the pain and suffering of the people that allowed the political candidate (Tsipras) calling for an end to austerity to overcome the reigning government’s plea for patience. Guess what’s happening in Spain today? The Leftists are Coming! This month, a wave of leftists (not my description) won victories in municipal elections across Spain. The political push in Spain sure resembles the same movement that took control of Greece and led Europe and relative investors into today’s turmoil. In the comment section of the article I linked to here, the first comment says something like, “This must be the Greek contagion they were all afraid of. This won’t end well.” I agree, but would add, this won’t end well for European stocks and debt and the euro, and especially Spanish equities. The newly elected municipal leaders in Spain easily overcame their predecessors with popular campaign pleas. For instance, one new mayor is working to put the victims of foreclosure (that’s how they see it) into homes foreclosed upon and held by banks. Back in Greece, Syriza won with promises to hire back laid-off public sector workers, reduce taxes and to restore old pension norms. But what the so-called leftists in Greece and Spain will have in common is an aversion to German inspired austere budgeting. So then the leftists in Spain are likely to cause a fuss, and I suspect they’ll stare their national intentions now that the Greeks are on the marquee. Opportunistic politicians with plans to take control of Spain this year should find opportunity now to organize gatherings in support of the Greek people. I would be surprised if it doesn’t happen. It will draw global investor attention to the contagion they all feared might spread across the PIIGS (Portugal, Italy, Greece, Spain – I’ll leave out Ireland) of the eurozone periphery. And when the leftists unseat the ruling power atop the Prime Ministry in Spain this year as I expect, we will all have to take note. 10-Year Chart of EWP at Seeking Alpha Just like it played out for Greece, none of this weighs well for Spanish stocks. It portends rather that this 10-year chart of the iShares MSCI Spain Capped ETF , which seems to show stocks going up and down before ending up at the same place, will continue to do so while sporting a new leg lower. Indeed, EWP was one of the poorest performers of the eurozone on Monday, as this secret seems to be leaking. EWP fell 5.2% on Monday, while the iShares Europe ETF (NYSE: IEV ) dropped just 3.4% and the iShares MSCI Germany ETF (NYSE: EWG ) fell 4.0%. The Global X FTSE Greece 20 ETF (NYSE: GREK ) fell 19.4%, since it was the star of the show. Take note that the German ETF was doing quite well this year, but EWP had a negative year-to-date performance record heading into the black day for Europe. Things just got worse for Spain. The political change overtaking Europe is a problem for the euro, but the Swiss National Bank (SNB) and the European Central Bank (ECB) have managed to manipulate the currency well enough to turn a 1.9% overnight loss into a sharp gain by Monday afternoon. The SNB flooded the market with Swiss francs (the safe haven for capital running from the euro at the time) to weaken the franc unnaturally against the euro and support stability (or illusion) in Europe. It’s going to get harder to hide this mess, though, when the Spaniards hit the streets in solidarity with Greece or when these new party candidates win national elections. I found a CNBC report interesting today, as I watched Sarah Eisen report that currency traders believe the euro has not yet given way because of no sign of Greek contagion. Well, I agree but I’m saying that is exactly what is about to change. So, friends, I would keep this in mind when venturing investments in European shares and especially when considering the iShares MSCI Spain Capped ETF, which I would avoid. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.