ETFs To Play The Market During More Volatile Conditions

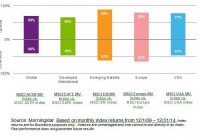

The markets are experiencing greater volatility. More conservative investors may take a look at low-volatility ETF related strategies. Low-vol ETF strategies for domestic and international markets. With the sudden bout of volatility shaking up the markets from its listless first half, more conservative investors may consider exchange traded funds that track a low-volatility strategy. Market watchers argue that investors should get used to stock volatility as it is here to stay for some time, reports Michelle Fox for CNBC . Fueling the risk, the escalation in the Greek debt crisis and a major sell-off in Chinese markets sent global markets reeling. “People are not taking a lot of risk right now. There are too many cross-currents right now to really take a big position out there,” Brian Kelly, founder of Brian Kelly Capital, said on CNBC. “Yes, potentially we get some kind of deal in Greece but then it’s unclear exactly what the damage has been done in China.” Consequently, retail investors have been hesitant on joining the market as market swings remain a major concern. Nevertheless, there are a number of low-volatility ETFs available that track more steady segments of the markets. For instance, over the past month, the PowerShares S&P 500 Low Volatility Portfolio ETF (NYSEARCA: SPLV ) , which tracks the 100 least volatile stocks on the S&P 500, rose 1.3% and the iShares MSCI USA Minimum Volatility ETF (NYSEARCA: USMV ) , which selects stocks based on variances and correlations, along with other risk factors, rose 0.9%. In contrast, the S&P 500 has declined 1.2% over the past month. “Low-volatility stocks have historically offered higher risk-adjusted returns than their more-volatile counterparts, suggesting that the market has not offered adequate compensation for incremental risk,” according to Morningstar analyst Michael Rawson. ETF investors can also take the low volatility theme to overseas markets. The low-volatility ETFs have helped soften the blow from the global sell-off. For example, the PowerShares S&P International Developed Low Volatility Portfolio ETF (NYSEARCA: IDLV ) and the iShares MSCI EAFE Minimum Volatility ETF (NYSEARCA: EFAV ) provide a low-volatile option for developed overseas markets. Over the past month, IDLV dipped 2.8% and EFAV fell 1.4% while the iShares MSCI EAFE ETF (NYSEARCA: EFA ) declined 2.9%. Additionally, investors can target emerging market exposure through the iShares MSCI Emerging Markets Minimum Volatility ETF (NYSEARCA: EEMV ) and the PowerShares S&P Emerging Markets Low Volatility Portfolio ETF (NYSEARCA: EELV ) . Over the past month, EELV was down 3.4% and EELV was 3.1% lower while the iShares MSCI Emerging Markets ETF (NYSEARCA: EEM ) retreated 5.2%. Max Chen contributed to this article . Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.