Value And Momentum Are Highly Correlated

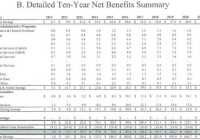

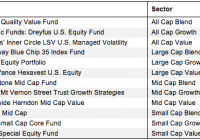

One of the most popular research papers on momentum is ” Value and Momentum Everywhere ” by Asness, Moskowitz, and Pedersen. In June 2013, this was published in the prestigious Journal of Finance . I have an earlier blog post which discussed that paper. However, one important item slipped by me then. It was a statement by the authors that value and momentum strategies are negatively correlated. They cited a negative monthly correlation coefficient between value and momentum of -0.24. Asness and his crew have brought up this negative correlation in subsequent writings regarding the merits of momentum and value investing.[1] Other writers and speakers have also been expounding this idea of negative correlation between value and momentum strategies. Long/Short Versus Long Only However, some of us, including myself, did not carefully consider the fact that the Asness et al. study dealt only with long/short momentum and value. This is where you are long high book-to-value and high momentum stocks, while simultaneously short low book-to-value and low momentum stocks. As we will see, the correlations between long/short value and momentum are substantially different than the correlations between long-only value and momentum. The vast majority of the investing world uses long-only rather than long/short portfolios. This applies to both value and momentum strategies. In looking at dozens of mutual and exchange traded funds, I am not aware of any value/growth oriented funds (other than those from AQR using muti-assets or multi-factors) that use a balanced long/short approach. With momentum, I know of only a single public fund [the QuantShares U.S. Market Neutral Momentum ETF (NYSEARCA: MOM ) ] that uses a long/short approach, and it is tiny with only $1.23 million in assets. Therefore, correlations between value and momentum using long/short portfolios are largely irrelevant and may be misleading to most investors. We will show the correlations between U.S. value and momentum stocks using long-only portfolios from the Kenneth French Data Library . We will use the value weighted top one- third of book-to-market value stocks and the top one-third of momentum stocks measured over their prior 2-12 month’s performance during the past 87 years. We will use stocks above the median NYSE in market capitalization. These are the ones that are most commonly traded. By using only large and mid-cap stocks, we avoid the problems associated with micro-cap liquidity. Besides looking at separate value and momentum portfolios, we will also examine a portfolio allocated 50/50 to value and momentum with monthly rebalancing. Our benchmark will be all stocks above the median NYSE market capitalization. No transaction costs or other expenses are deducted. Correlations Here are the monthly correlations from February 1927 to June 2015: MOM VALUE 50/50 MKT MOM 1.00 0.81 0.94 0.90 VALUE 1.00 0.96 0.92 50/50 1.00 0.96 MKT 1.00 The correlations of value and momentum to the market index are 0.92 and 0.90, respectively. As expected, these correlations are very high. What may not be expected is that the correlation between long-only value and long-only momentum is also very high at 0.81. This is dramatically different from the Asness et al. -0.24 monthly correlation between idiosyncratic long/short momentum and value. This difference has important implications for what long-only investors might expect if they invest in both value and momentum. Performance Statistics The return of any blended portfolio is a weighted average of the component returns regardless of the correlations. However, the risk exposure of a blended portfolio can differ greatly based on the correlations between the components. If those components have low or negative correlation, then there should be a substantial reduction in portfolio volatility. However, if the component correlations are strongly positive, as they are here with long-only value and momentum, then there may be little reduction in risk by combining them. We see this is the case looking at results from February 1927 to June 2015: MOM VALUE 50/50 MKT ANN RTN 15.70 15.23 15.46 11.73 STD DEV 19.21 24.75 20.95 20.44 SHARPE 0.59 0.44 0.53 0.38 MAX DD -77.4 -89.0 -83.9 -88.0 Results are hypothetical, are NOT an indicator of future results, and do NOT represent returns that any investor actually attained. Please see our Disclaimer page for more information. The momentum portfolio has the highest return and the highest Sharpe ratio. However, a momentum portfolio of individual stocks also has very high turnover and associated high transaction costs that are not accounted for in the data. See Novy-Marx and Velikov (2014) for an up-to-date analysis of these costs and a review of earlier cost studies. High transaction costs is one reason why I prefer to use momentum with indices and sectors. These work very well with momentum while having substantially lower transaction costs. Value shows almost the same return as momentum and also a higher Sharpe ratio than the large/mid-cap market benchmark.We should understand that if value and momentum had a low or negative correlation, then the standard deviation of a 50/50 mix of value with momentum would likely show a lower volatility than either value or momentum individually. That is not the case here. The standard deviation of the blended portfolio is higher than the standard deviation of the momentum portfolio. It is, in fact, almost identical to the volatility of the market portfolio. Drawdown The same is true with respect to maximum drawdown. The market and value portfolios show around the same maximum drawdown of -88 to -89%. This is based on month-end values. Intra-month drawdowns would be higher. I cannot imagine any investor who would be comfortable losing more than 90% of the value of their portfolio. The maximum drawdown of the momentum portfolio is a little better at -77.4%, but the maximum drawdown of the value/momentum blended portfolio is back up to -83.9%. So should there be value and momentum everywhere? We didn’t think so before, and we don’t think so now, at least not for long-only investors. Momentum without value shows the highest return, highest Sharpe ratio, lowest volatility, and lowest maximum drawdown. But its -77.4% maximum drawdown is still uncomfortably high, and high transaction costs may substantially reduce momentum returns from individual stocks. Summary The way to reduce large downside exposure as well as boost expected returns in the long-run is by using dual momentum as explained in my book and throughout this blog. The absolute momentum component of dual momentum boosts the Sharpe ratios of all the above portfolios and cuts their maximum drawdowns almost in half. Perhaps what we can say is, “Dual Momentum Everywhere!” [1] See reports by the AQR posse, ” Fact, Fiction, and Momentum Investing ” and ” Investing with Style “.