Taking A Look At Kevin O’Leary’s New ETF

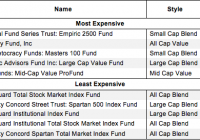

Kevin O’Leary is venturing into the ETF world with his new fund-OUSA. The ETF tracks a new multi-factor index by FTSE Russell which focuses on bigger companies with good dividends and low volatility. With an expense ratio of .48, this ETF is a decent choice but it will be hard to compete with Vanguard’s lower cost funds. Kevin O’Leary has just introduced his first ETF through O’Shares, after running a family of mutual funds for several years. The O’Shares FTSE U.S. Quality Dividend ETF (NYSEARCA: OUSA ). The focus of this particular fund is on dividend paying stocks with low volatility. The target index that this ETF tracks the performance of is the FTSE U.S. Qual/Vol/Yield Factor 5% Capped Index, and this index was just released by FTSE Russell. The design of this multi-factor index is to include quality large-cap and mid-cap U.S. companies that have high dividends and lower volatility. Also, the index is designed to keep a cap of 5% on any one company, which will keep it from being too concentrated. Ron Bundy, who is the CEO Benchmarks North America, FTSE Russell, explains : We are seeing growing demand in the investment community for more sophisticated indexes that can tap into market exposures efficiently and, in many cases, combine multiple factors. We are excited to introduce factor indexes that help clients like O’Shares target the specific exposures they seek. Here is what Kevin O’Leary has to say on this index: We believe now is the time to provide our time tested investment principles through a simple, transparent, efficient and cost effective index-based investment product. So we are launching our new family of global index-based ETFs for investors and joining forces with leading global index provider FTSE Russell. This is not the only new fund though, as O’Leary will be rolling out four more ETFs within the next 90 days: O’Shares FTSE Europe Quality Dividend ETF O’Shares FTSE Europe Quality Dividend Hedged ETF O’Shares FTSE Asia Pacific Quality Dividend ETF O’Shares FTSE Asia Pacific Quality Dividend Hedged ETF Here are more details of OUSA. The holdings are diversified into 10 different sectors. (click to enlarge) These are the top 10 holdings in the fund: Johnson & Johnson (NYSE: JNJ ) Exxon Mobile Corp. (NYSE: XOM ) Apple Inc. (NASDAQ: AAPL ) AT&T (NYSE: T ) Microsoft Corp. (NASDAQ: MSFT ) Verizon Comm. (NYSE: VZ ) Pfizer (NYSE: PFE ) Proctor & Gamble (NYSE: PG ) Phillip Morris Intl. (NYSE: PM ) Chevron (NYSE: CVX ) Here is a look at how OUSA stacks up against other dividend ETFs in regards to yield and expenses. ETF Ticker Symbol 12-Mo Yield Expense Ratio OUSA 3.2%* 0.48% Vanguard High Dividend Yield ETF ( VYM) 3.05% 0.10% iShares Select Dividend ETF (NYSEARCA: DVY ) 3.26% 0.39% Vanguard Dividend Appreciation ETF (NYSEARCA: VIG ) 2.23% 0.10% iShares MSCI USA Quality Factor ETF ( QUAL) 1.50% 0.15% Global X Super Dividend U.S. ETF (NYSEARCA: DIV ) 6.03% 0.45% WisdomTree U.S. Dividend Growth ETF ( DGRW) 2.01% 0.28% WisdomTree LargeCap Dividend ETF ( DLN) 2.59% 0.28% *Average yield of holdings While choosing to go with an ETF instead of mutual funds is definitely more in line with what investors are wanting these days, the expense ratio is still a bit high for my liking and it just shows what a competitive advantage that Vanguard has with it’s low fees. With that said, this ETF is a decent choice for what it offers and investors looking for a simple buy and hold ETF to compound the dividends or receive income might be pleased with this new choice. There is not much that makes this fund extremely unique though, and there are better choices out there. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.