Get Out Of Swiss Stocks Now: Barclays

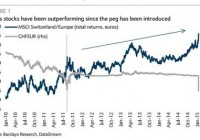

By Michael Ide Swiss stocks took a beating yesterday (and are falling again today) after the Swiss National Bank ’s decision to end the 1.20 cap on the EUR/CHF exchange rate. But if you are a non-CHF investor the exchange rate shift more than made up for falling stock prices, pushing the Swiss Index up in USD even as it fell in CHF. Barclays PLC analysts Dennis Jose and Ian Scott think this is the perfect opportunity for those non-CHF investors to get out (although many would have argued that before the big drop would have been a better time). “The sudden appreciation of the Swiss franc has provided a windfall to non-Swiss denominated investors despite the decline in the stock market in domestic currency terms,” they write. “We advocate switching out of Swiss stocks into Euro Area stocks now… if as per our FX view, the CHF weakens hereon, the benefit to non-CHF returns should no longer be there.” Non-CHF investors should take advantage of temporary exchange rate effects: Barclays The obvious reason to take yesterday’s gains and get out of the Swiss market is that Swiss companies are expected to face earnings pressure now that their currency has gotten stronger. The SNB has said that the strength of the Swiss franc is still a concern, part of the reason Jose and Scott expect it to depreciate by other means, but it probably won’t return to the 1.20 EUR/CHF exchange rate naturally any time soon. Non-Swiss investors who stay invested risk watching the beneficial exchange rate effects wear off while stock prices continue to struggle and dividends probably get reduced. (click to enlarge) European QE could undermine the Swiss stock market The other reason to worry about Swiss stocks is the effect that European QE would have on Switzerland. Swiss stock market gains have been inversely correlated with German Bund yields for more than a decade. If that relationship continues, then when ECB QE pushes yields higher it would also pull Swiss stock prices down. We won’t know officially whether the ECB is going to start buying sovereign bonds until January 22, but all signs point to yes – the SNB decision being the most recent signal. Investors who wait until the end of the month to make their decision by may not be able to exit quite as easily. Jose and Scott removed Credit Suisse Group AG (ADR) (NYSE: CS ) and Adecco ( OTCPK:AHEXY ) from their recommended European portfolio and replaced them with Airbus ( OTCPK:EADSY ) and Publicis ( OTCQX:PUBGY ). (click to enlarge) Disclosure: None Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague