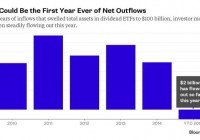

Summary Father’s Day is on June 21; here are 5 ways for kids to afford a present. Some are small (starting at $10) and some are large (> $100,000). 3 examples of high yield equity opportunities for the family bank. Father’s Day has a -EV Father’s Day is unavoidably coming up later this month. The utility leakage from gift giving is usually measured at around 50%. Thus holidays such as Father’s Day are the inverse of value investing: turning $1.00 of cash into about $0.50 of value has a terribly negative expected value/-EV. With a houseful of young kids, my pain is especially acute. I am, one way or the other, coughing up the $1.00. As far as the likely gifts, the most common ones are “paper weight” defined herein as anything with mass enough to hold down paper, typically covered in glitter. Glitter Paperweights Do I want a glitter paperweight? One piece of solid evidence would be if I had ever attempted to purchase one on my own. I have not. However, for the sake of research, I found that I could have easily bought one for myself on Amazon (NASDAQ: AMZN ). The fact that I have not and have not ever seriously considering doing so has failed to discourage my kids’ production and gifting of glittery paperweights. Saving and Investing Ideas for Kids So, if I am going to try and improve future Father’s Days, how can I encourage adequate funding and taste? This project benefits from the phenomenon that it is easy to improve in percentage when one starts from an extremely low base on both metrics. 1.) $10/year/kid from Toronto-Dominion Bank (NYSE: TD ) TD offers a summer reading program in which kids can earn $10 each for reading 10 books. You can get the form here . In addition, our TD branch has a coin deposit machine. As it accepts only US$, the rejects slot typically contains a few dollars’ worth of Canadian and other foreign coins for the kids to collect. 2.) $40/year/kid from Airbanking Kids can each earn $40/year in interest in a junior airsavings account . These accounts offer an annual percentage yield/ABY of 4% for accounts up to $1,000 owned by depositors under eighteen years old. 3.) $50/year/kid from DFCU Financial Deposits age 0-17 get $50 in cash per $100 account. If you have an account at DFCU or if you can open one (either via a family relationship or living in their region of Michigan), it might be worth getting your kids set up with accounts too. 4.) $272/year/kid from Fidelity The best credit card deal available is the Fidelity Investment Rewards American Express (NYSE: AXP ) Card. There is no age limit. You can co-sign the agreement, get cards in your kids’ names and start building their credit history. The average American kid’s expenses are $13,611 per year. With the 2% cash back on this card, that comes to a rebate of $272 each year. Once the kids are legitimately earning income from chores, they can start funding their IRAs. 5.) $109,565/year/kid from family bank According to the IRS, the long-term adjusted Applicable Federal Rate/ AFR is currently 2.3%. In order to qualify as a loan, parents need to charge that amount of interest to each kid. However, parents can also gift the interest rate payment up to $28k . So, one can loan up to $1,217,391 from each couple to each of their kids per year without it costing them any net interest. If they can compound at 9% per year, that will come to just under $110k per year per kid. 9% Average Yield Investments Where can you find ideas that compound at an average of 9%? Here are three examples of high yielding equity opportunities that average at a 9% annual yield: 6% Yield From Intel’s Deal With Altera INTC reached a deal with ALTR. This deal was due to a concerted shareholder effort. INTC wanted the deal and ALTR holders did, too. After this effort from the owners, there is still an opportunity. 11% Yield: Integrys, A Safe UTE With A Catalyst Integrys is a safe utility investment. It is currently being bought by WEC. TEG holders get > 11% annualized between now and closing. 10% Yield From IGATE IGATE is getting bought by Capgemini. You can capture a 10% yield. IGTE shares trade about $0.50 beneath the deal price. It will probably close in a month. Maintain control over cash flow After year one, parents can toggle on our off the gift of the interest rate payments as per their choice. Without the gift, the interest payments come to $84,000 per year for a family with three kids, which is in excess of the $75,000 annual income that Nobel laureate Danny Kahneman’s study indicates is the maximum annual income at which money is positively correlated to happiness. Do You Trust Your Wife? This is an important question in terms of maximizing expected value across a family. If you have no one whom you can trust, then the idea of investing in order to achieve some specific payoff structure makes sense. Instead, if you want to maximize expected value across a family, you can use the family bank to move the more equity-like investments down generationally and the more credit-like investments up generationally. This liberates investors from reliance on high nominal yield. In the case of dividends, they are increasingly expensive. I have long advocated certain dividend investments such as the WisdomTree Total Dividend ETF (NYSEARCA: DTD ). Since writing up DTD on Seeking Alpha as a long idea, it has returned over 75%. However, that leaves its prospective dividend rate at a relatively paltry 2.12%. With the family bank you will get a higher 2.3% yield while your children are able to benefit from higher returning equity opportunities. Long-term Goal While I want to have everything organized as efficiently and rationally as possible, my long-term goal is to create independent adults. I have a reminder on my Microsoft (NASDAQ: MSFT ) Outlook calendar to have the locksmith come to change the locks when the youngest kid turns eighteen. After that, I expect them to succeed under their own power. I hope that they will be independent of me. At the same time, I have no plans to be independent of them. I plan to borrow any and all toys that they acquire and I do not intend to reimburse them for the fuel. Finally, if they are reading this, it is time for me to come out with the truth: I do not need any more paper weights and I do not like glitter. Those are my thoughts on financing. As far as tastes, I don’t really have great taste. Fortunately, I know someone who does. So, if they want, they can read more about that on my Father’s Day Wish List . Disclosure: I am/we are long DTD. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law.