Futures Pits Shuttered But Trading Goes On

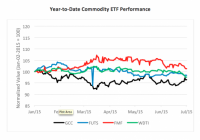

Why? To acknowledge the passing of a great tradition. This is “lights out” week for futures pit trading. As of Monday, all but the S&P 500 futures pit are to be shuttered by CME Group (commodity options pit trading will, however, survive). Futures aren’t going away, so worry not you holders of commodity ETFs; trading’s just going to be screen-based now. Well, truth be told, it’s been screen-based. Open-outcry trading has been dying for years as more and more business moved “upstairs.” At last look, pit trades represented only one percent of total futures volume. So, you can still buy futures-based funds and notes. That is, if you’re interested. There are 148 exchange-traded commodity products extant, ranging from broad-based long-only trackers to levered and inverse single-commodity items. Admittedly, long-only hasn’t been a very good play recently. Witness the GreenHaven Continuous Commodity Index ETF (NYSEARCA: GCC ), an index tracker representing 17 equally weighted commodities, which is off more than 3 ½ percent for the year. The beauty of futures, of course, is the ease of going short when appropriate. Margins are the same for sellers and buyers alike. Investors in managed futures ETFs have the potential to hold a diverse portfolio of short and long commodity positions. This year, managed futures ETFs have outperformed passive long-only trackers by varying degrees. Only one, though, has managed to churn out a positive return. The First Trust Morningstar Managed Futures Strategy ETF (NYSEARCA: FMF ) is up better than one percent in 2015 – not a great gain, mind you, but certainly better than its peers. Both the ProShares Managed Futures Strategy ETF (FUTS ) and the WisdomTree Managed Futures Strategy ETF (NYSEARCA: WDTI ) are currently under water. So what sets FMF apart? A hefty dollop of S&P 500 Index contracts for one thing. Both FUTS and WDTI eschew equity futures. Knowing this, potential users need to consider the utility of adding additional equity exposure to their portfolios, at least as long as FMF holds on to its S&P allocation. Oh, there’s one other thing to consider. Now that the pits are dark, where’s CNBC’s Rick Santelli cheering section going to be stationed? Brad Zigler is REP./WealthManagement’s Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.