Dividend Oriented Retirement Portfolio Using Only 9 Commission Free ETFs

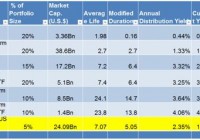

Asset allocation is set to generate approximately 3.0% yield. Dual momentum option is designed to enhance return while reducing risk. Three portfolio management styles are: Passive, Dual Momentum, and Tranche. A Tranche Model will reduce “luck” of rebalancing. Dividend yield closely matches that provided by a portfolio of Dividend Aristocrats. Retirement goals drive investors to save and invest. The following three models use eight ETFs for investing and one ETF, the iShares 1-3 Year Treasury Bond ETF ( SHY), as a cutoff or “circuit breaker” security. When set up using the following asset allocations, the portfolio will generate approximately 3.0% annually or not far off a portfolio built around Dividend Aristocrats. The nine ETFs are as follows. Vanguard Total Stock Market ETF ( VTI) Vanguard FTSE Developed Markets ETF ( VEA) Vanguard FTSE Emerging Markets ETF ( VWO) Vanguard REIT Index ETF ( VNQ) SPDR Dow Jones International Real Estate ETF ( RWX) PowerShares Emerging Markets Sovereign Debt Portfolio ETF ( PCY) iShares 20+ Year Treasury Bond ETF ( TLT) Vanguard Intermediate-Term Bond ETF ( BIV) iShares 1-3 Year Treasury Bond ETF (( SHY)) Passive Portfolio Model: The next major decision focuses on what percentage to invest in each ETF if one is constructing a portfolio to be passively managed. The percentage allocations follow the ” Swensen Six ” recommendations with a few modifications. RWX and PCY are new additions and BIV replaces TIP. SHY is the ninth ETF and is used strictly as a cutoff ETF in the momentum and tranche models – to be described below. VTI = 30% with a 1.96% yield VEA = 10% with a 3.07% yield VWO = 10% with a 3.1% yield VNQ = 15% with a 4.11% yield RWX = 5% with a 3.2% yield PCY = 10% with a 5.07% yield TLT = 10% with a 2.66% yield BIV = 10% with a 2.7% yield Using the above asset allocations, all one needs to do is keep the various asset classes in balance or close to the suggested targets. All ETFs pay a nice dividend, an advantage for retirees, while providing an equity emphasis for future return. The portfolio also meets the diversification requirement as there are hundreds of stocks and bonds spread out all over the globe. Dual Momentum Model: The dual momentum model is slightly more complicated compared to the passive model in that it requires a bit more time to manage. The basic concepts behind this model can be found in Antonacci’s Dual Momentum book or a condensed version in this Seeking Alpha article . The major advantage of this investing model is keep one out of deep bear markets as we experienced in the early part of this century and again in 2008 and early 2009. Using the same eight commission free ETFs, three metrics are used to rank the securities and compare performance with SHY. 1. Return of Capital (ROC1 and ROC2) are assigned weights of 50% and 30%. 2. Look-back periods are 91 and 182 calendar days. 3. A 20% weight is assigned to volatility where a mean-variance calculation is used and low volatility is rewarded. When a portfolio is reviewed, the securities are ranked as shown below. The recommendation is to only invest in the top two ranked ETFs, and then only if they are outperforming SHY. Based on current data (10/2/2015) only BIV and TLT meet this standard so 50% of the portfolio is invested in BIV and 50% in TLT. If there is a tie, then the investments are split evenly three ways. (click to enlarge) Tranche Model: The Tranche Model may be new to many investors and therefore requires a little explanation. The logic behind this model is to mitigate the “luck-of-review-day” problem. I review portfolios every 33 days so the reviews come at different times of the month. This also avoids wash sale issues and short-term trading fees that are accessed by brokers offering commission free ETFs. When a specific review days is selected, the dual momentum recommendations can vary from day to day. We might be lucky and find recommended buys on a day when the market down, or we could be unlucky and end up with a pair of ETFs that were not ranked so high on trading days on either side of the review day. What the Tranche Model (TM) does is permit the user to select multiple portfolios using different days of separation. The TM answers the question, what was the dual momentum recommendation two days ago, or four days ago? While the Tranche Model reduces risk, it also tends to reduce return. In the following screen-shot the number of Offset Portfolios is set to eight (8). The software permits as many as 12 portfolio options. The period (trading days) between offsets is set to 2. Otherwise, the settings are similar to the above dual momentum screen-shot. Recommendations from the Tranche Model, if rounding to the nearest 50 shares, are as follows. For a $100,000 portfolio, buy 200 shares of SHY or leave in cash. Purchase 400 shares of PCY, 250 shares of TLT, and 450 shares of BIV. Once the portfolio is positioned based on these recommendations, do nothing until the next portfolio review. (click to enlarge) The passive portfolio is the easiest to manage and there are tax advantages as shares are held for long periods of time. The dual momentum and tranche models require more attention, but will prevent major losses when major bear markets strike.