Top 10 Mutual Fund Performers Of 1H 2015

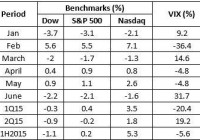

The first half performance of mutual funds cannot be termed as very strong. Only four of the mutual fund categories analyzed posted above a 10% gain in the first half. The broader market performance also compares unfavorably with the same periods in 2014 and 2013. Amid high volatility, the Dow failed to end in the green in 1H 2015, while the S&P 500 managed to gain just 0.2%. The Dow was the only benchmark in the first quarter to end in the red, but S&P 500 joined the blue-chip index in negative territory in the second quarter. The S&P 500 thus ended its nine-quarter winning trend, but the Nasdaq managed to extend its winning streak to 10 quarters and hit an all-time high. What Happened in First Half of 2015? The year started with concerns related to lower global growth projections, a slump in oil prices, strengthening of the dollar and apprehensions about the timing of the Fed interest rate hike. Amid this, the GDP data had been of little help. Beginning with the harsh winter and dismal releases, economic data has been mixed. Meanwhile, an increase in bond yields remained a cause for concern through May. By the first week of May, the yield on the benchmark U.S. 10-year note touched its highest level for 2015. However, recently, the retail and housing sector data have shown strength. The Fed officials meanwhile signaled a hike in interest rates, though at a slower-than-expected pace. The major headwind for the market is the drama in Greece. Greek debt negotiations have guided markets right from the beginning of 2015. On the last day of 1H 2015, Greece defaulted on IMF repayments despite submitting a fresh two-year aid proposal to its creditors. Synopsis of Benchmark & Fund Category Performance Below we present the performance of the key benchmarks, i.e., the Dow Jones Industrial Average, Standard & Poor’s 500, Nasdaq Composite Index, and the fear-gauge CBOE Volatility Index (VIX). Synopsis of YTD Fund Category Performance as evident from the chart, volatility has been very pronounced. Losses in January was followed by gains in Feb, and then ended in the red again in March. Though markets managed small gains in April and May, they were back to the negative zone in June. Focusing on June, the losses for the Dow and S&P 500 were the largest since January. Also, all three benchmarks ended in the red in June, repeating the event last seen in March. Except February, benchmarks have failed to post solid gains. In fact, it was February’s robust gains that had helped offset the losses in the first quarter and reduced the loss margin for 1H 2015. Except for the Nasdaq, we do not have a benchmark performance to be proud of. Below we present the top 15 fund categories for the first half of 2015: Source: Morningstar The performance chart clearly reveals the domination of the non-US fund categories. Apart from the Healthcare funds, there are no US categories in the top 5. Small growth fund category manages to snatch a place in the top 10 with gains of about 7.9%. It was fairly natural for the Japan Stock fund category to clinch the top spot given that Nikkei has hit an 18-year high. China too had soared this year, before hitting a rough patch recently. Key Events Coming to the key events now, earnings, data on GDP, nonfarm payroll, retail, and housing were the primary factors on the domestic front. Along with this, guessing the timing of the first rate hike has also swung markets. For international events, it has been predominantly the Greek drama with some inputs from China and Japan. Earnings Affected by Strong Dollar The US dollar achieved a 12-year high and had a meteoric rise against the euro early this year. However, the stronger dollar sparked concerns about the multinationals’ earnings numbers, as a stronger dollar will impact exports. This was proved true, or at least the ‘dollar scapegoating’ was a theme in the reading of the first quarter results. The large-cap S&P 500 companies earn about 40% of their revenues from outside the US. Total first quarter earnings for the 498 S&P 500 members were up 2.4% on lower revenues of 3.3%. Only 62% could beat EPS estimates and only 42.4% outperformed revenue expectations. GDP Advance estimates in January revealed that fourth quarter GDP increased at an annual rate of 2.6%, less than the consensus estimate of an increase by 3.6%. Eventually, the third estimate showed GDP increased at an annual rate of 2.2%, less than the consensus estimate of an increase by 2.4%. The advance estimate for the first quarter was again dismal. GDP was forecasted to have improved by 0.2%, less than the consensus estimate of an increase by 1%. The second estimate showed contraction as GDP was estimated to have shrunk 0.7%. However, this was narrower than the consensus estimate of a 0.8% decline. As for the latest data, the first quarter GDP reading showed that the economy contracted in the first quarter at a slower pace than previously estimated. According to the “third estimate,” GDP contracted at an annual rate of 0.2% in the first quarter. Employment Data Nonfarm payroll data has been mostly encouraging. The U.S. economy created 257,000 new jobs in January, the 11th consecutive month in which the economy generated more than 200,000 jobs, its longest such stretch since 1994. The unemployment rate went down to a six and a half year low of 5.5% in February. However in March, 126,000 jobs were added, less than the consensus estimate of 247,000. Also, job additions fell below 200,000, bringing an end to the unbroken run of 12 such successive monthly gains. March’s figure was later revised down to 85,000. In May, the US economy recorded the largest job additions since Dec. 2014. A total of 280,000 jobs were created in May. Fed’s Rate Hike A continuous market mover is the guessing game of the first rate hike. The nature of mixed economic data had somewhat restricted the Fed from giving a clear indication on the timing of the first rate hike. Also, there has been contradictory views, adding to volatility and shift in investor sentiment. Minutes from the FOMC’s April 28-29 meeting had stated that officials opined a rate hike in June was “unlikely” as they remained concerned about weak economic growth in the first quarter. However, now, the Federal Reserve signaled it will hike interest rates at a slower-than-expected pace. Fed officials said that the improving U.S. economy is strong enough to withstand one or two rate hikes this year. However, officials kept short-term interest rates unchanged in the FOMC policy meeting. Fed members haven’t yet decided when to raise rates this year as the decision will depend on how the economy evolves. Greece Crisis This has been the biggest international event driving the markets this year. Negotiations between Greece and its creditors have continued through the year, but on the final day of the first half of 2015, the country defaulted on its debt repayment. Looking back, Greece’s finance minister Yanis Varoufakis in January had rejected the country’s extended bailout program. February had begun on a tense note after the ECB cancelled its acceptance of junk-rated Greek government debts as security for regular central bank loans. Later in the month, Germany dismissed Greece’s plea for bridge funding until the end of May. Ultimately, Greece’s finance minister, Yanis Varoufakis and other Eurozone’s officials struck a deal regarding Greece’s bailout program. The Grexit concerns intensified again in May and continued to impact. Lingering uncertainty over striking a deal between Greece and its creditors dampened sentiment during the first week of June. Gains for stocks were limited during the second week due to the IMF halting negotiations with Greece. Eurozone finance ministers failed to strike a deal with Greece over the country’s bailout program during the third week as well. Uncertainty over Greece’s bailout program led to daily deposit outflow of around one billion euros, which eventually led to the ECB approving an emergency loan to Greece’s banking system. Breakdown in cash-for-reform talks between Greece and its lenders over the last weekend left the country teetering on the brink. Finally now, Greece defaulted on IMF repayments despite submitting fresh two-year aid proposal to its creditors. The latest update is that Greece is appealing to eurozone partners to ‘keep it afloat.’ Top 10 Mutual Fund Performers in 1H 2015 Below, we present the year-to-date best-performing mutual funds. However, we only have considered those funds that have a minimum initial investment within $5000 and net assets over $50 million. Six of these 10 mutual funds carry a favorable Zacks Mutual Fund Rank. While Fidelity China Region Fund (MUTF: FHKCX ) and VALIC Co I Health Sciences Fund (MUTF: VCHSX ) hold a Zacks Mutual Fund Rank #1 (Strong Buy), funds including Matthews China Dividend Fund (MUTF: MCDFX ), Fidelity Select Biotechnology (MUTF: FBIOX ) and T. Rowe Price Health Sciences (MUTF: PRHSX ) hold a Zacks Mutual Fund Rank #2 (Buy). However, Rydex Biotechnology A (MUTF: RYBOX ), Oberweis China Opportunities (MUTF: OBCHX ) and Invesco China A (MUTF: AACFX ) carry a Zacks Mutual Fund Rank #4 (Sell). Separately, Fidelity Adv Biotechnology A (MUTF: FBTAX ) holds a Zacks Mutual Fund Rank #5 (Strong Sell). Meanwhile, with net assets below $50 million, Buy-ranked Rydex Japan 2x Strategy A (MUTF: RYJSX ) has gained 27.7%. This would have thus ranked second in the top-15 list. Going Forward Greece will continue to affect mood and everyone want a positive progress. The rate hike too is most likely to come in the second half and this will guide markets. GDP will most likely turn out to be positive hereafter and the labor data has already shown strength. Retail will further add strength in the concluding months when holiday season heats up. Housing market has already shown signs of a rebound, and except for a temporary glitch, they may not trend south. Therefore, let’s hope for a profitable second half now. Original Post